Last updated: July 27, 2025

Introduction

Acetaminophen, known internationally as paracetamol, remains one of the world’s most widely utilized over-the-counter (OTC) analgesic and antipyretic agents. Its extensive use stems from its efficacy, safety profile when used appropriately, and broad availability across global markets. This analysis examines the current market landscape, future sales projections, key drivers, challenges, and strategic opportunities for acetaminophen within the pharmaceutical industry.

Market Overview

Global Demand and Usage Trends

Acetaminophen’s widespread application spans multiple segments: OTC pain relievers, prescribed formulations, combination products, pediatric medicines, and generic equivalents. The drug’s popularity persists due to its proven safety profile, cost-effectiveness, and regulatory approvals across regions.

The global acetaminophen market was valued at approximately USD 2.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of approximately 4.2% from 2023 through 2030 [1]. The increasing prevalence of pain-related conditions, fever management, and the high demand for OTC medication drive steady growth.

Regional Market Dynamics

-

North America: The largest segment, attributable to high healthcare expenditure, OTC sales, and widespread consumer awareness. The U.S. accounts for significantly over 50% of the regional market, driven by well-established retail chains and pharmacies.

-

Europe: The mature market benefits from stringent regulatory controls and consumer preferences for safety. Increasing self-medication trends further boost demand.

-

Asia-Pacific: The fastest-growing region, with expanding healthcare infrastructure, rising disposable incomes, and improving access to medicines in emerging economies like China and India [2].

-

Latin America and Middle East & Africa: Growth in these regions is driven largely by increasing healthcare access and demand for affordable analgesic options.

Market Drivers

- High Usage in OTC Segment: Acetaminophen remains a staple in OTC analgesic and antipyretic formulations, spurred by consumer trust and extensive marketing.

- Expanding Indications: Emerging evidence supports its role beyond mild pain and fever, including potential applications in osteoarthritis and postoperative pain management.

- Affordable Pricing and Generic Availability: Low-cost manufacturing, patent expirations, and numerous generics secure its market position.

- Growing Awareness of Safety Profile: Compared to NSAIDs and opioids, acetaminophen’s safety profile for short-term use encourages utilization.

Market Challenges

- Safety Concerns: The risk of hepatotoxicity at high doses or with chronic use limits sales growth potential.

- Regulatory Restrictions: Increased regulation around maximum permissible doses and combination products, especially in Europe and North America, might constrain market expansion.

- Competition from New Analgesic Agents: Emerging drugs, including novel non-opioid pain relievers, could impact market share.

- Alternative Therapies: The rise of natural and herbal remedies may influence consumer preference, particularly in regions with traditional medicine practices.

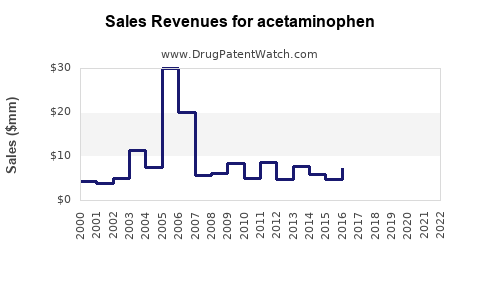

Sales Projections (2023-2030)

Based on current trends, consumption data, and market dynamics, acetaminophen sales are projected to grow substantially over the next decade:

| Year |

Estimated Global Sales (USD Billion) |

Growth Rate (CAGR) |

| 2023 |

USD 3.2 billion |

— |

| 2025 |

USD 3.8 billion |

~5.0% |

| 2027 |

USD 4.5 billion |

~4.7% |

| 2030 |

USD 5.7 billion |

~4.2% |

The incremental growth will be driven globally, with Asia-Pacific accounting for the most significant contribution due to market penetration.

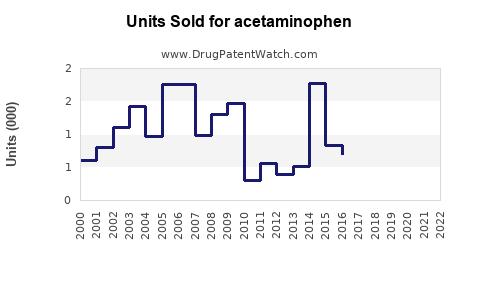

Key Market Segments Analysis

- Formulations: Tablets dominate, but liquids and suspensions are growing segments, particularly for pediatric use. Fixed-dose combinations with antihistamines or decongestants are also expanding.

- Distribution Channels: OTC retail pharmacies, online pharmacies, and direct sales to hospitals & clinics contribute to diversified sales streams. Online OTC channels are burgeoning, particularly in North America and Europe.

- Manufacturers: Large pharmaceutical companies like Johnson & Johnson, GlaxoSmithKline, and Teva Pharmaceuticals dominate, with numerous generics manufacturers further expanding access.

Strategic Opportunities and Outlook

- Product Innovation: Development of combination formulations aimed at chronic pain management and multi-symptom relief.

- Market Penetration in Emerging Economies: Tailored marketing and pricing strategies to expand penetration in developing nations.

- Regulatory Alignment: Proactive engagement with regulators concerning dosing limits and safety warnings to mitigate future restrictions.

- Digital Engagement: Leveraging e-commerce and telemedicine platforms to enhance consumer reach and education.

Conclusion

The acetaminophen market remains resilient amid regulatory and safety challenges, driven by its entrenched OTC presence and consumer trust. Sustained growth is anticipated through regional expansion, formulation diversification, and strategic partnerships. Companies poised to adapt to evolving regulatory environments and innovate in product delivery will likely secure competitive advantage.

Key Takeaways

- The global acetaminophen market is projected to grow at approximately 4.2% CAGR from 2023 to 2030, reaching roughly USD 5.7 billion.

- North America dominates, but Asia-Pacific presents the highest growth opportunities due to increasing healthcare access.

- Safety concerns, regulatory changes, and competition from newer pain management agents are potential headwinds.

- Strategic focus on product innovation, regional expansion, and digital marketing can fuel future sales.

- The market’s stability and growth potential make acetaminophen a reliable segment for pharmaceutical investment and development.

FAQs

1. What factors most significantly influence acetaminophen sales?

Consumer awareness, OTC availability, regulatory restrictions, and safety profiles primarily drive sales. Emerging markets and new formulations also impact demand.

2. How will safety concerns affect market growth?

Heightened awareness of hepatotoxicity risks may lead to tighter dosing regulations and reduced consumer use, but the overall impact is mitigated by the drug's accessibility and generic options.

3. Which regions are expected to see the fastest growth in acetaminophen sales?

Asia-Pacific is anticipated to experience the highest CAGR due to rising income levels, expanding healthcare infrastructure, and increased self-medication.

4. Are there any notable innovations in acetaminophen formulations?

Yes. Fixed-dose combinations, pediatric-friendly liquids, and improved delivery systems (e.g., controlled-release tablets) are emerging to meet diverse consumer needs.

5. What are the strategic considerations for pharmaceutical companies entering this market?

Focus on regulatory compliance, regional market nuances, consumer education campaigns, and product differentiation through innovation.

References

[1] Market Research Future, "Global Acetaminophen Market Forecast to 2030," 2022.

[2] Grand View Research, "Pain Management Market Analysis," 2022.