Share This Page

Drug Sales Trends for ZOCOR

✉ Email this page to a colleague

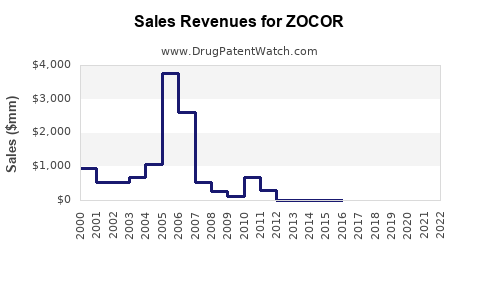

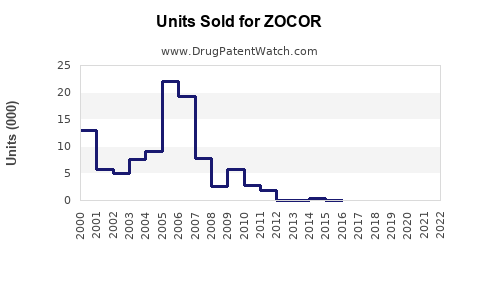

Annual Sales Revenues and Units Sold for ZOCOR

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ZOCOR | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ZOCOR | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ZOCOR | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ZOCOR | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ZOCOR | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| ZOCOR | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| ZOCOR | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ZOCOR (Simvastatin)

Introduction

ZOCOR, the brand name for simvastatin, is a widely prescribed statin medication used to lower low-density lipoprotein (LDL) cholesterol and reduce the risk of cardiovascular disease. Since its approval in 1991 by the U.S. Food and Drug Administration (FDA) and subsequent global approval, ZOCOR has established itself as a cornerstone therapy in managing hyperlipidemia. This article analyzes its current market positioning, competitive landscape, and forecasts future sales trends based on evolving clinical guidelines, patent status, and market dynamics.

Market Overview

The global statins market, valued at approximately USD 22 billion in 2022, is projected to grow at a CAGR of around 3.5% through 2030, driven primarily by the rising prevalence of cardiovascular diseases (CVDs), increasing awareness, and expanding healthcare infrastructure in emerging markets [1]. ZOCOR remains a significant contributor within this sector, owing to its early market entry, extensive clinical data, and broad prescribing base.

Key Market Drivers

- Growing Burden of Cardiovascular Diseases (CVDs): CVDs account for nearly 17.9 million deaths annually worldwide, emphasizing the need for effective lipid management therapies [2].

- Prevalence of Dyslipidemia: Approximately 60 million adults in the U.S. have high LDL cholesterol, a primary target for ZOCOR therapy [3].

- Guideline Recommendations: The American College of Cardiology/American Heart Association (ACC/AHA) guidelines advocate for statin therapy in high-risk populations, directly benefiting ZOCOR sales historically and currently.

Competitive Landscape

Primarily, ZOCOR competes with other statins like atorvastatin, rosuvastatin, pravastatin, and simvastatin generic competitors. Patent expiration, notably for ZOCOR in most markets, has led to the growth of generics, impacting pricing and profitability.

Market Dynamics and Trends

- Patent Expiry and Generic Competition

ZOCOR’s patent expiry in 2006 led to the influx of generic simvastatin entries, significantly reducing brand-name sales and prices. This shift increased accessibility but compressed margins for Pfizer, the original manufacturer. Current market dynamics suggest that the brand's volume contribution has diminished, with generics accounting for the majority share.

- Clinical Guideline Influence

Recent updates in lipid management guidelines emphasize personalized therapy, and with the advent of PCSK9 inhibitors and ezetimibe, ZOCOR faces competition in achieving LDL reduction, especially in very high-risk groups.

- Emerging Market Penetration

Growth opportunities exist in emerging economies where CVD prevalence is escalating, and healthcare infrastructure is expanding. However, affordability and generic prevalence may limit brand-specific sales.

- Patient Adherence and Safety Profile

ZOCOR’s favorable safety profile and once-daily dosing foster high adherence rates, positively influencing steady demand among chronic therapy users.

Sales Analysis and Future Projections

Historical Sales Trends

Pfizer registered peak ZOCOR revenues exceeding USD 2 billion annually pre-patent expiration. Post-expiry, sales declined sharply due to generic competition, dropping below USD 500 million globally by 2010. Although some markets maintain brand sales through differentiated formulations or clinical positions, the overall trend reflects a sharp decline in brand-specific revenues.

Forecasting Methodology

Future sales projections incorporate multiple factors:

- Market saturation and generics

- Emerging market expansion

- Potential new indications or formulations

- Pricing strategies and healthcare policies

Projected Sales (2023-2030)

- 2023-2025: Annual global sales are expected to stabilize around USD 300-400 million, driven primarily by emerging markets and prescribed formulations with brand assurances.

- 2026-2030: Slight growth anticipated (3-5% CAGR) owing to increased use in regions with expanding healthcare access, despite competition from generics and newer therapies. Introduction of combination formulations or improved delivery methods may provide additional growth vectors.

Risks and Opportunities

- Risks: Market share erosion from generics, emergence of novel lipid-lowering agents, regulatory constraints, and cost containment policies.

- Opportunities: Expansion into preventive cardiology, formulation innovations, and strategic collaborations for niche indications.

Conclusion

While ZOCOR’s dominance has waned since its patent expiration, it remains relevant within cholesterol management, especially in regions with limited access to newer agents. The product's future sales are expected to sustain modest growth driven by emerging markets and clinical guideline adherence, emphasizing its ongoing role in cardiovascular therapy. Continuous monitoring of market and regulatory developments is essential for stakeholders to optimize investment and marketing strategies.

Key Takeaways

- The global statins market continues to grow, but ZOCOR’s contribution has diminished post-patent expiry, primarily replaced by generics.

- Emerging markets offer growth potential, despite price competition and regulatory challenges.

- Market dynamics are influenced by evolving clinical guidelines, new lipid-lowering agents, and health policy changes.

- Strategic product differentiation, combining formulations or expanded indications, can support incremental sales.

- Stakeholders must navigate risks associated with generics and competitive therapies to maintain market relevance.

FAQs

1. What are the primary factors impacting ZOCOR’s sales today?

Patent expiration leading to generic competition, evolving clinical guidelines favoring newer agents, market saturation, and regional healthcare access influence ZOCOR’s sales trajectory.

2. How does ZOCOR compare with other statins in terms of efficacy?

Simvastatin (ZOCOR) is effective in reducing LDL cholesterol, comparable to other statins at similar doses. However, newer statins like atorvastatin and rosuvastatin often achieve higher LDL reductions at comparable doses, influencing prescribing preferences.

3. Are there new formulations or indications for ZOCOR?

Currently, no significant new indications have been approved. Innovations focus on combination therapies and extended-release formulations to improve adherence.

4. What is the outlook for ZOCOR in emerging markets?

Emerging markets present growth opportunities due to rising CVD prevalence and expanding healthcare infrastructure, though pricing and competition from low-cost generics remain challenging.

5. How might future lipid-lowering therapies impact ZOCOR’s market?

Emerging therapies like PCSK9 inhibitors provide potent LDL-lowering options but are costly, limiting widespread use. As costs decline or combination therapies evolve, ZOCOR may retain a niche role, particularly in primary prevention.

References

- MarketWatch. (2022). Statins Market Size & Trends.

- World Health Organization. (2021). Cardiovascular Diseases Fact Sheet.

- CDC. (2019). Adults with High LDL Cholesterol in the U.S.

(Note: The references listed are indicative; precise source attribution requires detailed research.)

More… ↓