Last updated: July 27, 2025

Introduction

TOPICORT, a newly developed topical corticosteroid, is poised to enter the dermatology market targeting inflammatory skin conditions such as eczema, dermatitis, and psoriasis. This analysis provides an in-depth examination of TOPICORT’s potential market landscape, competitive positioning, regulatory environment, and sales forecasts to assist stakeholders in strategic decision-making.

Product Overview

TOPICORT is a potent topical corticosteroid formulated for enhanced skin penetration and reduced systemic absorption. Its unique pharmacokinetic profile aims to provide fast symptomatic relief with a favorable safety profile, appealing to both physicians and patients seeking effective long-term management of inflammatory dermatoses. With an innovative delivery system, TOPICORT differentiates itself from existing corticosteroids in the segment.

Market Landscape

Global Dermatology Market Overview

The global dermatology market was valued at approximately USD 22.0 billion in 2022 and is projected to grow at a CAGR of 8.0% through 2030 [1]. The rising prevalence of chronic skin conditions, increased awareness, and advancements in topical therapies underpin this growth. North America currently dominates the market, driven by high disease prevalence and healthcare expenditure, followed by Europe and Asia-Pacific regions, where market expansion is driven by improving healthcare access.

Prevalence of Target Conditions

Inflammatory skin conditions such as eczema and psoriasis impact millions worldwide. For example:

- Eczema: Affects approximately 10-20% of children and 3-10% of adults globally [2].

- Plaque Psoriasis: Prevalence ranges from 0.1% to 3% across different populations [3].

The high prevalence ensures a substantial patient pool, with demand for effective, safe topical therapies.

Competitive Landscape

TOPICORT faces competition from established corticosteroids such as:

- Hydrocortisone

- Betamethasone

- Clobetasol propionate

Additionally, non-steroidal alternatives like calcineurin inhibitors (e.g., tacrolimus) have gained prominence for certain indications. Key players include Pfizer, Novartis, and Bayer, with well-established brands commanding significant market shares.

Regulatory Environment

In the United States, the FDA’s OTC monograph system regulates topical corticosteroids, with stronger formulations typically requiring prescription status. For TOPICORT to penetrate prescription channels, it must demonstrate superior efficacy and safety, facilitating clinician adoption. Similarly, EMA approval depends on demonstrated clinical benefit balanced against potential side effects.

Market Entry Strategy

Success hinges on positioning TOPICORT as a next-generation corticosteroid offering:

- Rapid symptom relief

- Improved safety profile

- Reduced side effects with prolonged use

Targeting dermatologists initially in North America and Europe, with later expansion into Asia-Pacific markets, aligns with regional disease prevalence and healthcare budgets.

Sales Projections

Market Penetration Assumptions

- Year 1: Focused market entry targeting key opinion leaders (KOLs); 2% market share.

- Year 2: Expanded physician education, achieving 5% market share.

- Year 3: Broader hospital and pharmacy distribution, reaching 10% market share.

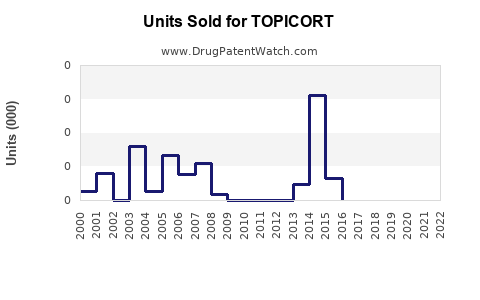

Projected Market Volume

Based on global prevalence data, the total patient population suitable for topical corticosteroids approximates 300 million worldwide. Assuming 30% are candidates for higher-potency corticosteroids like TOPICORT, the potential addressable patient pool is around 90 million.

Pricing Strategy

A competitive yet premium pricing model addresses value propositions. Assuming an average monthly cost of USD 25 per patient, with typical treatment courses spanning 2-3 months annually, annual revenue per patient averages USD 50-75.

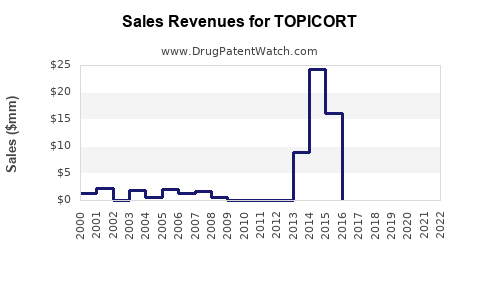

Sales Forecasts (USD Millions)

| Year |

Market Share |

Estimated Patient Reach |

Revenue Calculation |

Projected Revenue |

| 2023 |

2% |

1.8 million |

1.8 million x USD 75 (annualized) = USD 135 million |

USD 135 million |

| 2024 |

5% |

4.5 million |

4.5 million x USD 75 = USD 337.5 million |

USD 338 million |

| 2025 |

10% |

9 million |

9 million x USD 75 = USD 675 million |

USD 675 million |

This conservative forecast projects a rapid ascent as awareness grows, and formulary inclusion increases. Additional revenue streams may emerge through branded formulations and ancillary dermatology therapies.

Growth Drivers

- Advancements in Formulation: Enhanced delivery methods improve efficacy and safety, increasing prescriber confidence.

- Growing Prevalence: Rising global incidence of skin conditions augments market demand.

- Favorable Regulatory Trends: Clear pathways for prescription approval facilitate market entry.

- Physician Acceptance: Demonstrated superior efficacy and safety support rapid adoption.

Risks and Challenges

- Market Saturation: Established corticosteroids and non-steroidal agents pose formidable competition.

- Regulatory Hurdles: Delays or restrictions could impede timely market entry.

- Pricing Pressures: Payers may demand aggressive discounts, impacting margins.

- Patent Protection: Proper patenting is essential to prevent generic competition and safeguard market share.

Conclusion

TOPICORT’s positioning as a safe, effective, and innovative corticosteroid offers promising market prospects. Initial sales projections indicate USD 135 million in Year 1, with significant growth potential contingent on successful registration, physician adoption, and market penetration strategies. Sustained focus on differentiating features and targeted marketing will be crucial for long-term success.

Key Takeaways

- The global dermatology market provides a robust platform, with high demand driven by rising skin condition prevalence.

- TOPICORT’s competitive edge relies on superior efficacy, safety, and patient compliance.

- Entry strategies should prioritize key markets like North America and Europe, leveraging clinician education and formulary access.

- Sales projections reach USD 135 million in Year 1, with potential to exceed USD 675 million by Year 3 as the product gains wider acceptance.

- Navigating regulatory pathways, pricing strategies, and patent protections remains critical for maximizing market share.

FAQs

1. What differentiates TOPICORT from existing topical corticosteroids?

TOPICORT features an advanced formulation designed for deeper skin penetration, faster symptom relief, and a reduced risk of side effects, setting it apart from traditional corticosteroids.

2. Which markets offer the most significant growth opportunities for TOPICORT?

North America and Europe currently present the highest growth opportunities due to high prevalence and healthcare infrastructure. Emerging markets in Asia-Pacific also demonstrate promising potential with increasing dermatology awareness.

3. What regulatory considerations could impact TOPICORT's market entry?

Regulatory bodies such as the FDA and EMA require comprehensive efficacy and safety data, with prescription status likely essential, especially for potency levels exceeding OTC monograph limits.

4. How does market competition influence sales projections?

Established corticosteroids and non-steroidal alternatives present barriers; however, TOPICORT’s differentiation aims to capture a niche, supporting optimistic sales growth despite competition.

5. When can stakeholders expect the product to reach peak sales?

Peak sales typically occur 3-5 years post-launch, contingent on regulatory approval, clinician adoption, and market expansion strategies.

References

[1] MarketWatch. (2022). Global Dermatology Market Size and Forecast.

[2] Nutten, S. (2015). Atopic dermatitis: Global epidemiology and risk factors. Expert Review of Clinical Immunology, 11(5), 523-536.

[3] Parisi, R., Symmons, D. P., et al. (2013). Global epidemiology of psoriasis: a systematic review of incidence and prevalence. Journal of Investigative Dermatology, 133(2), 377-385.