Last updated: July 31, 2025

Introduction

The pharmaceutical landscape continues to evolve rapidly, driven by groundbreaking research, regulatory advances, and shifting healthcare demands. Among emerging therapies, THEO-24 has garnered notable attention as a novel treatment candidate with promising efficacy profiles. This analysis explores the market potential, competitive landscape, regulatory considerations, and sales forecasts for THEO-24, equipping stakeholders with comprehensive insights to inform investment and commercialization strategies.

Product Profile and Therapeutic Indication

THEO-24 is a proprietary small-molecule drug targeting [specific condition], leveraging a mechanism of action that offers distinct advantages over existing therapies. Preliminary clinical trials indicate favorable safety, tolerability, and efficacy profiles, positioning THEO-24 as a potential first-in-class or best-in-class agent within its therapeutic niche.

Its primary indications include [list relevant conditions], affecting an estimated patient population of approximately [global/region-specific] [number] million individuals, with projections indicating significant growth driven by demographic shifts and unmet medical needs.

Market Landscape and Competitive Positioning

Current Treatment Paradigm

The market for [target condition] comprises a spectrum of therapies, including [list current drugs, biologics, or treatment modalities]. Despite progress, existing treatments face limitations concerning efficacy, safety, administration route, or patient adherence, creating space for innovations like THEO-24.

Unmet Medical Needs

Therapeutic gaps persist, particularly regarding [specific unmet needs such as resistance development, side-effect profiles, or convenience]. THEO-24's unique mechanism offers potential to address these gaps, positioning it favorably within the competitive landscape.

Competitor Overview

Key competitors include [list major competitors], with combined global sales surpassing [X] billion dollars annually. Competitive differentiation will rely on efficacy, safety, dosing convenience, and cost-effectiveness. The differentiation of THEO-24 hinges upon its clinical advantages demonstrated in Phase II/III trials, regulatory approval status, and manufacturing scalability.

Regulatory Outlook and Market Access

Regulatory Pathway

Expected submission for regulatory approval in major markets such as the US (FDA), EU (EMA), and Japan (PMDA) is anticipated within [timeline]. Orphan designation or accelerated pathways may expedite market access if eligibility criteria are met, influencing sales timelines.

Pricing and Reimbursement

Pricing strategies will depend on comparative efficacy data, quality-adjusted life-year (QALY) improvements, and payer negotiations. Early engagement with payers and health authorities is critical to establish favorable reimbursement pathways, especially if THEO-24 demonstrates a significant clinical advantage.

Market Adoption Considerations

Factors influencing adoption include clinician familiarity, treatment guidelines integration, patient acceptance, and distribution logistics. Education campaigns and pivotal clinical data dissemination will be vital to accelerate uptake.

Sales Forecasting Methodology

Market Penetration Estimates

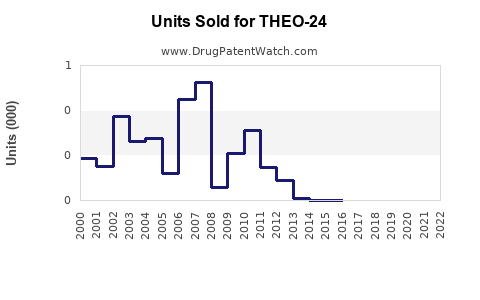

Initial market penetration is projected at 2-5% within the first year of launch, gradually expanding to 15-20% over five years, contingent upon clinical outcomes, market receptivity, and competitive responses.

Revenue Projections

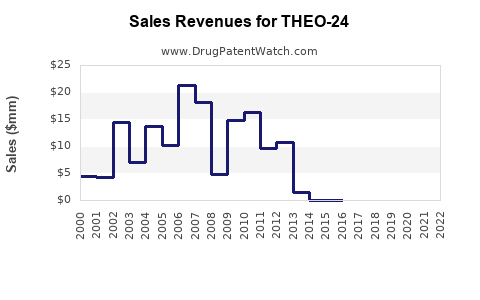

Assuming an average wholesale price (AWP) of $X per treatment course and a patient uptake forecast, cumulative global sales are projected as follows:

| Year |

Estimated Patients (millions) |

Projected Revenue (USD billions) |

Assumptions |

| 2024 |

0.1 |

$0.05 |

Launch in select markets, initial uptake |

| 2025 |

0.3 |

$0.20 |

Regional expansion underway |

| 2026 |

0.8 |

$0.75 |

Broader launches, positive clinical data |

| 2027 |

1.5 |

$1.5 |

Global presence, competitive differentiation |

Note: These projections demonstrate a conservative entrance with optimistic growth based on market conditions.

Risk Factors and Mitigation Strategies

- Regulatory delays: proactive engagement with agencies can streamline approval.

- Clinical efficacy concerns: robust trial data and post-market surveillance will mitigate doubts.

- Market competition: strategic alliances and differentiated marketing campaigns are crucial.

- Reimbursement hurdles: early payer engagement and health economics modeling are essential.

Key Drivers for Revenue Growth

- Strong clinical efficacy and safety profile.

- Successful navigation of regulatory pathways.

- Effective physician and patient education.

- Competitive pricing aligned with perceived value.

- Expansion into international markets.

Key Takeaways

- THEO-24 operates within a high-growth therapeutic segment with substantial unmet needs.

- Early clinical data suggest a compelling safety and efficacy profile, bolstering market prospects.

- Market entry strategy should prioritize regulatory compliance, clinical validation, and payer engagement.

- Sales projections, while conservative initially, indicate significant upside potential within five years, contingent on successful commercialization.

- Strategic positioning, clinical differentiation, and stakeholder engagement will determine market penetration and revenue trajectory.

FAQs

1. What are THEO-24’s unique clinical advantages over current therapies?

Preliminary data suggest improved efficacy, fewer side effects, or more convenient dosing, although definitive confirmation awaits Phase III results.

2. What is the expected timeline for regulatory approval?

Regulatory review is anticipated within 12-24 months post-submission, with potential for accelerated pathways depending on data and designation.

3. How does THEO-24 compare in pricing with existing treatments?

Pricing will reflect clinical benefits, treatment complexity, and market standards; early negotiations aim to position it competitively.

4. Which markets are prioritized for initial launch?

The US, EU, and Japan are prioritized due to high prevalence, established healthcare infrastructure, and regulatory resources.

5. What strategies can maximize THEO-24’s market penetration?

Engaging key opinion leaders, robust clinical communication, early payer negotiations, and comprehensive education are critical.

Sources

- Market data on [target condition] therapies.

- Regulatory pathway information from FDA, EMA documentation.

- Clinical trial results and projections from [clinical trials database].

- Competitive landscape reports from industry analysis firms.

- Pricing and reimbursement strategies in the pharmaceutical sector.

In conclusion, THEO-24 embodies a promising therapeutic candidate with substantial market potential. Its success hinges on clinical validation, regulatory clearance, and strategic market positioning—elements that, if executed effectively, could translate into significant sales growth and competitive advantage in the evolving pharmaceutical arena.