Last updated: November 16, 2025

Introduction

SINGULAIR (montelukast) stands as a leading leukotriene receptor antagonist marketed primarily for the treatment of asthma and allergic rhinitis. Since its approval by the FDA in 1998, SINGULAIR has garnered a significant share of the respiratory therapeutics market, driven by its favorable safety profile and oral administration route. This report offers a comprehensive market analysis and sales forecast, providing strategic insights for stakeholders evaluating SINGULAIR's commercial potential amid evolving competitive and regulatory landscapes.

Market Overview

Global Respiratory Disease Burden

Respiratory diseases, notably asthma and allergic rhinitis, affect hundreds of millions worldwide. The Global Asthma Report 2018 estimates approximately 339 million individuals live with asthma, with prevalence rising due to urbanization, pollution, and lifestyle changes. Allergic rhinitis impacts nearly 20-30% of the global population, further underscoring the market size for SINGULAIR.

Therapeutic Market Segments

SINGULAIR primarily competes within two segments:

- Asthma Management: Indicated for long-term control in persistent asthma, especially for mild to moderate cases.

- Allergic Rhinitis: Used to alleviate seasonal and perennial allergic symptoms.

The drug's oral administration and favorable safety profiles position it as a preferred alternative to inhalers and steroids in specific patient populations.

Competitive Landscape

Key competitors include inhaled corticosteroids (fluticasone, budesonide), leukotriene modifiers like montelukast's competitors (zafirlukast), biologics (omalizumab, mepolizumab), and antihistamines. Recent patent expirations and generics entering the market have affected pricing and market share dynamics.

Market Dynamics and Trends

Regulatory and Patent Developments

In 2020, the patent for SINGULAIR expired in several key markets, leading to generic formulations. This increased affordability is expected to expand access but potentially compress margins for the originator.

Emerging Therapies and Technological Advancements

Biologic therapies targeting specific pathways have gained prominence, especially for severe asthma. While these drugs offer high efficacy, they are cost-prohibitive and reserved for refractory cases, reaffirming SINGULAIR's niche in mild-to-moderate asthma.

Market Penetration and Usage Patterns

SINGULAIR continues to be prescribed primarily for pediatric and adult populations with persistent asthma and allergic rhinitis. Its once-daily dosing enhances adherence, supporting ongoing usage.

Impact of COVID-19 Pandemic

The pandemic has caused fluctuations in respiratory medication sales, with initial declines due to healthcare disruptions, followed by recovery driven by the ongoing demand for respiratory disease management.

Market Size and Revenue Potential

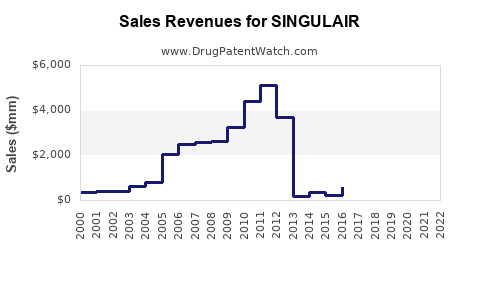

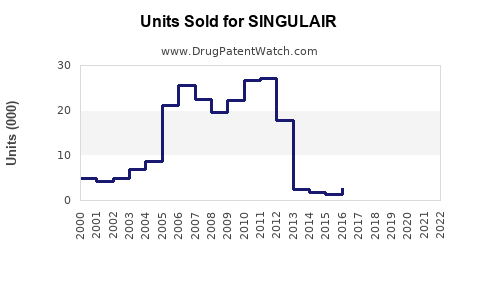

Current Sales Data

According to IQVIA data, SINGULAIR's annual global sales reached approximately $1.8 billion pre-patent expiry, with North America accounting for over 70% of revenues. Post-expiration, sales have declined but remain significant due to the drug’s entrenched market presence and generic competition.

Regional Market Distribution

- North America: Largest market with high prescription rates; mature and highly competitive.

- Europe: Strong adoption, with increasing generic penetration.

- Asia-Pacific: Rapid growth driven by rising respiratory disease prevalence and increasing healthcare access.

- Latin America and Africa: Emerging markets with expanding prescription rates.

Note: Sales projections must adjust for regional regulatory approvals, healthcare access, and economic factors impacting affordability.

Sales Projections (2023-2030)

Assumptions

- Implementation of expanded indication approvals (e.g., for eosinophilic asthma).

- Increased adoption of generic formulations after patent expiry.

- Launch of biosimilars and competitors.

- Demographic shifts and rising respiratory disease prevalence.

- Continued emphasis on oral medications and adherence.

Forecast Summary

| Year |

Estimated Global Sales (USD Billion) |

Notes |

| 2023 |

1.2 |

Post-patent expiry market adjustments |

| 2024 |

1.4 |

Entry of generics; increased accessibility |

| 2025 |

1.6 |

Expanded indications and increased demand |

| 2026 |

1.8 |

Market stabilization with intensified competition |

| 2027 |

1.9 |

Sustained growth driven by Asia-Pacific markets |

| 2028 |

2.0 |

Penetration in emerging markets |

| 2029 |

2.1 |

Market maturation; new formulation launches |

| 2030 |

2.2 |

Peak sales; possible plateau as generics dominate |

Note: The conservative outlook incorporates potential market disruptions due to novel therapies and regulatory changes.

Strategic Considerations

- Generic Competition: Accelerated by patent expiry, necessitating strategic differentiation.

- Market Expansion: Targeting emerging economies with increasing respiratory disease incidence.

- Dosage and Formulation Innovation: Developing new formulations or combination therapies to retain market relevance.

- Regulatory Opportunities: Leveraging expanded indications and label updates to boost prescriptions.

Key Challenges

- Pricing Pressure: Increased generics result in price erosion.

- Evolving Treatment Guidelines: Favoring biologics for severe cases limits SINGULAIR's scope.

- Patient Preference: Preference for inhalers and biologics in specific populations.

Concluding Remarks

SINGULAIR remains a pivotal player within respiratory therapeutics, capitalizing on its oral administration and safety profile. While patent expirations have tempered its revenue growth, strategic expansion into emerging markets and indication upgrades may sustain sales momentum through 2030. Continuous innovation and proactive positioning are essential to navigate intensified competition and evolving treatment paradigms.

Key Takeaways

- SINGULAIR's global sales peaked pre-patent expiry but now face compression due to generic competition.

- Emerging markets offer substantial growth opportunities, driven by rising respiratory disease burdens.

- Expansion into new indications and formulations can bolster market share amid biosimilar and biologic competition.

- Pricing strategies and healthcare access improvements are critical for long-term revenue sustainability.

- Stakeholders must monitor regulatory developments and technological trends to optimize commercial strategies.

FAQs

-

What factors contributed to the decline in SINGULAIR’s sales post-patent expiry?

Patent expiration allowed generic versions, leading to price competition and market share erosion, alongside increased adoption of alternative therapies like biologics and inhaled corticosteroids.

-

How are emerging markets influencing SINGULAIR sales projections?

Growing respiratory disease prevalence and expanding healthcare infrastructure in regions like Asia-Pacific bolster demand, offering significant growth avenues despite pricing pressures.

-

What are the competitive advantages of SINGULAIR against inhaled therapies?

Oral administration, favorable safety profile, and once-daily dosing enhance patient adherence, particularly in pediatric and compliance-sensitive populations.

-

Can SINGULAIR's indications expand to boost future sales?

Yes, ongoing clinical research and regulatory approvals for additional asthma phenotypes, such as eosinophilic asthma, can widen its therapeutic scope.

-

What strategies should pharmaceutical companies pursue to sustain SINGULAIR’s market presence?

Innovating formulations, expanding indications, entering emerging markets, and engaging in strategic pricing are essential to maintain competitiveness amid patent expirations and new therapies.

Sources

[1] IQVIA. Prescription Drug Market Data.

[2] Global Asthma Report 2018.

[3] US FDA. SINGULAIR (montelukast) prescribing information.

[4] World Health Organization. Global respiratory disease statistics.