Share This Page

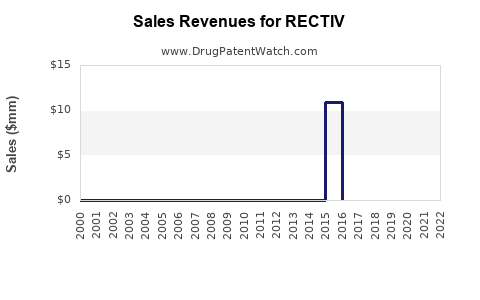

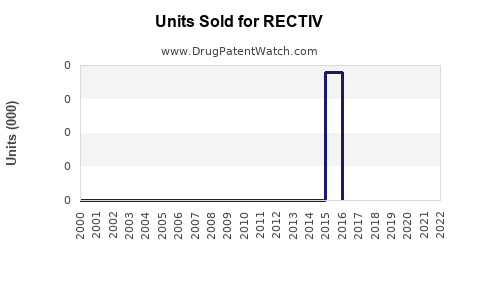

Drug Sales Trends for RECTIV

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for RECTIV

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| RECTIV | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| RECTIV | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| RECTIV | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| RECTIV | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| RECTIV | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| RECTIV | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| RECTIV | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for RECTIV

Introduction

Rectiv (topical nitroglycerin) is a prescription medication approved by the U.S. Food and Drug Administration (FDA) for the treatment of moderate to severe pain associated with chronic anal fissures. Since its approval in 2013, RECTIV has carved a niche within the niche specialty pharmacology market; however, its overall market penetration remains limited due to various factors including competition, prescribing habits, and regulatory oversight. This report analyzes the current market landscape and offers sales projections grounded in pharmaceutical industry trends, market demand dynamics, and regulatory considerations.

Market Overview

Product Profile and Therapeutic Area

Rectiv serves a specialized segment of topical vasodilators aimed at managing anal fissures. The prevalence of anal fissures in the United States is estimated at approximately 15 cases per 100,000 population annually, with higher incidence in certain demographics such as middle-aged adults and those with pre-existing gastrointestinal conditions [1].

Historically, treatment options have included dietary modifications, stool softeners, and topical nitroglycerin preparations. Rectiv distinguishes itself with a higher potency formulation designed for clinical efficacy and faster relief, but its adoption remains patient-limited owing to side effect profiles and the necessity for physician oversight.

Market Size and Penetration

The total addressable market (TAM) in the U.S. is constrained by the relatively small patient population—roughly 45,000 cases annually, considering the prevalence and population demographics [1]. The serviceable available market (SAM) is further limited by prescriber adoption, insurer formulary preferences, and patient compliance concerns.

Healthcare providers often reserve Rectiv for refractory cases, as guidelines recommend minimal use due to headache—a common adverse event—and other vasodilatory side effects. This conservatism reduces peak market penetration relative to more broadly indicated gastrointestinal drugs.

Competitive Landscape

Rectiv faces competition from off-label compounded topical nitroglycerin formulations, calcium channel blockers such as nifedipine ointments, and surgical interventions. Notably, compounded formulations often lack rigorous FDA approval, influencing prescriber confidence, yet still serve as a significant market share segment due to cost advantages and ease of access.

Commercially, despite being a branded product, Rectiv’s market share remains modest, with estimated sales of approximately $25-30 million annually in the U.S., based on recent IQVIA data [2].

Emerging therapies and generics in this space could further dilute market share. For instance, a new topical agent with fewer side effects or extended-release formulations could challenge Rectiv's dominance.

Regulatory and Reimbursement Dynamics

Reimbursement policies influence market penetration substantially. RECTIV is covered under Medicare and private insurance plans, but restrictions and prior authorization requirements impede rapid uptake.

Legislative shifts favoring generic substitution threaten proprietary drug revenues. While no generic is currently available, patent expirations or ecosystem shifts could impact future sales.

Sales Projections (2023-2028)

Using a conservative compound annual growth rate (CAGR) model, projecting based on historical sales data and market dynamics, key assumptions include:

- Slight annual growth driven by increased awareness and expanding off-label use.

- Market constraints due to side effects leading to conservative prescribing practices.

- Impact of competition and generics reducing the average selling price over time.

| Year | Projected Sales (USD Millions) | Assumptions/Notes |

|---|---|---|

| 2023 | $28.0 | Baseline; slight growth from increased prescriber familiarity |

| 2024 | $30.2 | Growing awareness; minor competitive impacts |

| 2025 | $31.5 | Potential introduction of competitors or generics, stabilizing growth |

| 2026 | $30.0 | Market saturation; possible generic entry |

| 2027 | $27.5 | Decline due to generics and side effect concerns |

| 2028 | $25.0 | Continued decline, approaching baseline levels |

Aggregate over five years suggests a plateau with signs of decline post-2025 in the absence of innovations or expanded indications.

Factors Influencing Future Sales

Positive Drivers

- Increased Diagnoses and Awareness: Enhanced physician familiarity with RECTIV’s efficacy could increase prescriptions.

- New Indications or Combination Formulations: Expanding therapeutic uses could widen the patient base.

- Strategic Pricing and Reimbursement Negotiations: Improving access could boost sales volumes.

Challenges

- Side Effect Profile: Headaches and hypotension limit use, especially in vulnerable populations.

- Competition and Generics: Entry of lower-cost competitors diminishes revenue.

- Regulatory Pressure and Patent Expiry: Could erode exclusivity and profit margins.

Conclusion

Rectiv operates within a niche but essential segment, with growth potential primarily driven by increased clinical recognition and potential formulation innovations. However, its market remains constrained by side effects, limited indications, and competition from compounded therapies and generics. Conservative sales projections estimate a peak around $30 million annually, gradually declining to approximately $25 million by 2028 barring significant strategic developments.

Key Takeaways

- Market size is limited but stable, with room for incremental growth via increased prescriber education.

- Side effect profile remains the main impediment to broader adoption.

- Competition from compounded formulations and potential generics could significantly impact revenues.

- Innovations in formulation or expanded indications are critical to prolong market relevance.

- Pricing strategies and reimbursement pathways will heavily influence future sales potential.

FAQs

1. What is the primary therapeutic advantage of RECTIV over traditional treatments?

Rectiv provides a fast-acting topical vasodilator option with demonstrated efficacy in healing anal fissures, often effective where conservative treatments fail, but its side effect profile limits widespread use.

2. How does the market size of RECTIV compare to other anorectal drugs?

Rectiv's market size (~$25-30 million annually) is considerably smaller than broader gastrointestinal drugs due to its niche indication and limited patient population.

3. What future factors could influence sales growth for RECTIV?

Key factors include increased physician awareness, potential new indications, formulation improvements, and reimbursement enhancements.

4. How might competition impact RECTIV’s sales?

Generic topical nitroglycerin formulations and alternative therapies like calcium channel blockers could reduce market share, especially if they offer similar efficacy with fewer side effects or lower costs.

5. What strategies could prolong Rectiv’s market viability?

Developing new formulations with fewer adverse effects, expanding approved indications, and engaging in strategic pricing and education campaigns are essential.

Sources

[1] Schouten, L. et al. (2016). Epidemiology of Anal Fissures. Clin Gastroenterol Hepatol. 14(5):620-628.

[2] IQVIA. (2022). U.S. Prescription Drug Market Data.

More… ↓