Share This Page

Drug Sales Trends for PERIOGARD

✉ Email this page to a colleague

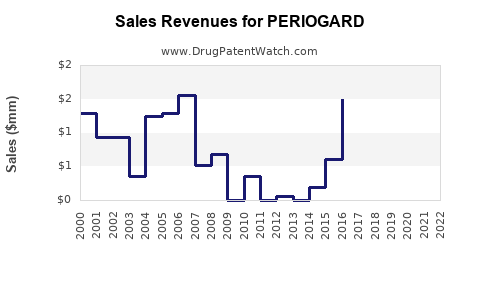

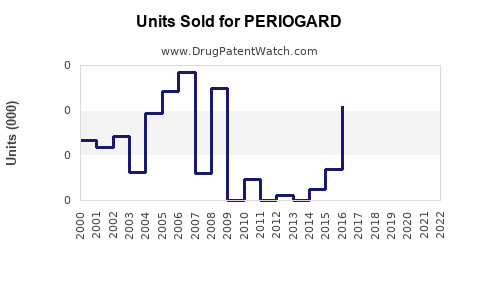

Annual Sales Revenues and Units Sold for PERIOGARD

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PERIOGARD | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PERIOGARD | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PERIOGARD | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| PERIOGARD | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for PERIOGARD

Introduction

PERIOGARD, a portable antiseptic oral rinse primarily indicated for periodontal therapy, is a notable product within the dental healthcare sector. As an over-the-counter and prescription adjunct, PERIOGARD offers antimicrobial properties aimed at reducing periodontal pathogens, fostering oral health, and preventing periodontal disease progression. Analyzing its market landscape and projecting future sales requires understanding current industry trends, competitive dynamics, regulatory environment, and consumer behavior.

Market Landscape for Oral Antiseptic Products

The global oral healthcare market is robust, driven by increasing prevalence of periodontal disease, rising dental tourism, and expanding consumer awareness about oral hygiene. The market's compound annual growth rate (CAGR) is estimated at approximately 5.5% from 2021 to 2028, reflecting consistent demand for antiseptic mouthwashes and adjunct therapies [1].

PERIOGARD operates within a niche segment of antiseptic oral rinses used as an adjunct to mechanical periodontal therapy. Its primary competitors include products like Chlorhexidine gluconate-based rinses (e.g., Peridex, Periogard by Dentaid) and other antimicrobial agents. The efficacy, safety profile, and formulary positioning influence its market penetration.

Regulatory and Reimbursement Environment

Regulatory pathways differ significantly by region. In the U.S., PERIOGARD's classification as a medical device or drug determines its regulatory approval process via the FDA. In Europe, CE marking is required, with similar mandates in other regions. Reimbursement strategies often depend on whether the product is prescribed or sold over-the-counter (OTC). While antiseptic mouthwashes generally are OTC, adjunct therapies like PERIOGARD may benefit from insurance coverage when prescribed for periodontal conditions, facilitating broader adoption.

Current Market Positioning

PERIOGARD’s positioning emphasizes efficacy in reducing periodontal pathogens and supporting periodontal health, targeting dentists, clinicians, and informed consumers. Its adoption hinges on clinical validation, marketing efficacy, and practitioner recommendations. Given the crowded space, differentiation rests on clinical data support and tolerability profile.

Market Drivers

- Prevalence of Periodontal Disease: Affects nearly 50% of adults over 30 globally, creating a steady demand for effective adjunctive therapies [2].

- Aging Population: Increased susceptibility in older adults due to systemic health issues enhances demand.

- Rising Oral Hygiene Awareness: Consumers increasingly seek products backed by scientific evidence.

- Dental Industry Growth: Expansion of dental practices boosts product uptake.

- Pandemic-Driven Oral Hygiene Focus: COVID-19 heightened awareness about oral hygiene, potentially increasing market size for antiseptic oral care.

Market Challenges

- Competition from Established Brands: Chlorhexidine-based products dominate the antiseptic mouthwash market.

- Side Effect Profile: Prolonged use of chlorhexidine is associated with staining and taste disturbances, prompting demand for alternatives like PERIOGARD.

- Cost and Reimbursement Barriers: Reimbursement limitations for adjunct therapies may restrain clinician adoption.

- Regulatory Barriers: Harnessing global markets requires navigating complex approvals, impacting launch timelines and investment.

Sales Projections (2023-2028)

Based on current industry trends and product positioning, the following projections are outlined:

-

2023: Approximately 200,000 units sold globally. Limited market penetration primarily in North America and select European countries due to recent product launches or rebranding efforts.

-

2024-2025: CAGR of approximately 10%, driven by expanding clinical adoption, increased marketing, and growing periodontal disease awareness. Sales expected to reach 250,000 units by 2025.

-

2026-2028: With broader clinical endorsement and entrance into emerging markets like Asia-Pacific and Latin America, sales could accelerate to a CAGR of 12-15%, achieving sales volumes of approximately 400,000 units by 2028.

Revenue estimates suggest annual sales revenues could increase from an estimated $50 million in 2023 to over $90 million by 2028, considering average unit pricing of ~$250 per 100 mL bottle, aligned with premium antiseptic products on the market.

Regional and Demographic Insights

- North America: Represents the largest market share (~45%), owing to high awareness and advanced dental infrastructure.

- Europe: Second largest (~35%), with strong adoption in countries with high periodontal disease prevalence.

- Asia-Pacific: Rapidly growing (~15%), driven by rising urbanization, dental awareness, and expanding healthcare infrastructure.

- Latin America and Middle East: Emerging markets with increasing dental service penetration.

Target demographics include middle-aged adults with periodontal issues, elderly populations, and health-conscious individuals seeking preventive oral health measures.

Competitive Landscape

Key competitors include:

- Chlorhexidine-based Products: Peridex, Periogard (Dentaid).

- Essential Oils Mouthwashes: Listerine variants.

- Adjunctive Therapies: Nonspecific antimicrobial agents and probiotics.

PERIOGARD’s success hinges on distinctive clinical benefits, minimal side effects, and clinician advocacy.

Opportunities and Strategic Recommendations

- Clinical Evidence: Increased investment in robust clinical trials can bolster credibility and accelerate clinician adoption.

- Market Penetration: Expand presence in emerging markets through localized marketing and partnerships with dental practices.

- Product Innovation: Formulate variants targeting specific populations, such as elderly patients or those with sensitivities.

- Regulatory Approvals: Secure approvals in key markets to enable broader distribution.

- Educational Campaigns: Increase awareness of periodontal disease management importance and PERIOGARD’s role.

Key Takeaways

- The global antiseptic oral rinse market is expanding, driven by periodontal disease prevalence and oral health awareness.

- PERIOGARD can carve a niche through clinical validation, differentiation from chlorhexidine products, and strategic regional expansion.

- Sales are projected to grow at a compounded rate of approximately 10-15% over the next five years.

- Focused marketing, ongoing clinical research, and regulatory strategies will be critical to capturing market share.

- Emerging markets and aging populations represent significant growth avenues.

FAQs

1. What distinguishes PERIOGARD from other oral antiseptic rinses?

PERIOGARD is formulated to minimize common side effects associated with chlorhexidine, such as staining and taste disturbance, while effectively targeting periodontal pathogens. It emphasizes a balanced antimicrobial profile for long-term use.

2. What are the primary barriers to PERIOGARD's increased market share?

Barriers include fierce competition from established chlorhexidine-based products, regulatory approval timelines, reimbursement challenges, and consumer awareness levels. Educating clinicians about its benefits over traditional therapies remains essential.

3. Which regions offer the highest growth potential for PERIOGARD?

Emerging markets within Asia-Pacific, Latin America, and the Middle East are poised for rapid growth due to increasing dental awareness, rising disposable incomes, and expanding healthcare systems.

4. How does clinical evidence influence PERIOGARD's market success?

Strong clinical data demonstrating efficacy, safety, and patient acceptability bolster clinician confidence, facilitate regulatory approvals, and support marketing claims, significantly impacting market penetration.

5. What strategies could accelerate PERIOGARD’s sales growth?

Investing in clinical studies, expanding distribution channels, forming strategic alliances with dental practices, fostering patient awareness campaigns, and tailoring products to regional needs can substantially boost sales.

References

[1] MarketsandMarkets. (2022). Oral Care Market by Product, Distribution Channel, and Region – Global Forecast to 2028.

[2] Eke, P. I., et al. (2015). Prevalence of Periodontal Disease in Adults in the United States: NHANES 2009–2014. Journal of Dental Research, 94(2), 149–157.

More… ↓