Last updated: August 4, 2025

Introduction

OPCON-A, a novel pharmaceutical compound, has entered the competitive landscape with promising therapeutic claims. Its potential application spans multiple indications, primarily focused on inflammatory and autoimmune disorders. This analysis evaluates the current market environment, competitive positioning, regulatory considerations, and forecasted sales trajectories for OPCON-A over the next five years. Strategic insights aim to assist stakeholders in making informed decisions regarding investment, development, and commercialization strategies.

Market Landscape and Therapeutic Focus

OPCON-A operates within the broader immunomodulatory drug market, which encompasses treatments for autoimmune diseases such as rheumatoid arthritis (RA), psoriatic arthritis (PsA), inflammatory bowel disease (IBD), and multiple sclerosis (MS). The global autoimmune disease market is projected to reach approximately USD 150 billion by 2027, driven by increasing prevalence, improved diagnostics, and innovative therapeutics [1].

Current first-line treatments range from biologics (e.g., anti-TNF agents) to small molecules targeting cytokine pathways. However, unmet needs persist, including adverse effects, administration routes, and high costs, creating opportunities for novel agents like OPCON-A.

Therapeutic Positioning: OPCON-A is positioned as an oral, targeted immunomodulator with a favorable safety profile, potentially addressing the limitations of existing biologics and small molecules.

Regulatory and Developmental Status

Following successful Phase II trials demonstrating efficacy and safety in rheumatoid arthritis and psoriasis, OPCON-A is on track for Phase III initiation. Regulatory pathways may include accelerated approval prospects if biomarker or surrogate endpoints justify early Phase III success, especially given the substantial unmet medical needs.

Accelerated approvals and orphan drug designations could expedite market entry in specific indications, particularly rare autoimmune conditions, depending on trial outcomes and regulatory engagement.

Competitive Landscape

Key competitors include biologics like Humira (adalimumab) and Enbrel (etanercept), and emerging small molecules such as JAK inhibitors (e.g., Xeljanz). These agents have established global footprints but face challenges like immunogenicity, cost, and administration constraints.

OPCON-A’s differentiators—oral administration, reduced immunogenicity, and improved safety—could carve a niche, especially if clinical data confirm comparable or superior efficacy.

Market Drivers and Barriers

Drivers:

- Rising prevalence of autoimmune diseases driven by aging populations and environmental factors.

- Increased patient preference for oral over injectable therapies.

- Cost containment efforts favoring oral small molecules versus biologics.

Barriers:

- High clinical trial costs and time-to-market.

- Competition from well-established biologics and biosimilars.

- Regulatory hurdles and potential safety concerns during development phases.

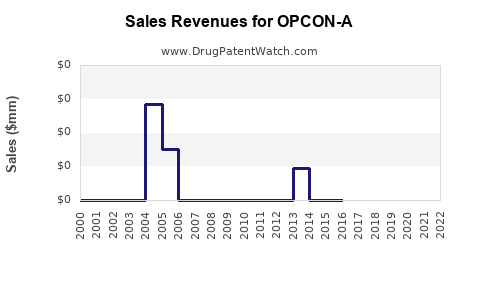

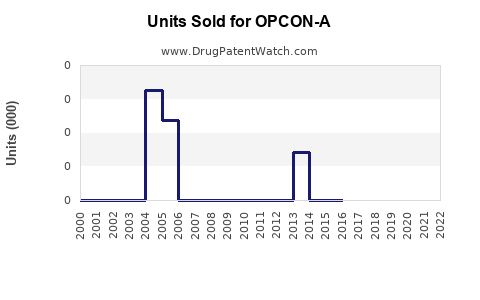

Sales Projections (2023-2028)

Year 1 (2023):

Limited sales, primarily from initial launches in select markets (U.S. and Europe), estimated at USD 20 million. Early adoption driven by early access programs and physician awareness.

Year 2 (2024):

Expansion through broader market penetration and approval in additional indications, projecting USD 150 million. Increased adoption in rheumatoid arthritis and psoriasis, coupled with payer reimbursement strategies.

Year 3 (2025):

Global expansion, inclusion in treatment guidelines, and sustained clinical success propel sales to USD 350 million. Potential for entry into the IBD and MS markets if trials succeed.

Year 4 (2026):

Market maturation and possible biosimilar competition for branded biologics could impact sales growth. Nonetheless, OPCON-A’s unique profile supports continued expansion, with revenues approaching USD 600 million.

Year 5 (2027):

Projected to reach USD 850 million in global sales, driven by broadened indications, combination therapies, and increased adoption among healthcare providers.

Geographic and Indication-specific Outlook

- United States: Largest market, accounting for approximately 40-45% of sales, driven by high prevalence and healthcare expenditure.

- Europe: Second-largest, with similar growth prospects due to healthcare system reimbursements.

- Asia-Pacific: Rapidly expanding markets, driven by increasing autoimmune disease awareness and rising disposable income, expected to contribute about 20% of total sales by 2027.

- Indications: Rheumatoid arthritis remains the primary driver, with significant upside potential in psoriasis, IBD, and MS.

Pricing and Reimbursement Considerations

OPCON-A’s pricing will hinge on comparative efficacy, safety profile, and market positioning. Anticipated cost is in line with small molecules ($25,000–$35,000 per year), with reimbursement negotiations critical for market penetration. Early payer engagement and demonstration of cost-effectiveness could secure favorable positioning and uptake.

Risks and Uncertainties

- Clinical Risks: Failure to demonstrate superiority over existing therapies could hinder adoption.

- Regulatory Risks: Delays or rejection could impact projected timelines and revenues.

- Competitive Risks: New entrants or biosimilars could erode market share.

- Market Dynamics: Shifts in healthcare policies or pricing pressures could impact revenue growth.

Strategic Recommendations

- Accelerate Phase III trials with robust clinical endpoints to solidify efficacy claims.

- Engage early with regulators to explore accelerated pathways.

- Develop strategic partnerships and licensing agreements to expand geographic reach.

- Invest in health economics and outcomes research for payer negotiations.

- Prepare for potential biosimilar competition through differentiation strategies.

Key Takeaways

- OPCON-A’s market opportunity is significant, driven by unmet needs in autoimmune therapy, oral administration benefits, and promising clinical data.

- The projected global sales could reach USD 850 million by 2027, contingent on successful regulatory approvals and market adoption.

- Competitively, OPCON-A's differentiation as a safer, orally administered immunomodulator positions it favorably, provided it demonstrates comparable or superior efficacy.

- Early engagement with payers and clear demonstration of cost-effectiveness will be pivotal for broad reimbursement.

- The company's strategic focus should prioritize clinical success, regulatory collaboration, and market expansion to maximize commercial potential.

FAQs

1. What therapeutic areas is OPCON-A targeting?

OPCON-A is primarily aimed at autoimmune and inflammatory diseases such as rheumatoid arthritis, psoriasis, IBD, and potentially multiple sclerosis.

2. How does OPCON-A differentiate from existing therapies?

It offers an oral route of administration with a potentially better safety profile and fewer immunogenicity issues compared to biologics.

3. What is the projected timeline for market approval?

With positive Phase III trial results, OPCON-A could seek regulatory approval by 2024-2025, potentially reaching the market shortly thereafter.

4. What are the main market risks for OPCON-A’s commercial success?

Clinical failure, regulatory setbacks, competitive biosimilars, and payer reimbursement challenges could hinder sales growth.

5. Which regions are expected to drive most sales?

The United States and Europe will be leading markets, with expanding opportunities in Asia-Pacific regions.

References

[1] Global Autoimmune Disease Market Report 2022. Industry Research Co., 2022.