Last updated: July 27, 2025

Introduction

Mometasone, a potent corticosteroid used primarily in treating allergic rhinitis, asthma, and various dermatological conditions, has experienced consistent growth driven by expanding therapeutic indications and global demand for anti-inflammatory therapies. This analysis evaluates the market dynamics, competitive landscape, regulatory environment, and projections to inform strategic decision-making for stakeholders involved in the drug’s commercialization.

Market Overview

Therapeutic Applications and Market Demand

Mometasone is marketed across multiple formulations including nasal sprays (e.g., Nasonex), topical creams, and inhalers, serving both respiratory and skin-related indications. Its high efficacy and minimal systemic absorption make it a preferred choice among corticosteroids.

The global corticosteroids market was valued at approximately USD 13 billion in 2022 and is projected to grow at a CAGR of around 4-5% through 2030 [1]. Mometasone, as a key product in this segment, benefits from the broader trends in allergy management, chronic respiratory disease treatment, and dermatological care.

Key Geographic Markets

- North America: Dominates the market due to high awareness, developed healthcare infrastructure, and strong patent protections for branded formulations.

- Europe: Significant growth driven by aging populations and increased allergy and asthma prevalence.

- Asia-Pacific: Fastest growing region, owing to rising disposable incomes, expanded drug access, and increasing prevalence of allergic conditions.

Competitive Landscape

Major Players and Market Share

- Merck & Co. (Nasonex): Leading brand with extensive market penetration.

- GlaxoSmithKline: Offers inhaled methylprednisolone products.

- Teva Pharmaceuticals: Generic formulations of mometasone.

- Other Competitors: Mylan, Cipla, and local generic manufacturers expanding presence.

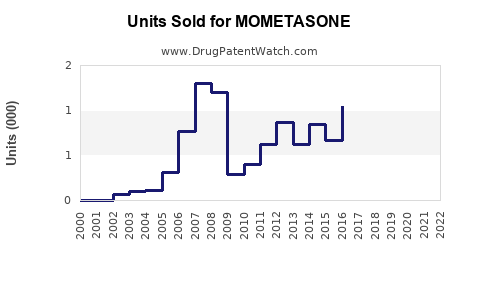

Patent expirations on branded mometasone products from major pharma may catalyze generic entry, intensifying competition but also expanding accessibility.

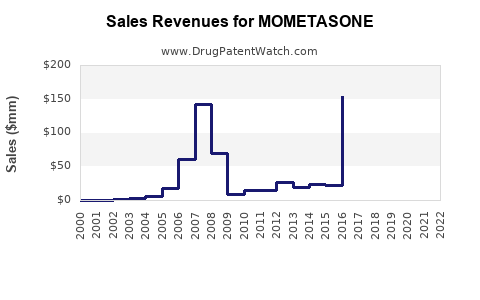

Pricing Trends

Branded formulations maintain premium pricing, but patent cliffs and regulatory approvals of generics have historically led to significant price erosion—averaging 20-30% upon generic launches [2].

Regulatory Environment

- Approval Pathways: Mometasone’s various formulations are approved through stringent processes by the FDA, EMA, and other regulators.

- Patent Landscape: Patents typically enforce for 20 years from filing, with some formulations facing expiry in the next 2-5 years, opening opportunities for generics.

Sales Projections (2023-2030)

Baseline Scenario

- 2022 Revenue Estimation: Approximately USD 1.2 billion globally, primarily driven by nasal and topical formulations.

- CAGR Forecast: 7%, driven by expanding indications and rising prevalence of allergic and inflammatory conditions.

- Incremental Growth Factors:

- Increasing adoption of mometasone-based nasal sprays and inhalers.

- Uptake of generic equivalents reducing prices and increasing accessibility.

- Entry into emerging markets with expanded healthcare infrastructure.

Optimistic Scenario

- Accelerated growth at 9-10% CAGR due to:

- Broadened indications, including innovative delivery systems.

- Strategic partnerships and partnerships enhancing distribution.

- Regulatory approvals for new formulations (e.g., combination therapies).

Conservative Scenario

- Growth slowed to 4-5%, affected by:

- Market saturation in developed regions.

- Competitive pricing pressures.

- Stringent regulatory hurdles in emerging markets.

Market Drivers and Barriers

Drivers

- Growing prevalence of allergic rhinitis, asthma, and dermatological conditions.

- Increasing awareness of corticosteroids’ efficacy.

- Adoption of combination therapies.

Barriers

- Potential side effects like nasal irritation or skin thinning.

- Stringent regulatory requirements.

- Competition from newer biologics and alternative therapies.

Strategic Opportunities

- Generic Expansion: Capitalize on patent cliffs to capture market share with cost-effective generics.

- New Formulation Development: Invest in innovative delivery mechanisms such as extended-release or targeted nasal sprays.

- Emerging Markets Penetration: Leverage demographic shifts and healthcare investments in Asia-Pacific, Africa, and Latin America.

- Collaborations and Licensing: Partner with local distributors to expand reach and accelerate time-to-market.

Conclusion

Mometasone maintains a resilient position within the corticosteroid market, underpinned by broad therapeutic applications, persistent demand, and expanding markets. While patent expiries pose competitive challenges, they simultaneously unlock opportunities for generics and biosimilars. Strategic investments in formulation innovation and emerging market expansion are critical to sustaining growth, with sales projections indicating a compound annual growth rate of 6-8% over the next decade.

Key Takeaways

- Market Growth: Anticipated global CAGR of 6-8% through 2030 driven by rising allergies and inflammatory diseases.

- Patent Outlook: Upcoming patent expirations between 2024-2027 will catalyze generic proliferation, exerting downward pressure on prices.

- Geographic Focus: Prioritize expansion into Asia-Pacific and emerging markets to maximize growth potential.

- Product Development: Invest in innovative delivery systems and combination therapies to differentiate offerings.

- Regulatory Strategy: Maintain agility to navigate evolving approval landscapes, especially for new formulations and indications.

FAQs

1. What are the primary therapeutic indications for mometasone?

Mometasone is mainly used for allergic rhinitis, asthma management, and dermatological conditions such as eczema and psoriasis, owing to its anti-inflammatory and immunosuppressive properties.

2. How does patent expiration impact the mometasone market?

Patent expirations open the market for generic manufacturers, increasing competition, reducing prices, and expanding patient access. This often leads to a significant decrease in branded product revenues but creates new revenue streams for generics.

3. What are the main challenges facing mometasone market expansion?

Regulatory hurdles, side effect profiles, and intense competition from both generics and emerging biologics pose challenges. Market saturation in developed countries also limits growth opportunities there.

4. Which regions present the most lucrative opportunities for mometasone?

Emerging markets in Asia-Pacific, Latin America, and Africa offer the greatest growth potential due to rising disease prevalence, increasing healthcare access, and lower market penetration of existing products.

5. What innovations could sustain the market’s growth?

Developing novel delivery mechanisms (e.g., targeted nasal sprays, inhalers), combination therapies, and formulations addressing unmet needs can enhance differentiation and market share.

References

[1] Global Market Insights. “Corticosteroids Market Size & Trends.” 2022.

[2] IMS Health Report. “Impact of Patent Expiries on Pharmaceutical Pricing.” 2021.