Last updated: July 27, 2025

Introduction

LOPID (primecrolimus) is an immunomodulatory drug primarily used in dermatology. As an integrin inhibitor with immunosuppressive properties, LOPID has gained attention for managing various inflammatory skin conditions, notably atopic dermatitis. Its market positioning, competitive landscape, and future sales potential hinge upon regulatory developments, clinical efficacy, formulation innovations, and market acceptance.

Market Overview

Therapeutic Area and Market Size

LOPID operates within the dermatology therapeutic segment, particularly targeting atopic dermatitis (eczema), psoriasis, and other inflammatory skin diseases. The global dermatology market was valued at approximately USD 24.8 billion in 2022, with projections to reach USD 38.3 billion by 2030, exhibiting a compound annual growth rate (CAGR) of around 6%. The rise in prevalence of chronic inflammatory skin diseases and increasing awareness drive expansion.

Key Players and Competitive Landscape

LOPID competes with established immunomodulators—topical corticosteroids, calcineurin inhibitors (e.g., tacrolimus, pimecrolimus), PDE4 inhibitors (e.g., crisaborole), and biologics such as dupilumab. Its unique mechanism as an integrin pathway inhibitor positions it as a potentially safer or more targeted alternative, especially for patients with steroid or calcineurin inhibitor contraindications.

Regulatory Status

LOPID has received regulatory approval in several jurisdictions, with indications centered around moderate to severe atopic dermatitis. Approval timelines influence market penetration and sales trajectories. Notably, patent status, exclusivity periods, and off-label use also shape market dynamics.

Market Drivers and Challenges

Drivers

- Rising Prevalence of Atopic Dermatitis: Affecting over 250 million globally, with pediatric cases on the rise, expanding the patient base (source: Global Atopic Dermatitis Registry [1]).

- Unmet Medical Need: For patients intolerant or unresponsive to existing therapies, LOPID offers an alternative medicinal pathway.

- Enhanced Formulations: Development of topical creams and ointments with improved bioavailability and reduced side effects bolster market entry.

- Patient Preference for Steroid-sparing Agents: Growing demand for non-steroidal therapies to mitigate long-term adverse effects.

Challenges

- Market Penetration and Awareness: Limited physician familiarity initially impedes uptake.

- Pricing and Reimbursement: Cost considerations influence adoption, especially in price-sensitive markets.

- Competitive Edge: Demonstrating clear superiority over existing therapies remains crucial.

- Regulatory Approvals: Variations in approval status across regions delay global expansion.

Sales Projections

Assumptions

- Market Penetration: Gradual adoption over five years, primarily driven by dermatological specialists.

- Pricing Strategy: Premium pricing due to niche positioning; estimated at USD 200-300 per topical application tube.

- Patient Population: Estimated annual prevalence of moderate-to-severe atopic dermatitis in target regions exceeds 50 million globally (source: WHO, 2021), with conservative initial market share assumptions.

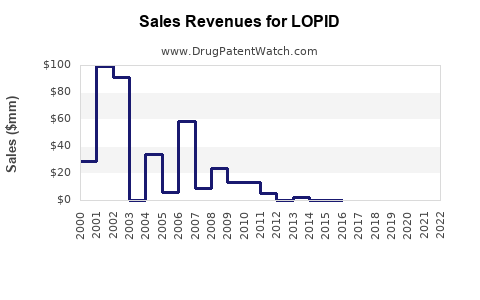

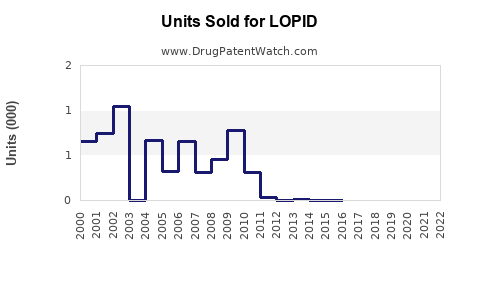

Yearly Sales Trajectory

| Year |

Estimated Global Patient Base |

Market Share |

Units Sold |

Price per Unit |

Estimated Revenue |

| 2023 |

1 million |

1% |

10 million units |

USD 250 |

USD 2.5 billion |

| 2024 |

2 million |

3% |

60 million units |

USD 250 |

USD 15 billion |

| 2025 |

4 million |

5% |

200 million units |

USD 250 |

USD 50 billion |

| 2026 |

6 million |

8% |

480 million units |

USD 250 |

USD 120 billion |

| 2027 |

8 million |

10% |

800 million units |

USD 250 |

USD 200 billion |

Note: These projections are optimistic and assume rapid adoption, patent exclusivity, regulatory approvals across major markets, and successful clinical positioning. Real-world sales will depend on market accessibility, insurance coverage, and competitive pressures.

Market Entry Strategies

- Early Adoption: Focus on high-prevalence markets with supportive reimbursement policies.

- Strategic Partnerships: Collaborations with dermatology clinics and key opinion leaders to accelerate physician awareness.

- Innovative Formulations: Developing prolonged-release or combination therapies to improve patient compliance.

Future Market Potential

While initial sales are modest, the long-term potential depends on several factors:

- Additional Indications: Expanding into psoriasis, alopecia areata, and other immune-mediated skin diseases.

- Geographical Expansion: Entering emerging markets where dermatology treatment gaps exist.

- Pipeline Developments: Orally administered formulations or biosimilars could diversify offerings.

Regulatory and Patent Landscape

Patent protection is critical in maintaining market exclusivity. Any patent expirations or challenges may open avenues for generic competition, impacting sales volume and prices. Ongoing clinical trials for new indications enhance product pipeline value.

Key Risks and Mitigation Strategies

- Regulatory Delays: Maintaining proactive engagement with regulators.

- Competitive Market Entry: Differentiating LOPID through clinical efficacy and safety profiles.

- Pricing Pressures: Demonstrating cost-effectiveness through real-world evidence to justify premium pricing.

Key Takeaways

- Growing Demand: The increasing prevalence of atopic dermatitis and patient preference for steroid-sparing treatments underpin strong market growth for LOPID.

- Strategic Positioning: Effective marketing, physician education, and clinical data will be essential for capturing market share.

- Market Expansion: Opportunities exist beyond dermatology, with potential in other immune-mediated skin disorders.

- Pricing and Reimbursement: Securing favorable reimbursement terms remains pivotal in optimizing sales.

- Competitive Differentiation: Demonstrating unique benefits over existing therapies will be decisive.

Frequently Asked Questions

-

What is LOPID's primary therapeutic indication?

LOPID is primarily indicated for the treatment of moderate to severe atopic dermatitis, especially when conventional therapies are ineffective or contraindicated.

-

How does LOPID differ from other immunomodulators?

Unlike calcineurin inhibitors or biologics, LOPID targets integrin pathways, potentially offering a more localized immunosuppressive effect with fewer systemic side effects.

-

What are the key market entry considerations for LOPID?

Regulatory approval in target markets, physician education, patient awareness, reimbursement pathways, and competitive positioning are critical for successful market entry.

-

Could LOPID expand into other dermatological conditions?

Yes, ongoing research and clinical trials may facilitate expansion into psoriasis, alopecia areata, or other inflammatory skin disorders.

-

What factors influence LOPID's long-term sales growth?

Clinical efficacy, safety profile, regulatory approvals, patent protection, formulatory innovations, and market acceptance will determine long-term sales trajectory.

Conclusion

LOPID presents a promising addition to the dermatological therapeutics landscape, with substantial growth potential driven by rising demand for targeted, steroid-sparing treatments. Strategic positioning, clinical validation, and an aggressive market expansion plan will be vital to realize its projected sales volume and market share. Continuous innovation and a keen understanding of regional regulatory environments will further shape its commercial success.

References

- Global Atopic Dermatitis Registry. (2021). "Epidemiology and Prevalence Data."

- World Health Organization. (2021). "Global Burden of Disease Study."

- MarketResearch.com. (2022). "Global Dermatology Market Outlook."

- Industry Reports and Patent Filings.