Last updated: July 30, 2025

Introduction

LEVOXYL (levothyroxine sodium) is a synthetic form of thyroxine (T4), primarily prescribed for hypothyroidism, myxedema, and certain thyroid cancers. As a longstanding staple in endocrine therapy, it commands a stable presence in the pharmaceutical market. This report analyzes the current market landscape for LEVOXYL, examines key growth drivers and challenges, and presents sales projections over the coming five years to aid strategic decision-making.

Market Overview

Product Profile and Approval Status

LEVOXYL remains one of the most widely prescribed thyroid hormone replacements worldwide, with pharmacovigilance and approved formulations standardized per pharmacopeial standards, including USP and BP. Its widespread approval across global markets, notably in North America, Europe, and parts of Asia, underscores its critical role in managing hypothyroidism.

Market Dynamics

The global thyroid disorder treatment market is driven by rising prevalence of hypothyroidism, aging populations, increased awareness, and expanding healthcare infrastructure. According to the American Thyroid Association, hypothyroidism affects approximately 4.6% of the U.S. population, with higher rates in women and older adults.[1] Similar patterns are observed globally, bolstering demand for levothyroxine.

Competitive Landscape

LEVOXYL faces competition from other brands of levothyroxine, such as Euthyrox, Synthroid, and Levoxyl, as well as generic formulations. Market share is influenced by pricing, brand recognition, and formulary inclusions. The patent expiry of several branded formulations has intensified generic competition, fueling price competition and accessibility.

Market Segmentation

Geographical Distribution

- North America: Largest market share, driven by high hypothyroidism prevalence, advanced healthcare, and robust insurance coverage.

- Europe: Similar trends with high awareness and established supply chains.

- Asia-Pacific: Rapidly growing with increasing diagnosis rates, urbanization, and healthcare expansion.

- Emerging Markets: Present opportunities but face challenges such as regulatory hurdles and cost constraints.

End-User Segments

- Hospitals: Predominant setting for initial prescriptions, especially for severe cases.

- Outpatient Clinics and Pharmacies: Significant in ongoing, long-term management.

- Direct-to-Consumer (DTC): Growing influence as awareness campaigns promote chronic disease management.

Drivers of Market Growth

Increasing Prevalence of Hypothyroidism

The global rise in hypothyroid cases directly correlates with increased levothyroxine prescriptions. Factors like iodine deficiency, autoimmune diseases (e.g., Hashimoto's thyroiditis), and environmental influences contribute significantly.

Aging Population

Older populations have higher hypothyroidism incidence, particularly in developed markets, expanding the patient pool.

Healthcare Infrastructure and Diagnostic Capabilities

Enhanced diagnostic tools lead to better detection and earlier treatment initiation, boosting demand for LEVOXYL.

Brand Recognition and Prescriber Confidence

LEVOXYL's long-standing reputation creates trust among clinicians, maintaining steady prescription rates despite the availability of generic options.

Regulatory Approvals and Guidelines

Endorsements from leading health authorities and inclusion in clinical guidelines, such as those from the Endocrine Society, sustain market stability.

Challenges and Market Risks

Generic Competition and Pricing Pressures

The commoditization of levothyroxine formulations exerts downward pressure on prices, affecting revenues, especially for branded versions like LEVOXYL.

Manufacturing and Supply Chain Disruptions

Global supply chain vulnerabilities, including raw material shortages and geopolitical issues, threaten product availability.

Regulatory Changes and Stringent Quality Standards

Evolving regulatory landscapes demand ongoing compliance, increasing operational costs.

Market Saturation

Mature markets indicate slowing growth, necessitating diversification and innovation strategies.

Sales Forecasts and Future Outlook

Methodology

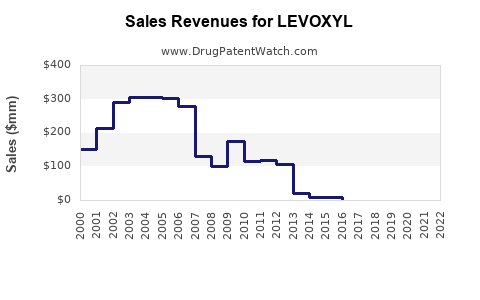

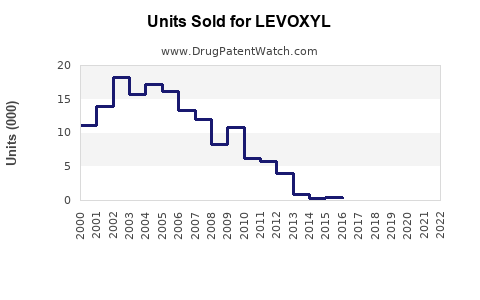

Projections are based on compound annual growth rates (CAGR), historical sales data, epidemiological trends, and market dynamics modeling, considering regional variations.

Baseline Scenario

Assuming an average global CAGR of approximately 3-4% over the next five years, driven by expanding diagnosed populations and increasing acceptance of long-term thyroid hormone therapy.

Key Regional Projections

- North America: Market is expected to stabilize with a modest CAGR of about 2-3%, given market maturity. Growth driven by continued diagnosis of hypothyroidism in aging demographics.

- Europe: Similar patterns with CAGR around 2.5%, supported by healthcare initiatives and increased awareness.

- Asia-Pacific: Outpaces mature markets with projected CAGR between 5-7%, fueled by rising diagnosis rates and healthcare expansion.

- Emerging Markets: Potentially higher growth, but actual growth depends on regulatory and economic factors, estimated at 4-6%.

Market Value Estimations

Current global sales of levothyroxine products—including LEVOXYL—are estimated at $800 million to $1 billion annually.[2] With ongoing growth, sales are projected to reach $1.2 billion to $1.5 billion by 2028.

Impact of Patent Expiry and Generics

Patent expiries globally continue to accelerate generic market penetration. This results in lower average selling prices but expanded volume sales, enabling overall revenue growth when volume outpaces price declines. Notably, LEVOXYL's brand status maintains a loyal patient base, providing resilience against total generic commoditization.

Strategic Opportunities

- Product Line Extensions: Development of formulations with alternative delivery methods, such as liquid or softgel forms.

- Regulatory Approvals: Seeking approvals for new indications or pediatric formulations.

- Markets Expansion: Target emerging countries through partnerships and tailored formulations.

- Digital and Patient Engagement: Enhancing adherence and supply chain visibility via digital health platforms.

Conclusion

LEVOXYL holds a stable position within the global thyroid treatment market, buoyed by persistent hypothyroidism prevalence, demographic shifts, and clinical guideline endorsements. While intensifying generic competition constrains pricing power, volume growth and strategic market expansions offer substantial growth opportunities. Conservative but steady sales growth, averaging 3-4% CAGR over the next five years, positions LEVOXYL as a resilient asset in endocrine therapeutics. Companies should leverage its trusted brand recognition while innovating and expanding into emerging markets to sustain competitive advantage.

Key Takeaways

- Market Stability: LEVOXYL benefits from long-standing clinical use and prescriber loyalty, supporting consistent sales.

- Growth Drivers: Rising hypothyroidism prevalence, aging demographics, and improved diagnostics fuel future demand.

- Challenges: Pricing pressures from generics, supply chain vulnerabilities, and regulatory shifts necessitate proactive strategies.

- Regional Opportunities: Asia-Pacific and emerging markets present substantial growth potential with tailored approaches.

- Strategic Focus: Diversifying formulations, entering new markets, and embracing digital health can unlock additional value.

FAQs

1. What is the primary market for LEVOXYL?

The primary market comprises North America, particularly the U.S., owing to high hypothyroidism prevalence and established healthcare infrastructure.

2. How does patent expiration affect LEVOXYL's sales?

Patent expirations lead to increased generic competition, driving down prices but often increasing volume sales, which balances overall revenue.

3. Are there regulatory challenges facing LEVOXYL?

Yes, stricter quality standards and regulatory requirements demand ongoing compliance, but LEVOXYL remains widely approved globally.

4. What are potential growth areas for LEVOXYL?

Emerging markets in Asia-Pacific and formulations with improved dosing options represent promising growth avenues.

5. How will demographic trends influence future sales?

An aging population will likely sustain or increase demand for levothyroxine therapy, underpinning steady growth over the next years.

Sources:

[1] American Thyroid Association. Thyroid Disease Facts. 2022.

[2] Industry Reports, Global Thyroid Market Analysis, 2022.