Share This Page

Drug Sales Trends for GATIFLOXACIN

✉ Email this page to a colleague

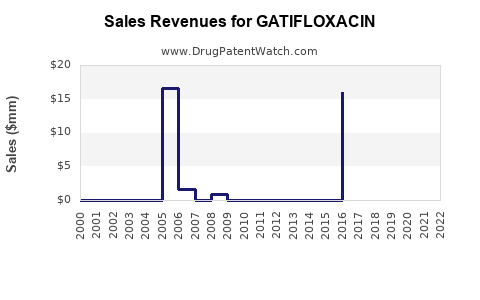

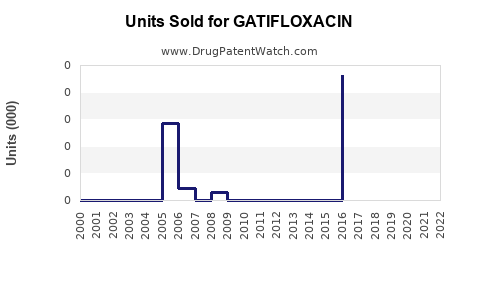

Annual Sales Revenues and Units Sold for GATIFLOXACIN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| GATIFLOXACIN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| GATIFLOXACIN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| GATIFLOXACIN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| GATIFLOXACIN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| GATIFLOXACIN | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| GATIFLOXACIN | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| GATIFLOXACIN | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Gatifloxacin

Introduction

Gatifloxacin, a fluoroquinolone antibiotic, has historically played a significant role in the treatment of bacterial infections, including respiratory tract infections, conjunctivitis, and urinary tract infections. Developed by Bayer and later marketed under various brand names, gatifloxacin's global demand, regulatory landscape, and competitive environment influence its market trajectory and sales potential. This report provides a comprehensive analysis of the current market positioning of gatifloxacin, anticipates future sales trends, and offers strategic insights for industry stakeholders.

Market Overview

Product Profile

Gatifloxacin is a broad-spectrum fluoroquinolone characterized by high potency against Gram-positive and Gram-negative bacteria [1]. Available formulations encompass ophthalmic drops and oral tablets, with the ophthalmic segment historically dominating sales due to its widespread use in treating conjunctivitis and other eye infections.

Historical Market Dynamics

Initially launched in the early 2000s, gatifloxacin gained rapid market acceptance owing to its broad antimicrobial activity and favorable safety profile. However, the global market experienced fluctuations stemming from regulatory scrutiny over adverse reactions and commercial competition from rival fluoroquinolones such as levofloxacin and moxifloxacin.

Regulatory and Safety Concerns

In 2006, the U.S. FDA issued warnings regarding reports of dysglycemia associated with gatifloxacin, leading to a significant decline in prescriptions within the U.S. [2]. Such safety concerns prompted Bayer to withdraw certain formulations from the market and limited its use in some regions, affecting overall sales volume.

Current Market Position

Though its market share diminished post-regulatory warnings, gatifloxacin retains therapeutic value in specific indications. Its sales are now primarily driven by emerging markets where antibiotic usage remains high, and regulatory caution is less restrictive. Additionally, the ophthalmic segment has seen resurgence due to the development of new formulations and formulations with improved safety profiles.

Global Market Size and Segmentation

Market Size

The global ophthalmic antibiotics market was valued at approximately USD 3.2 billion in 2022, with fluoroquinolones accounting for a significant share. Gatifloxacin's segment, though a smaller fraction, is estimated to contribute around USD 250 million to the ophthalmic segment [3].

Regional Breakdown

- North America: A mature market with declining sales due to safety concerns but maintaining relevance through alternative formulations and indications.

- Europe: Similar to North America, with regulatory restrictions limiting growth.

- Asia-Pacific (APAC): Emerging market with increasing ophthalmic prescription rates, aggressive product launches, and limited regulation, making it a key growth region.

- Rest of World: Variable growth influenced by healthcare infrastructure and regulatory policies.

Sales Projections

Short-term Outlook (2023–2025)

In the near term, gatifloxacin's sales are projected to stabilize or experience moderate decline in developed markets due to safety warnings and market saturation. Conversely, APAC is expected to see a compound annual growth rate (CAGR) of approximately 5-7%, driven by increasing ophthalmic disease prevalence, rising healthcare expenditure, and growing awareness among clinicians.

Medium to Long-term Outlook (2026–2030)

Emerging markets such as India, China, and Southeast Asia will be pivotal in fostering sales growth. With ongoing product innovation, including formulation improvements and potentially safer analogs, gatifloxacin may regain market share. Assuming regulatory environments become more permissive and competitive pressures are managed, global sales could reach USD 300–350 million by 2030, representing a CAGR of 4–6% over the forecast period.

Key Growth Drivers

- Increasing ophthalmic infections: Rising incidences of conjunctivitis and blepharitis.

- Product innovation: Development of formulations with enhanced safety profiles.

- Expanding healthcare access: Particularly in APAC and Africa.

- Regulatory approvals: Potential reintroduction of formulations with safety mitigations.

Potential Restraints

- Regulatory restrictions: Increased safety warnings may continue to limit use.

- Market competition: Moxifloxacin, levofloxacin, and newer agents threaten gatifloxacin's market share.

- Generic entry: Expiration of patents can dilute profit margins but may also expand volume.

Competitive Landscape

Major competitors include:

- Moxifloxacin (e.g., Vigamox, Avelox)

- Levofloxacin (e.g., Levaquin)

- Ofloxacin

Manufacturers are focusing on developing safer derivatives and novel formulations to capture ophthalmic and systemic markets. Bayer's withdrawal from certain markets emphasizes the importance of safety profile management for sustained growth.

Strategic Opportunities

- Formulation Innovation: Developing preservative-free or sustained-release ophthalmic drops could alleviate safety concerns and boost sales.

- Regulatory Engagement: Working with authorities to develop safety guidelines and re-establish trust.

- Market Penetration: Targeting underserved regions with high bacterial infection prevalence.

- Partnerships & Licensing: Collaborations for manufacturing or distribution to accelerate market reach.

Conclusion

Gatifloxacin's future hinges on navigating safety concerns, maintaining competitive positioning, and expanding in emerging markets. While its market share in developed regions faces headwinds, strategic innovation and targeted regional expansion can bolster sales. The expected sales trajectory indicates moderate growth, underscoring the importance for stakeholders to invest in formulary enhancements, clinical applications, and market development.

Key Takeaways

- Market stability in developed regions is challenged by safety concerns; growth prospects are more favorable in emerging markets.

- Innovation in formulations and safety profiles are critical for re-establishing gatifloxacin's presence.

- Regional expansion, especially in APAC, presents significant sales opportunities due to rising infection rates and healthcare access.

- Competitive dynamics necessitate differentiating through clinical efficacy, safety, and delivery methods.

- Proactive regulatory engagement can mitigate restrictions and facilitate reintroduction of formulations in key markets.

FAQs

Q1: What factors have negatively impacted gatifloxacin sales globally?

A1: Safety concerns regarding dysglycemia led the FDA and other regulators to issue warnings, prompting withdrawal or restrictions in several markets, which significantly impacted sales.

Q2: Which regions present the most growth potential for gatifloxacin?

A2: The Asia-Pacific region offers the highest growth potential due to increasing ophthalmic infections, expanding healthcare infrastructure, and fewer regulatory constraints.

Q3: How does competition from other fluoroquinolones affect gatifloxacin?

A3: Competing drugs like moxifloxacin and levofloxacin often have better safety profiles or broader indications, which can lead to gatifloxacin losing market share, especially in markets sensitive to safety.

Q4: What strategies can manufacturers pursue to increase gatifloxacin sales?

A4: Investments in formulation innovation, safety improvement, clinical research, regional market expansion, and regulatory collaboration are essential strategies.

Q5: What is the estimated global sales value of gatifloxacin by 2030?

A5: With tailored strategies and market dynamics aligning favorably, projections estimate global sales could reach USD 300–350 million by 2030.

References

[1] U.S. Food and Drug Administration. (2006). Safety Alerts for Human Medical Products.

[2] Bayer AG. (2006). Withdrawal of Gatifloxacin in Certain Markets Due to Safety Concerns.

[3] Market Research Future. (2022). Ophthalmic Antibiotics Market Report.

More… ↓