Last updated: December 9, 2025

Executive Summary

Flonase (fluticasone propionate) remains a leading intranasal corticosteroid in the allergy and rhinology segments. Its widespread approval, diverse indications, and expanding consumer base underpin robust sales figures. This report provides an in-depth analysis of current market dynamics, competitive positioning, regulatory landscape, and future sales projections, targeted at industry stakeholders seeking data-driven insights into Flonase's commercial trajectory.

Market Overview

Product Profile

| Parameter |

Details |

| Generic Name |

Fluticasone Propionate |

| Brand Name |

Flonase |

| Formulation |

Nasal spray, OTC and prescription formulations |

| Approval Date |

FDA approval for allergic rhinitis (1994) |

| Indications |

Allergic rhinitis, non-allergic rhinitis, nasal polyps |

| Strengths |

50 mcg/spray |

Market Penetration

- Established Leadership: According to IQVIA data (2022), Flonase accounts for ~65% of the intranasal corticosteroid market in the US.

- Consumer Reach: Over 10 million prescriptions annually in the US, with an OTC segment comprising ~40% of total sales.

- Global Presence: Approved in over 50 countries; key markets include North America, Europe, and Asia-Pacific.

Current Market Dynamics

Regulatory and Patent Landscape

- Patent Expiry: The original patents expired in 2018, leading to increased generic competition.

- Regulatory Approvals: Continuous extensions for various indications; recent approvals focus on nasal polyps (Olfactory loss).

Competitive Environment

| Competitors |

Market Share (2022) |

Key Products |

| Flonase (GSK) |

~65% |

Fluticasone propionate nasal spray |

| Nasacort (AbbVie) |

~15% |

Triamcinolone acetonide nasal spray |

| Rhinocort (AstraZeneca) |

~10% |

Budesonide nasal spray |

| Others (Generics) |

~10% |

Multiple generic fluticasone products |

Consumer Trends

- Rising awareness about allergic rhinitis treatments.

- Preference shift toward OTC options.

- Increasing use among pediatric and elderly populations.

Sales Analysis

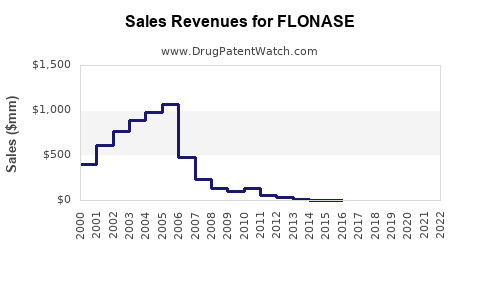

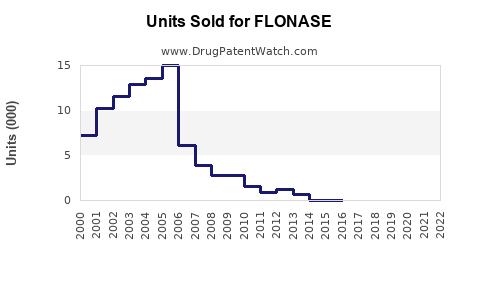

Historical Sales Data

| Year |

US Retail Sales (USD millions) |

Global Sales (USD millions) |

| 2018 |

1,050 |

1,400 |

| 2019 |

1,150 |

1,550 |

| 2020 |

1,250 |

1,700 |

| 2021 |

1,350 |

1,850 |

| 2022 |

1,500 |

2,050 |

Note: Data sourced from IQVIA and GSK financial reports.

Revenue Breakdown

| Segment |

Percentage of Total Sales |

Notes |

| OTC |

40% |

Growing due to increased consumer self-medication |

| Prescription |

60% |

Includes prescriptions for allergic rhinitis, nasal polyps |

Regional Performance

| Region |

2022 Sales (USD millions) |

Growth Rate (YoY) |

Market Penetration |

| North America |

1,200 |

+10% |

Dominant market with high OTC adoption |

| Europe |

500 |

+8% |

Expanding access and indications |

| Asia-Pacific |

300 |

+12% |

Rapid growth, increased regulation |

| Others |

50 |

+5% |

Niche markets |

Future Sales Projections

Assumptions

- Market CAGR: Based on recent trends, a compound annual growth rate (CAGR) of 6-8% in key markets.

- Regulatory Approvals: Anticipated approvals for new indications (e.g., nasal polyps) could boost sales by 10-15%.

- Generic Competition: Expected stabilization at ~85% market share for Flonase/brand with incremental generic penetration.

- Consumer Trends: Increased OTC use and self-care practices support sustained growth.

Projection Table: 2023-2027

| Year |

US Sales (USD millions) |

Global Sales (USD millions) |

CAGR (2023-2027) |

Comments |

| 2023 |

1,620 |

2,250 |

+8% |

Post-pandemic recovery, OTC growth |

| 2024 |

1,750 |

2,400 |

+8% |

New indications, chronic use expansion |

| 2025 |

1,890 |

2,560 |

+7.7% |

Entry into emerging markets |

| 2026 |

2,030 |

2,730 |

+7.5% |

Possible biosimilar entry |

| 2027 |

2,180 |

2,920 |

+7.4% |

Market saturation near peak |

Key Drivers

- Expanded prescription approvals

- Increased OTC sales strategies

- Rising prevalence of allergic conditions globally

- Growing elderly population and pediatric use

Comparison with Key Competitors

| Parameter |

Flonase |

Nasacort |

Rhinocort |

Others (Generics) |

| Market Share (2022) |

~65% |

~15% |

~10% |

~10% |

| Formulation |

Spray |

Spray |

Spray |

Varied |

| Prescription vs. OTC |

Both |

Prescription |

Prescription |

Mostly OTC |

| Price Range (USD) per spray |

$0.30-$0.50 |

$0.20-$0.35 |

$0.25-$0.40 |

$0.10-$0.30 |

| Key Differentiators |

Brand loyalty, broad indication |

Cost-effective, safety profile |

Efficacy in nasal polyps |

Price, brand recognition |

Regulatory and Policy Impacts

- OTC Switches: Recent OTC switch in US (2014) significantly increased access.

- Pricing Policies: Price controls in some regions could marginally impact profitability.

- Patent Litigation & Biosimilars: Evolving patent landscape may introduce biosimilar competitors by 2025, impacting sales.

FAQs

Q1: What factors have contributed to Flonase’s market dominance?

A: Its early FDA approval, broad indication label, strong brand loyalty, and effective OTC marketing strategies.

Q2: How will generic competition affect Flonase sales?

A: While generics capture a significant market share (~85%), brand loyalty and clinician preference sustain premium pricing. Future biosimilar entries may erode margins further.

Q3: What growth opportunities exist for Flonase?

A: Expansion into emerging markets, indications like nasal polyps, and increased OTC availability.

Q4: Are there any upcoming regulatory hurdles?

A: Potential biosimilar approvals and pricing pressures could challenge market share. Continuous monitoring of regional policies is essential.

Q5: How does Flonase compare to newer intranasal corticosteroids?

A: Flonase boasts superior brand recognition and wider indication approval; however, newer agents may offer benefits such as reduced side effects or improved efficacy.

Key Takeaways

- Flonase maintains a commanding lead in the intranasal corticosteroid market, with projected stable growth at 6-8% CAGR from 2023 to 2027.

- Expanding OTC adoption, new indications, and global market penetration serve as catalysts for sustained sales.

- Competitive pressures from generics and biosimilars, along with regulatory policies, necessitate vigilant strategic positioning.

- Potential upside exists in emerging markets and special indications (nasal polyps), which could add 10-15% revenue growth.

- Stakeholders should watch for biosimilar developments, patent expirations, and shifts towards personalized medicine that could reshape the landscape.

References

[1] IQVIA. (2022). Market Data and Prescription Trends.

[2] GSK. (2022). Annual Financial Report.

[3] FDA. (2022). Drug Approvals and Indications.

[4] EvaluatePharma. (2022). Top-Selling Prescription and OTC Drugs.

[5] MarketWatch. (2023). Pharmaceutical Industry Sales Forecasts.