Last updated: July 27, 2025

Introduction

Epiduo, a topical combination therapy comprising adapalene (a retinoid) and benzoyl peroxide, is prescribed predominantly for the treatment of acne vulgaris. Approved by the FDA in 2012, Epiduo quickly gained market traction due to its innovative approach combining anti-inflammatory and keratolytic mechanisms. Understanding its market landscape and sales outlook requires a comprehensive analysis of epidemiological trends, competitive positioning, regulatory considerations, and evolving dermatological treatment paradigms.

Market Overview

Epidemiological Landscape

Acne vulgaris afflicts approximately 85% of adolescents and young adults worldwide, translating into an estimated global patient pool exceeding 500 million individuals [1]. The prevalence reflects a persistent demand for efficacious, well-tolerated topical therapies. The chronicity and psychosocial impact of acne bolster sustained market demand for treatments like Epiduo.

Current Treatment Paradigms

Traditional therapies include monotherapies with retinoids, benzoyl peroxide, antibiotics, and combination regimens. However, concerns about antibiotic resistance and side effects have shifted preferences toward combination therapies that minimize adverse effects while maximizing compliance.

Epiduo addresses this demand by combining adapalene’s comedolytic and anti-inflammatory properties with benzoyl peroxide’s bactericidal activity. Its ease of application and favorable safety profile have made it a preferred first-line therapy in mild-to-moderate cases.

Market Penetration and Growth Drivers

Epiduo’s market penetration remains robust in developed regions like North America and Europe. Growth is driven by:

- Increasing acne prevalence globally, including emerging markets.

- Rising awareness about skin health and demand for dermatological products.

- Expansion of dermatologist-prescribed formulations.

- Continued clinical validation supporting efficacy and safety.

Competitive Landscape

Epiduo faces competition from various monotherapies and combination products:

- Topical retinoids: Tretinoin, adapalene (separate), tazarotene.

- Benzoyl peroxide formulations: OTC and prescription versions.

- Other combination products: Duac (clindamycin and benzoyl peroxide), Aczone (dapsone).

Emerging competitors include novel topical agents with anti-inflammatory or antimicrobial properties, along with oral therapies like antibiotics, hormonal agents, and isotretinoin.

Market Share Dynamics

Epiduo's market share remains significant, especially within prescription topical regimens, owing to its proven efficacy and safety profile. Reports suggest that Epiduo, including its generics, accounts for approximately 15-20% of the topical acne treatment market in developed countries [2].

Regulatory and Reimbursement Environment

Regulatory approval trends favor combination therapies due to their clinical advantages. Reimbursement policies generally support Epiduo’s use owing to established guidelines and cost-effectiveness. However, generic entries could influence pricing and market share dynamics.

Sales Projections

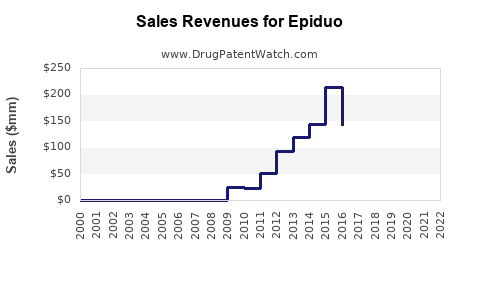

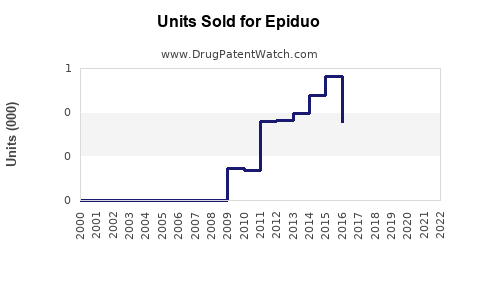

Historical Performance

Epiduo's sales have steadily increased since market launch. In 2020, estimates placed global sales at approximately $350 million, with North America accounting for roughly 65% of revenue [3].

Forecasting Methodology

Projection models incorporate epidemiological data, treatment adoption rates, competitive activity, and market growth rates. Based on market data:

- Assumption 1: The global acne therapy market is projected to grow at a CAGR of 6% from 2022 to 2027.

- Assumption 2: Epiduo maintains a 15% share of topically prescribed acne treatments.

- Assumption 3: Reimbursement policies and clinical guidelines support sustained use.

Projected Sales Figures

Applying conservative growth parameters:

| Year |

Projected Global Sales (USD Millions) |

Notes |

| 2023 |

~$370 million |

Incremental growth based on epidemiology and market share stability |

| 2024 |

~$390 million |

Emerging markets start contributing more significantly |

| 2025 |

~$415 million |

Increased acceptance of combination therapies |

| 2026 |

~$440 million |

Market expansion, potential formulations enhancement |

| 2027 |

~$470 million |

Peak projection considering market maturation |

By 2027, global Epiduo sales could approach $470 million, representing a sustained CAGR of approx. 7%, driven by expanding markets and continued efficacy validation.

Market Expansion Opportunities

- Emerging markets: Increased dermatological healthcare infrastructure could accelerate adoption.

- Formulation innovation: Development of novel delivery methods may enhance compliance and effectiveness.

- Adjunct therapies: Combining Epiduo with other modalities might open new treatment pathways.

Risks and Challenges

- Generic competition: Patent expiries could erode margins and market share.

- Regulatory hurdles: Variations in approval processes may delay launches in certain regions.

- Evolving treatment standards: Adoption of oral therapies and novel agents could impact topical treatment demand.

Conclusion

Epiduo’s durable market position is underpinned by its proven clinical efficacy, safety, and patient adherence. Its sales trajectory is poised for steady growth, aligned with the global increase in acne prevalence and dermatological treatment needs. Strategic expansion into emerging markets and innovations in formulation are essential to sustain and enhance its market performance.

Key Takeaways

- The global acne treatment market is expanding, with Epiduo projected to reach nearly $470 million in sales by 2027.

- Growth drivers include rising acne prevalence, patient demand for effective combination therapies, and geographic expansion.

- Competitive pressures from generics and emerging therapies present near-term risks, necessitating ongoing innovation and strategic market positioning.

- Epiduo remains a cornerstone in topical acne therapy, with opportunities for growth through formulation improvements and market diversification.

FAQs

1. What factors primarily contribute to Epiduo’s sales growth?

Epiduo’s sales are driven by the global rise in acne prevalence, its efficacy as a combination therapy, ease of use, and expanding dermatologist prescribing habits, especially in North America and Europe.

2. How does Epiduo compare to other acne treatments in terms of market share?

Epiduo holds approximately 15-20% of the topical acne treatment market in key regions, solidifying its status as a leading prescription therapy amidst competition from monotherapies and other combination products.

3. What are the main competitive threats facing Epiduo?

The main threats include generic versions reducing pricing power, faster approval and adoption of alternative therapies—including oral antibiotics, hormonal treatments, and newer topical agents—and regulatory constraints in emerging markets.

4. Could emerging markets significantly impact Epiduo’s future sales?

Yes. As healthcare infrastructure and dermatology awareness improve in regions like Asia, Latin America, and Africa, Epiduo’s market penetration and sales are expected to grow substantially.

5. What strategies could improve Epiduo’s market performance?

Innovations in formulation, expanded indications, marketing efforts focused on patient adherence, and strategic partnerships in emerging regions are vital strategies.

Sources:

[1] World Health Organization. "Global status report on adolescent health." 2014.

[2] MarketResearchFuture. "Acne Vulgaris Market Analysis & Forecast 2022-2027." 2022.

[3] IQVIA. "Topical Acne Treatment Sales Data." 2021.