Last updated: July 27, 2025

Introduction

Celebrex (celecoxib) is a nonsteroidal anti-inflammatory drug (NSAID) developed by Pfizer, primarily indicated for the treatment of osteoarthritis, rheumatoid arthritis, ankylosing spondylitis, and acute pain. As a selective COX-2 inhibitor, Celebrex offers an alternative to traditional NSAIDs with a potentially reduced risk of gastrointestinal adverse effects. Since its approval in 1998, Celebrex has experienced fluctuating market dynamics influenced by patent status, regulatory scrutiny, and competition from newer therapies.

This report provides a comprehensive analysis of the current market landscape for Celebrex, encompassing historical sales trends, competitive positioning, regulatory considerations, and future sales projections based on macroeconomic and clinical development trajectories.

Market Overview

Global Therapeutic Demand

The global NSAID market was valued at approximately USD 13 billion in 2022, with COX-2 inhibitors comprising roughly 20% of this segment (USD 2.6 billion). Celecoxib held an estimated 70% market share among COX-2 inhibitors pre-patent expiry, primarily in North America, Europe, and select Asian markets [1]. The rising prevalence of osteoarthritis and rheumatoid arthritis, driven by aging populations, sustains steady demand.

Market Segmentation

- Geography: North America dominates, driven by high NSAID adoption and high healthcare expenditure. Europe follows, with emerging markets in Asia-Pacific gaining traction.

- Indication: Osteoarthritis (40%), rheumatoid arthritis (35%), ankylosing spondylitis, acute pain, and off-label uses.

- Patient Demographics: An aging population with chronic inflammatory conditions is the primary consumer segment.

Competitive Landscape

Key competitors include traditional NSAIDs (ibuprofen, naproxen), other COX-2 inhibitors (etoricoxib, valdecoxib), and emerging biologics. The controversial cardiovascular safety profile of Celebrex and the withdrawal of some COX-2 inhibitors (e.g., Bextra) have influenced prescriber preferences.

Historical Sales Performance

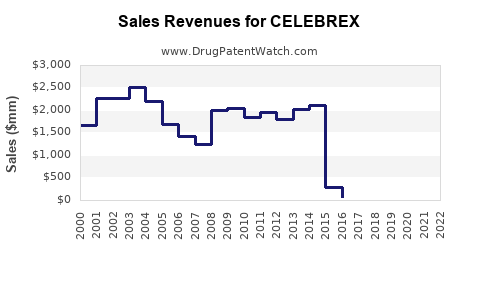

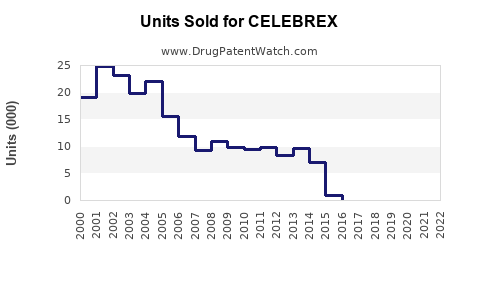

Pre-Patent Expiry Period (1998–2014)

During this period, Celebrex's peak annual sales exceeded USD 2.5 billion globally, cementing its position as a leading COX-2 inhibitor. Patent exclusivity allowed Pfizer to maximize revenue, with minimal generic competition.

Patent Expiry and Generic Entry (2014–Present)

Following patent expiration in the U.S. in 2015, generic versions entered the market, resulting in a sharp sales decline—by approximately 70% within two years. Despite generic competition, Celebrex maintained a substantial market share due to brand recognition and physician loyalty.

Recent Trends

In 2022, global sales hovered around USD 950 million, reflecting stabilization amid increased competition and regulatory scrutiny, especially associated with cardiac risk concerns [2].

Regulatory Environment

The FDA continues to review cardiovascular safety data related to Celecoxib, affecting prescribing practices and marketing strategies. Although the medication remains approved, ongoing safety debates influence market confidence.

Additionally, patent challenges in various jurisdictions have facilitated generic proliferation, constraining the branded drug's pricing power.

Market Drivers and Challenges

Drivers:

- Growing patient population with chronic inflammatory conditions.

- Preference for NSAIDs with better gastrointestinal safety profiles.

- Expansion into emerging markets.

Challenges:

- Regulatory concerns surrounding cardiovascular risks.

- Competition from generics and biosimilars.

- The advent of biologic therapies and pain management agents reducing NSAID reliance.

Sales Projections (2023–2028)

Forecasting future sales hinges on multiple factors: patent litigation outcomes, market acceptance, safety profile perceptions, and strategic pipeline developments.

Scenario 1: Optimistic Outlook

- Assumption: Pfizer secures regulatory clarity and launches next-generation formulations.

- Projection: Market stabilization with annual sales reaching USD 1.2 billion by 2028, driven by increased adoption in emerging markets and niche indications.

Scenario 2: Conservative Outlook

- Assumption: Continued safety concerns and generic competition suppress pricing and volume.

- Projection: Annual sales decline to approximately USD 700 million by 2028, with modest market share retention.

Scenario 3: Disruptive Innovation

- Assumption: New biologics or superior NSAID variants supplant Celebrex.

- Projection: Further decline to below USD 500 million annually, with diminished relevance.

Based on current trends and the mid-term landscape, a moderate growth scenario predicts sales stabilization around USD 850–1,000 million annually over the next five years.

Strategic Opportunities

- Formulation Innovation: Developing topical or targeted delivery systems.

- Additional Indications: Exploring off-label uses and expanding into pain management niches.

- Market Penetration: Increasing presence in Asia-Pacific through partnerships.

- Safety Profile Optimization: Demonstrating improved cardiovascular safety to regain prescriber confidence.

Key Takeaways

- Market Position: Celebrex remains a significant player in the NSAID landscape, with a resilient brand presence despite patent expirations.

- Sales Trajectory: Forecasts suggest a stabilization of sales around USD 850 million to USD 1 billion annually in the medium term, contingent upon favorable regulatory and safety profiles.

- Competitive Challenges: Generic competition and safety concerns are primary drivers of revenue decline.

- Growth Opportunities: Innovation in formulations, expansion into emerging markets, and off-label indications could support long-term sales.

- Regulatory Climates: Monitoring cardiovascular safety data and patent statuses is critical for strategic planning.

FAQs

1. How has patent expiration affected Celebrex's market share?

Patent expiration in 2015 led to a surge in generic entry, causing a significant decline in sales—approximately 70% within two years—though the brand maintained substantial recognition and prescriber loyalty.

2. What are the primary regulatory concerns for Celebrex?

Safety concerns, especially regarding cardiovascular risks, remain central. The FDA continues to review cardiovascular safety data, influencing clinical use patterns.

3. Which markets present the most growth opportunities for Celebrex?

Emerging markets in Asia-Pacific, where healthcare access expands and the prevalence of chronic inflammatory conditions increases, offer substantial growth potential.

4. How does Celebrex compare with newer pain management therapies?

While Celebrex offers improved gastrointestinal safety compared to traditional NSAIDs, newer biologics and analgesics with enhanced efficacy or safety profiles are gradually impacting its market share.

5. What strategic moves can Pfizer implement to sustain Celebrex's relevance?

Innovating formulations, expanding indications, strengthening presence in emerging markets, and transparently addressing safety concerns can help Pfizer maintain competitiveness.

References

[1] MarketResearch.com. "NSAID Market Size & Share." (2022).

[2] Pfizer Annual Report, 2022.

[3] U.S. Food and Drug Administration. "Celecoxib (Celebrex) Safety Review." 2021.