Last updated: July 28, 2025

Introduction

Aspirin, known chemically as acetylsalicylic acid, is among the world's oldest and most widely used nonsteroidal anti-inflammatory drugs (NSAIDs). Its commercial and medicinal significance endures, fueled by applications in pain management, cardiovascular prevention, and anti-inflammatory therapy. This report offers a comprehensive market analysis and sales projection for aspirin, examining key market drivers, competitive landscape, regulatory environment, and future growth potential.

Market Overview

The global aspirin market was valued at approximately USD 1.2 billion in 2022, with a steady compound annual growth rate (CAGR) estimated around 3.1% through 2030. Despite being an off-patent drug, aspirin sustains robust demand largely due to its over-the-counter (OTC) availability and widespread use in prophylactic cardiovascular treatments.

Key Market Segments

- Application-Based Segmentation: Pain relief (analgesic), antipyretic, anti-inflammatory, and cardioprotective uses.

- End-User Segmentation: Hospitals, clinics, retail pharmacies, and direct OTC consumers.

- Distribution Channel: OTC sales dominate, accounting for over 70% of total sales, with prescription-based sales remaining stable in certain regions like Europe and North America.

Regional Analysis

- North America: Largest market, driven by aging populations and high prevalence of cardiovascular diseases.

- Europe: Similar trends as North America, with high OTC consumption.

- Asia-Pacific: Fastest-growing segment, propelled by increasing healthcare infrastructure and awareness.

- Latin America and Middle East & Africa: Emerging markets with expanding access and awareness.

Market Drivers

-

High Prevalence of Cardiovascular Diseases (CVDs):

Aspirin's role in secondary prevention of myocardial infarction and stroke sustains its demand. The CDC reports that CVDs remain the leading cause of death globally, which directly correlates to the consistent use of aspirin for prophylaxis.

-

OTC Availability and Self-Medication:

Aspirin’s OTC status in many countries enhances market accessibility, particularly for pain relief and fever reduction, driving consistent sales volumes.

-

Growing Elderly Population:

The aging demographic increases demand for prophylactic treatments against thrombotic events, reinforcing aspirin’s position in preventive cardiology.

-

Emerging Markets Growth:

Increasing healthcare awareness, expanding distribution channels, and affordability boost consumption in developing regions.

-

Product Diversification:

The development of low-dose aspirin formulations enhances safety profiles, encouraging wider usage.

Market Challenges

-

Regulatory & Legal Constraints:

Regulatory agencies (e.g., FDA, EMA) impose guidelines for OTC aspirin use, especially concerning prolonged or high-dose regimens, potentially limiting market expansion.

-

Safety Concerns & Side Effects:

Risks of gastrointestinal bleeding and hemorrhagic stroke restrict some patient populations, impacting sales growth.

-

Competitive Alternatives:

Availability of other analgesics and antiplatelet agents (e.g., clopidogrel) offers competition, especially for prescription applications.

Competitive Landscape

The market comprises major global players such as Bayer AG, Johnson & Johnson, and local generic manufacturers. Bayer, with its flagship product Ecotrin, holds a significant share, especially in North America. Generic manufacturers account for a rapidly growing segment, focusing on cost-effective formulations and regional distribution.

Sales Projections and Future Outlook

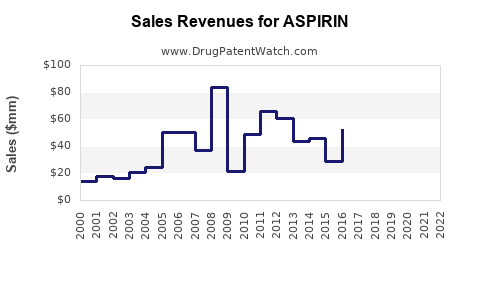

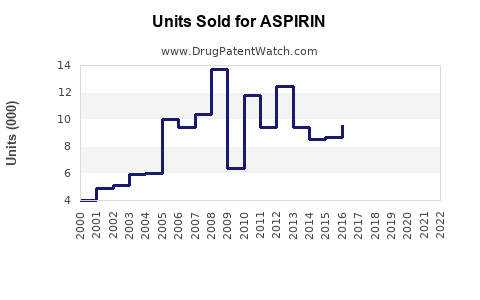

Projection Methodology

Sales forecasts consider historical trends, demographic shifts, regulatory influences, and emerging clinical guidelines. The CAGR of 3.1% from 2022-2030 is maintained, with regional variations.

Forecasted Market Size (2023-2030)

| Year |

Estimated Market Size (USD billion) |

| 2023 |

1.25 |

| 2024 |

1.29 |

| 2025 |

1.34 |

| 2026 |

1.40 |

| 2027 |

1.45 |

| 2028 |

1.52 |

| 2029 |

1.58 |

| 2030 |

1.64 |

The growth is predominantly driven by increased cardiovascular disease prevention in aging populations and expanding OTC use in emerging markets.

Key Market Trends Influencing Sales

- Enhanced Formulations: Introduction of low-dose, gastro-resistant, or combo formulations.

- Regulatory Endorsements: Updated clinical guidelines and safety advisories influencing prescribing and OTC recommendations.

- Digital & E-Commerce Expansion: Increasing online availability supports higher sales, especially in mature markets.

- New Indications & Clinical Trials: Ongoing research into aspirin's role in cancer prevention and other novel therapeutic areas could diversify revenue streams.

Strategic Implications for Stakeholders

- Manufacturers should focus on optimizing low-dose formulations and expanding regional distribution, particularly in Asia-Pacific.

- Regulators need to balance safety with accessibility, particularly for OTC categories.

- Investors can capitalize on emerging markets and product innovation, considering aspirin's well-established market presence.

Key Takeaways

- The aspirin market maintains steady growth driven by widespread therapeutic use, especially in cardiovascular disease prevention.

- OTC sales dominate, providing consistent revenue streams, with regional growth disparities influenced by demographic and healthcare infrastructure factors.

- Emerging markets present significant growth opportunities owing to increasing healthcare access and awareness.

- Regulatory considerations, safety concerns, and competition from alternative therapies remain key factors affecting future sales.

- Innovation in formulations and expanding indications could further strengthen market position and sales potential.

FAQs

1. Is aspirin expected to maintain its market dominance in the coming decade?

Yes. Aspirin's extensive history, proven efficacy in cardiovascular prevention, and widespread OTC availability support its continued market dominance, despite competition from newer antiplatelet agents.

2. How are regulatory bodies impacting aspirin sales?

Regulatory agencies are emphasizing safety, especially concerning bleeding risks. Changes in labeling, dosage recommendations, and restrictions on long-term use may influence sales, but overall access remains largely intact in most regions.

3. What growth opportunities exist in emerging markets?

Rapid urbanization, increasing awareness of cardiovascular health, expanding healthcare infrastructure, and affordability foster significant growth in Asia-Pacific and Latin America.

4. What are the main challenges facing aspirin manufacturers?

Safety concerns, regulatory restrictions, and competition from other analgesic and antiplatelet drugs challenge market expansion, requiring ongoing innovation and strategic positioning.

5. Will new clinical research influence aspirin’s market in the future?

Yes. Studies exploring aspirin’s role in cancer prevention and other indications could broaden its therapeutic profile, potentially unlocking new markets and revenue streams.

References

- [1] Global Aspirin Market Report, MarketWatch, 2022.

- [2] CDC, Cardiovascular Disease Statistics, 2022.

- [3] European Medicines Agency, Aspirin Use Guidelines, 2021.

- [4] Bayer AG Annual Report, 2022.

- [5] World Health Organization, Global Cardiovascular Disease Burden, 2021.