Last updated: July 27, 2025

Introduction

Aricept (donepezil) is a front-line cholinesterase inhibitor prescribed predominantly for the management of Alzheimer’s disease (AD). As one of the most widely used therapies in dementia care, understanding its market dynamics and sales outlook provides critical insight for stakeholders across pharmaceutical development, healthcare, and investment sectors.

Market Overview

Therapeutic Context and Disease Burden

Alzheimer’s disease remains the leading cause of dementia worldwide, with an estimated 55 million people affected globally, projected to surpass 78 million by 2030 [1]. The increasing aging population correlates with a surge in AD prevalence, positioning medications like Aricept as essential components of the therapeutic landscape.

Mechanism of Action and Clinical Profile

Donepezil functions as a reversible acetylcholinesterase inhibitor, augmenting cholinergic neurotransmission and providing symptomatic relief in cognitive decline [2]. Its established efficacy, once-daily dosing convenience, and favorable safety profile underpin its widespread adoption.

Market Penetration

Aricept currently holds a significant share in the symptomatic treatment segment of AD, with extensive prescription data indicating high coverage in North America and Europe. However, its position faces pressure from emerging treatments targeting disease modification, biomarker-driven therapies, and other drug classes.

Competitive Landscape

Key Competitors

- Galantamine (Razadyne): Another cholinesterase inhibitor, with a smaller market share.

- Rivastigmine (Exelon): Offers transdermal patches, extending application options.

- NMDA receptor antagonists (Memantine): Often prescribed alongside or as alternatives.

- Emerging Disease-Modifying Agents: Aducanumab (Aduhelm), lecanemab, and others aim to alter disease progression, potentially supplanting symptomatic therapies in the future.

Innovative Developments

Advances in biomarker-guided diagnostics, combination therapies, and personalized medicine are anticipated to influence future prescribing trends, which may impact Aricept’s market share over the next decade.

Market Challenges

- Efficacy Limitations: While Aricept provides cognitive symptom relief, it does not alter disease progression.

- Regulatory and Reimbursement Policies: Stricter approval criteria and variable insurance coverage influence prescribing patterns.

- Emerging Therapies: Disease-modifying treatments could reduce demand for symptomatic agents.

- Patient and Caregiver Acceptance: Variability in response and side effects may limit universal applicability.

Sales Projections

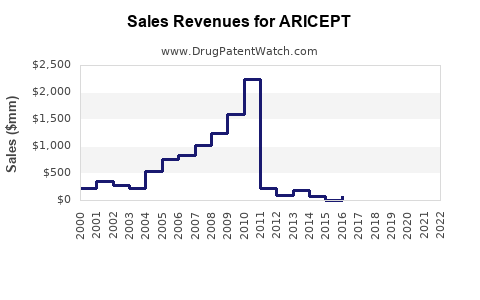

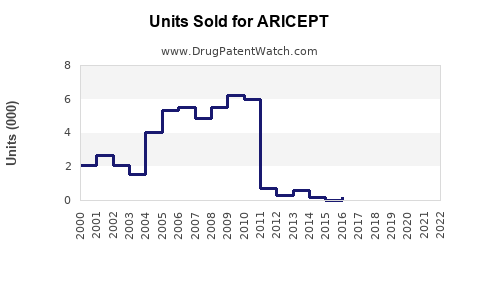

Historical Sales Trends

Aricept's sales peaked around 2015, reaching approximately $2.2 billion globally [3]. Since then, sales have plateaued or declined modestly, attributable to patent expirations, generic entry, and increased competition.

Patent Expiry and Generics Impact

The patent expiry in the U.S. occurred in 2010, leading to increased generic prescribing and a significant decline in branded sales. Globally, patent state varies, with many regions experiencing similar generic penetration.

Forecasted Market Growth

Despite challenges, the persistent prevalence of AD ensures a continuous baseline demand. Experts project a compound annual growth rate (CAGR) of approximately 1-2% over the next five years, driven by:

- Population aging: The elderly population grows, expanding the total addressable market.

- Global healthcare expansion: Improving diagnosis rates, especially in emerging markets.

- Healthcare policy: Increasing adoption of screening and early intervention protocols.

Regional Variations

- North America: Largest market, with sustained demand amid high awareness and reimbursement.

- Europe: Stable, with increased adoption in certain countries.

- Asia-Pacific: Rapid growth potential, driven by aging populations and healthcare infrastructure development.

- Emerging Markets: Growing awareness and affordability improvements are expanding access.

Future Market Scenario

In a conservative estimate, worldwide sales of branded Aricept could stabilize at around $300–$500 million annually in the next five years, primarily driven by emerging markets and expanded indications within existing patient pools.

Strategic Opportunities

- Formulation Innovations: Transdermal patches (e.g., Rivastigmine) have improved adherence; similar modifications could rejuvenate Aricept’s market**.

- Combination Therapies: Developing fixed-dose combinations with other agents to enhance efficacy could sustain demand.

- Biomarker Integration: Tailoring treatment based on genetic and biomarker profiles may optimize outcomes and market retention.

Regulatory and Reimbursement Outlook

Regulatory agencies continue to review existing indications for cognitive disorders, with some countries considering expanded approval for early-stage AD or mild cognitive impairment (MCI). Reimbursement policies favor cost-effective symptomatic treatments, but strict cost-effectiveness analyses may limit label extensions unless aligned with superior efficacy data.

Conclusion

Given the shifting landscape of Alzheimer’s treatment—anchored by demographic trends, regional healthcare investments, and emerging therapies—Aricept's sales outlook remains cautiously optimistic. While patent expiry and competition have tempered growth, the ongoing global burden of AD secures a stable core market. Strategic differentiation through formulation, personalized medicine, and combination therapies can bolster Aricept’s long-term positioning.

Key Takeaways

- Persistent Need: The global rise in AD prevalence guarantees sustained demand for symptomatic treatments like Aricept.

- Market Share Decline: Patent expirations and generics have diminished branded sales; growth is contingent upon regional market expansion and innovation.

- Regional Dynamics: North America remains dominant, but Asia-Pacific offers significant growth opportunities.

- Competitive Pressure: New disease-modifying therapies threaten to reshape treatment paradigms, potentially reducing reliance on symptomatic agents.

- Strategic Innovation: Development of novel formulations, combination therapies, and biomarker-guided treatments could extend Aricept’s relevance.

FAQs

-

What is the primary current market for Aricept?

The main market remains North America, where high awareness, established prescribing habits, and insurance coverage sustain demand.

-

How will patent expirations affect Aricept’s sales?

Patent expirations led to increased generic competition, substantially reducing branded sales; future impact depends on regional patent statuses.

-

Are there new formulations of Aricept in development?

Currently, no new formulations are in advanced stages, but innovations like transdermal patches used by competitors could influence future development.

-

Can Aricept be used for early-stage Alzheimer’s disease?

Yes, it is approved for use across mild to moderate AD; ongoing research explores benefits in early or prodromal stages.

-

What role will emerging disease-modifying therapies play in Aricept’s future?

They may reduce the reliance on symptomatic treatments, potentially limiting Aricept’s sales unless combination strategies or added indications are pursued.

References

[1] World Health Organization. (2022). Dementia Fact Sheet.

[2] Birks, J. (2006). Cholinesterase inhibitors for Alzheimer’s disease. Cochrane Database of Systematic Reviews.

[3] IQVIA. (2022). Global Pharmaceutical Sales Data.