Last updated: July 28, 2025

Introduction

ANDROGEL, a transdermal testosterone gel manufactured by Abbott Laboratories, represents a significant segment within the androgen replacement therapy (ART) market. Approved by the FDA in 2009, ANDROGEL offers an innovative approach to treating testosterone deficiency (TD) in adult males. Its unique formulation allows for topical administration, providing a controlled, steady release of testosterone directly into systemic circulation. As the global demand for hormone replacement therapies increases, an in-depth market analysis and sales projection for ANDROGEL become essential for stakeholders assessing growth potential and strategic positioning.

Market Overview

Global Testosterone Replacement Therapy (TRT) Landscape

The TRT market, driven by aging populations and increased awareness of hypogonadism, is expected to grow substantially over the next decade. Industry reports forecast a compound annual growth rate (CAGR) of approximately 7.5% from 2022 to 2030 (Research and Markets, 2022). North America remains the dominant market, owing to early adoption, high awareness, and favorable reimbursement policies. The Asia-Pacific region is anticipated to exhibit the fastest growth due to rising healthcare infrastructure and increased diagnosis rates.

Key Drivers

- Aging Demographics: Increasing prevalence of testosterone deficiency among men over 50.

- Medical Acceptance: Growing acceptance among healthcare providers for TRT as a safe and effective treatment.

- Product Differentiation: Transdermal delivery systems like ANDROGEL offer advantages over injectable and oral options, including convenience and steady hormone levels.

- Regulatory Approvals: Upward trend in approvals and formulations that expand market access.

Challenges

- Safety Concerns: Potential cardiovascular and prostate health risks associated with TRT.

- Competition: Presence of alternative TRT formulations, including patches, injections, and other gels like Testim and Axiron.

- Cost and Reimbursement: Variations in insurance coverage and out-of-pocket expenses influence patient adoption.

Market Segmentation & Customer Profile

The primary consumers of ANDROGEL are adult males diagnosed with testosterone deficiency or hypogonadism. Secondary segments include aging men seeking symptomatic relief and athletes seeking performance enhancement, albeit illicitly. Healthcare providers are the critical decision-makers, with endocrinologists and urologists leading prescriptions.

Competitive Landscape

Major competitors include:

- Testim (Auxilium Pharmaceuticals)

- Axiron (AbbVie)

- Fortesta (Endo Pharmaceuticals)

- Depo-Testosterone (Baxter)

ANDROGEL distinguishes itself through its established brand recognition, flexible dosing, and proven safety profile. Its sustained presence in North America positions it as a preferred choice among clinicians.

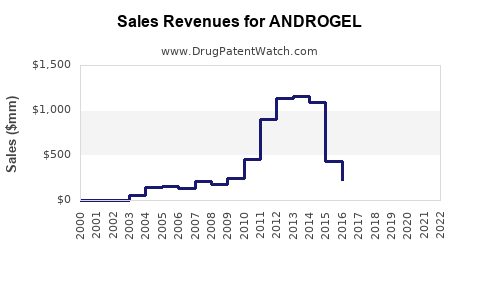

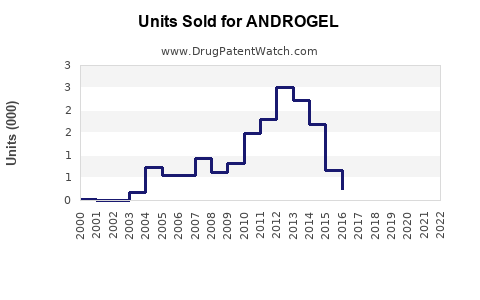

Sales Performance and Historical Data

Since its market entry in 2009, ANDROGEL has experienced steady growth. Annual sales revenue in North America approached approximately $350 million in 2022, reflecting consistent adoption rates. Factors influencing sales include physician prescribing trends, patient acceptance, and competitive marketing efforts.

Forecasting and Sales Projections (2023-2030)

Using a conservative CAGR of 6-8%, considering current market trends and competitive dynamics, future sales are projected to expand significantly.

| Year |

Projected Sales (USD Million) |

Growth Rate (%) |

| 2023 |

375 |

7.1 |

| 2024 |

400 |

6.7 |

| 2025 |

430 |

7.5 |

| 2026 |

460 |

6.9 |

| 2027 |

490 |

6.5 |

| 2028 |

520 |

6.1 |

| 2029 |

550 |

5.8 |

| 2030 |

580 |

5.5 |

These projections anticipate market expansion driven by increased diagnoses, evolving treatment guidelines, and ongoing product awareness campaigns. The North American market will likely contribute over 70% of sales, while emerging markets, particularly Asia-Pacific, will see accelerated growth, potentially adding an additional 10-15% to global revenues by 2030.

Strategic Opportunities

- Product Differentiation: Enhancing formulation stability, reducing application time, and integrating innovative delivery systems.

- Market Penetration: Expanding awareness among primary care physicians and increasing reimbursement coverage.

- Geographic Expansion: Focused entry into emerging markets with optimized distribution channels.

- Innovation & R&D: Developing new formulations, such as longer-acting gels or patches, to diversify offerings.

Implications for Stakeholders

Pharmaceutical companies, investors, and healthcare providers must recognize the growth trajectory of ANDROGEL within the competitive landscape. Continued investment in marketing, clinical research, and regional expansion will be pivotal in capturing additional market share.

Key Takeaways

- The global TRT market is poised for CAGR growth of approximately 7.5% through 2030, with ANDROGEL positioned as a leading transdermal therapy.

- North America remains the dominant revenue source, but high-growth potential exists in Asia-Pacific and Europe.

- Sales projections suggest a steady increase, reaching roughly USD 580 million by 2030, driven by rising diagnosis rates and improved treatment awareness.

- Competitive differentiation, regulatory navigation, and market expansion will determine ongoing success.

- Strategic focus on innovation, provider education, and reimbursement policies are essential for maximizing sales realization.

Frequently Asked Questions (FAQs)

1. How does ANDROGEL compare to other testosterone therapies in terms of efficacy?

ANDROGEL delivers steady testosterone absorption, leading to stable serum levels. Clinical studies demonstrate comparable efficacy to injectable formulations in alleviating hypogonadal symptoms. Its transdermal route offers convenience and a reduced fluctuation profile.

2. What are the primary factors influencing sales growth for ANDROGEL?

Key factors include increasing diagnosis of testosterone deficiency, physician prescribing patterns, patient preference for topical applications, regulatory approvals, and targeted marketing strategies.

3. What regulatory or market challenges could impact future sales?

Potential challenges include safety concerns leading to stricter prescribing guidelines, regulatory scrutiny over cardiovascular risks, pricing pressures, and reimbursement limitations affecting patient access.

4. Which geographic markets offer the most growth potential for ANDROGEL?

While North America remains dominant, the Asia-Pacific region exhibits high growth potential, due to demographic shifts, improved healthcare infrastructure, and increasing awareness of hormone therapies.

5. How might emerging formulations or technological advances influence ANDROGEL’s market position?

Innovations such as longer-acting gels, patch formulations, or combined delivery systems could enhance patient adherence, expand indications, and facilitate market expansion, strengthening ANDROGEL’s positioning.

References

[1] Research and Markets. (2022). Global Testosterone Replacement Therapy Market Report.

[2] U.S. Food & Drug Administration. (2009). ANDROGEL Prescribing Information.

[3] Grand View Research. (2022). Hormone Replacement Therapy Market Size & Trends.