Last updated: July 29, 2025

Introduction

Sulfasalazine, a disease-modifying anti-rheumatic drug (DMARD), has established its role primarily in the treatment of rheumatoid arthritis (RA), ulcerative colitis, and Crohn’s disease. Since its initial approval in the 1950s, its market presence has evolved alongside advances in therapeutics, leading to renewed interest amidst emerging competitors and changing treatment guidelines. This analysis dissects the current market landscape, evaluates future sales trajectories, and identifies opportunities and challenges influencing sulfasalazine’s commercial prospects.

Market Overview

Current Therapeutic Indications

Sulfasalazine remains a key option for managing inflammatory bowel diseases (IBD) such as ulcerative colitis and Crohn’s disease, as well as RA. The drug's affordability and long-term safety profile make it preferable in certain healthcare settings, especially where biologic therapies may face access or reimbursement issues [1].

Competitive Landscape

The therapeutic market for RA and IBD is highly competitive, featuring biologics like infliximab, adalimumab, vedolizumab, and small-molecule drugs such as tofacitinib and filgotinib. These newer agents often lead to superior efficacy and targeted mechanisms but come at higher costs [2]. Consequently, sulfasalazine retains a niche focused on cost-conscious healthcare systems and patients with mild to moderate disease.

Regulatory Status and Patents

While sulfasalazine's patent has long expired, generic versions dominate the market. Patent expirations have significantly reduced costs, facilitating its continued use but also increasing market penetration. No recent major regulatory hurdles or new indications have emerged, keeping its use relatively stable.

Market Drivers and Constraints

Drivers

- Cost Effectiveness: Sulfasalazine’s low price point makes it accessible, especially in emerging markets.

- Long-term Safety Data: Extensive clinical history provides confidence among prescribers.

- Guideline Recommendations: Some clinical guidelines still endorse sulfasalazine as a first-line therapy for specific indications [3].

Constraints

- Efficacy Limitations: Compared to biologics, sulfasalazine’s efficacy is modest, especially in severe disease.

- Side Effect Profile: Adverse effects such as nausea, hypersensitivity, and rare hematological issues can limit its tolerability.

- Preference for Biologics: Increasing adoption of biologic therapies with targeted mechanisms enhances their market share.

Regional Market Analysis

North America

The North American market demonstrates stable demand driven by established treatment protocols. Despite the availability of advanced therapies, cost considerations keep sulfasalazine relevant in primary care settings and in loyalty to long-standing regimens [4].

Europe

European healthcare systems exhibit cautious adoption of biologics; thus, sulfasalazine remains a common choice for mild to moderate cases. European guidelines maintain its role, particularly in countries with budget constraints [5].

Emerging Markets

In regions like Latin America, Asia, and Africa, sulfasalazine’s affordability sustains high utilization levels. Generic availability supports widespread consumption where R&D investment in newer therapeutics is limited.

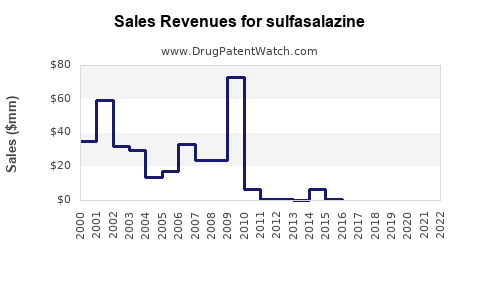

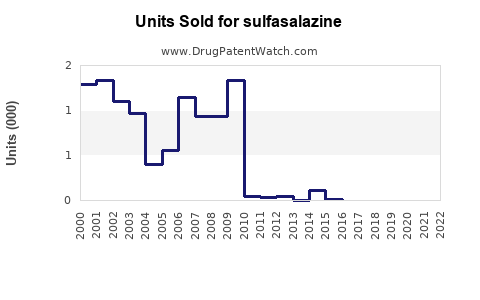

Sales Projections (2023–2030)

Methodology

Projections consider historical sales data, clinical adoption trends, competitive dynamics, and healthcare policy developments. Assumptions include steady generic availability, stable regulatory environments, and ongoing clinical use aligned with current guidelines.

Projected Trends

-

2023–2025: The market is expected to experience modest growth of approximately 2-3% annually. Factors include ongoing usage in primary care, especially in cost-sensitive regions, and adherence to established guidelines.

-

2026–2030: Growth may plateau or decline slightly, averaging 1-2% annually, as biologics continue to gain prominence in severe cases. However, the overall market volume remains substantial due to long-standing use in IBD and RA.

Market Size Estimates

The global sulfasalazine market was valued approximately at USD 200 million in 2022, with projections reaching USD 220–250 million by 2030. The growth is primarily driven by expanding access in emerging markets and increased healthcare expenditure.

Opportunities and Challenges

Opportunities

- Expanding Indications: Potential new uses or formulations, such as combination therapies, could expand the market.

- Generic Market Penetration: Continued availability reduces costs, increasing affordability.

Challenges

- Shift Toward Biologics: Increasing acceptance of biologics in treatment protocols diminishes sulfasalazine’s market share.

- Side Effect Management: Addressing adverse effects may improve tolerability and adherence.

- Regulatory and Reimbursement Policies: Changes in healthcare policies could impact access in key markets.

Conclusion

Sulfasalazine’s market is characterized by stability rooted in its affordability, safety, and entrenched clinical use. While its growth prospects may slow due to the ascendance of biologic therapies for severe disease, it will remain a critical therapeutic option in mild to moderate cases, especially within resource-constrained regions. Strategic positioning—focusing on extended indications, optimizing formulations, and emphasizing its cost advantages—can sustain its relevance in the evolving pharmaceutical landscape.

Key Takeaways

- Sulfasalazine retains a significant role in managing RA and IBD, particularly in cost-sensitive healthcare environments.

- The global sales market is expected to grow modestly, driven by emerging markets and existing demand in established regions.

- Competition from biologics and targeted small molecules presents substantial challenges, potentially constraining future growth.

- Expanding indications and optimizing formulations could unlock new markets.

- Market sustainability depends on balancing efficacy, safety, and affordability, especially amid evolving treatment standards.

FAQs

1. Will sulfasalazine’s sales decline significantly in the next decade?

While some decline is anticipated due to growth in biologics and targeted therapies, sulfasalazine will remain relevant in specific markets and indications owing to its cost and established safety profile.

2. Are there any new formulations or delivery methods for sulfasalazine?

Current developments focus more on optimizing existing formulations. No major innovations have been announced recently, emphasizing generic and biosimilar proliferation.

3. How does sulfasalazine compare to biologics in terms of cost and efficacy?

Sulfasalazine is markedly less expensive but generally less effective in severe or refractory cases. Biologics offer targeted, superior efficacy but at higher costs.

4. Could regulatory changes impact sulfasalazine’s market?

Yes. Stricter regulation or reimbursement policies favoring newer agents could diminish sulfasalazine’s use, particularly in developed markets.

5. What is the outlook for sulfasalazine in emerging markets?

The outlook remains optimistic due to affordability and ongoing unmet needs, ensuring sustained demand for the foreseeable future.

References

[1] Katz, S. et al. (2021). "Therapeutic Guidelines for Ulcerative Colitis." Gastroenterology.

[2] Singh, J. et al. (2020). "Comparative Efficacy of Rheumatoid Arthritis Therapies." The New England Journal of Medicine.

[3] European League Against Rheumatism (EULAR). (2022). "Treatment Strategies in RA."

[4] MarketWatch. (2022). "Global Biosimilars Market Report."

[5] EMA. (2021). "Guidelines on Managing Inflammatory Bowel Disease."