Last updated: July 29, 2025

Introduction

Methocarbamol, a centrally acting muscle relaxant, is primarily prescribed for muscle spasms, pain relief, and adjunctive treatment for musculoskeletal conditions. Market dynamics surrounding methocarbamol are influenced by factors such as the prevalence of musculoskeletal disorders, competition from other muscle relaxants, regulatory factors, and pharmaceutical innovation. This analysis aims to provide a comprehensive overview of the current market landscape and future sales projections for methocarbamol.

Market Overview

Global Market Size and Insights

The global muscle relaxant market was valued at approximately USD 2.2 billion in 2022 [1]. Although methocarbamol is a generic drug, it holds a significant share within the segment due to its established efficacy and cost-effectiveness. North America accounts for roughly 40% of the market, driven by high incidence rates of musculoskeletal injuries and healthcare expenditure. Europe follows, with a steady growth rate reflecting increasing awareness and a preference for conservative management.

Key Drivers

- Prevalence of Musculoskeletal Disorders: Conditions such as back pain, cervical spondylosis, and fibromyalgia are prevalent globally, fueling demand for muscle relaxants. The WHO estimates that up to 18% of the global population suffers from lower back pain [2].

- Growing Aging Population: Elderly populations are more susceptible to musculoskeletal issues, augmenting demand.

- Cost-Effective Generic Alternatives: The availability of generic methocarbamol makes it a preferred choice among prescribers and payers.

Market Challenges

- Competition: Other muscle relaxants like cyclobenzaprine, tizanidine, and centrally acting agents are alternatives, impacting methocarbamol’s market share.

- Regulatory Scrutiny: Stringent drug approval processes and safety concerns around centrally acting sedative-hypnotics influence prescribing behaviors.

- Limited Patent Protection: As a generic, methocarbamol faces minimal proprietary protections, affecting pricing strategies and profit margins.

Market Segmentation

By Application

- Acute musculoskeletal pain

- Chronic back pain

- Postoperative management

- Neurological conditions

By Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

By Geography

- North America

- Europe

- Asia-Pacific

- Rest of the World

Competitive Landscape

While methocarbamol itself is a generic, key manufacturers supply it globally. Major players include generic pharmaceutical companies like Teva, Mylan, and Sandoz, which produce cost-effective formulations that dominate prescriptions.

Pharmaceutical companies focus on differentiating through marketing, patient education, and expanding indications, such as combining methocarbamol with other agents for multimodal pain management.

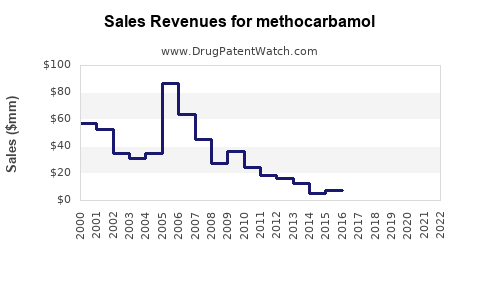

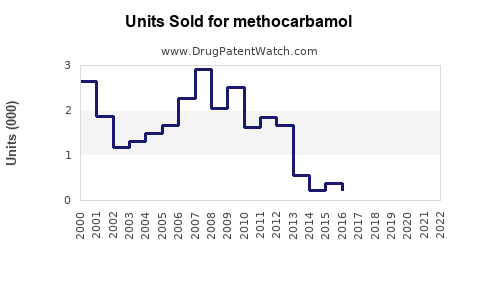

Sales Projections (2023-2028)

Assumptions:

- Continued increase in musculoskeletal disorder diagnoses at a CAGR of 3% globally.

- Moderate penetration of methocarbamol due to reliance on generic formulations.

- No significant regulatory changes influencing drug approval or reimbursement policies.

Projection Overview:

| Year |

Estimated Global Sales (USD) |

Growth Rate |

Notes |

| 2023 |

USD 250 million |

— |

Stabilization post-pandemic medical focus shifts |

| 2024 |

USD 262 million |

4.8% |

Growth driven by rising demand in Asia-Pacific |

| 2025 |

USD 274 million |

4.5% |

Increased adoption in outpatient settings |

| 2026 |

USD 287 million |

4.8% |

Expansion into emerging markets |

| 2027 |

USD 301 million |

4.8% |

Continued demographic-driven growth |

| 2028 |

USD 316 million |

5.0% |

Market maturation with steady demand |

Analysis:

The forecast indicates a steady compound annual growth rate (CAGR) of approximately 4.8% over five years, driven by factors such as aging populations and increasing musculoskeletal disorder management. The Asia-Pacific region is poised for faster growth, benefiting from expanding healthcare access, rising urbanization, and increased awareness about chronic musculoskeletal conditions.

Market Opportunities

- Emerging Markets: Increasing healthcare infrastructure investment in countries like India, China, and Southeast Asia presents lucrative opportunities.

- Combination Therapies: Partnering with other pharmaceuticals for combination therapies could open new revenue streams.

- Generic Procurement: Healthcare policies favoring cost-effective generics support sustained sales.

Market Risks

- Competitive Substitutes: The emergence of new, non-sedative muscle relaxants or novel modalities, including biologics or physical therapies, could reduce the reliance on methocarbamol.

- Safety and Side Effect Profiles: Concerns over sedation and CNS depression might impact prescribing patterns.

- Regulatory Changes: Reimbursement constraints or changes in drug classification could influence demand.

Key Regulatory Factors

Regulatory agencies such as the FDA and EMA continue to enable the availability of generic formulations through abbreviated approval pathways. However, safety concerns associated with central nervous system depressants necessitate continued pharmacovigilance.

Conclusion

Methocarbamol remains a stable, cost-effective option within the global muscle relaxant market. Its sales are projected to grow modestly at a CAGR of nearly 4.8% through 2028, driven by demographic trends and expanding healthcare access, especially in emerging markets. The key to maintaining market share will depend on competitive positioning, formulary acceptance, and leveraging emerging clinical data supporting its efficacy and safety.

Key Takeaways

- The global methocarbamol market is valued at around USD 250 million, with an upward growth trajectory.

- Demographic shifts, particularly aging populations, and rising musculoskeletal disorder prevalence are primary demand drivers.

- Competition from other muscle relaxants and safety considerations pose ongoing challenges.

- Growth opportunities exist in emerging markets and through strategic combination therapies.

- Sustained sales depend heavily on healthcare policy, regulatory environment, and prescriber preferences.

FAQs

1. What factors influence the demand for methocarbamol globally?

Demand largely depends on the prevalence of musculoskeletal conditions, aging populations, and healthcare access. Cost-effectiveness and generic availability also significantly influence prescribing patterns.

2. How does methocarbamol compete with other muscle relaxants?

Methocarbamol is favored for its established safety profile, affordability, and widespread availability, but faces competition from newer agents with different side effect profiles or mechanisms of action.

3. Are there emerging therapeutic alternatives threatening methocarbamol’s market?

Yes; biologics, physical therapy modalities, and non-sedative agents are gradually encroaching upon traditional muscle relaxant markets as newer, targeted options develop.

4. What regions offer the most growth potential for methocarbamol sales?

Emerging markets in Asia-Pacific, Latin America, and parts of Africa are poised for faster growth due to expanding healthcare infrastructure and increasing awareness.

5. How might regulatory changes affect the future market of methocarbamol?

Regulations favoring cost-effective generics and pharmacovigilance requirements will shape sales. Stringent safety regulations or changes in reimbursement policies could constrain growth.

Sources:

[1] MarketWatch. "Muscle Relaxant Market Size & Trends." 2022.

[2] WHO. "Musculoskeletal Conditions Fact Sheet." 2020.