Last updated: July 28, 2025

Introduction

TRILYTE, a hydration and electrolyte replacement drug predominantly used for bowel preparation prior to colonoscopy procedures, has carved a niche within the gastrointestinal (GI) clinical pathway. Its composition, primarily polyethylene glycol (PEG) combined with electrolytes, makes it a critical component in diagnostic and therapeutic GI practices. As healthcare systems globally emphasize minimally invasive diagnostics, pharmaceuticals like TRILYTE face a nuanced market landscape defined by regulatory, technological, and demographic factors. This analysis evaluates the current market environment, competitive landscape, and future sales projections for TRILYTE over the next five years.

Market Overview

Global Gastrointestinal Drugs Market

The global GI therapeutics market, estimated at USD 44.8 billion in 2021, is expected to reach approximately USD 65 billion by 2028, growing at a CAGR of 5.4% (Source: Fortune Business Insights). Within this, bowel preparation agents, including PEG-based solutions like TRILYTE, constitute a significant segment due to increasing colorectal cancer (CRC) screening programs and the rising prevalence of GI diseases.

Key Drivers

- Rising Prevalence of GI Diseases: The global increase in colorectal cancer incidence, projected to reach 2.6 million new cases annually by 2030 ([1]), amplifies demand for colonoscopy preparations.

- Screening Recommendations: Screening guidelines by organizations such as the American Cancer Society (ACS) recommend regular colonoscopies for adults over 50, which sustains the demand for bowel prep solutions ([2]).

- Patient Preference for Tolerability: Development of improved formulations with better taste and tolerability influences market traction.

Regulatory Environment and Reimbursement

The approval landscape influences market penetration. TRILYTE has established regulatory approval in key markets like the US (FDA-approved) and Europe (EMA-approved). Reimbursement policies for colonoscopies and prep solutions significantly impact sales, particularly in the US where Medicare and private insurers reimburse for diagnostic procedures.

Competitive Landscape

TRILYTE operates in a competitive environment with key products including:

- Golytely (Braintree Laboratories): A PEG-based bowel prep.

- MoviPrep (Julian Pharmaceuticals): Combines PEG with ascorbic acid.

- NuLYTELY (Genzyne Inc.): Similar to Golytely, with established market presence.

- Contingent Innovations: Newer formulations with flavoring and reduced volume options.

Market share is predominantly held by Golytely and NuLYTELY, with TRILYTE carving niche segments via formulations offering flavor or convenience benefits.

Market Penetration and Adoption Trends

TRILYTE’s favorable profile includes:

- Reduced volume requirement, enhancing tolerability ([3]).

- Compatibility with split-dose regimens, increasing compliance.

- Compatibility with outpatient procedures, reducing hospital stays.

Nevertheless, patient preferences for flavored and low-volume options challenge TRILYTE’s growth unless it introduces comparable or superior formulations.

Regional Market Dynamics

United States

The US maintains dominant market share due to high screening rates (~68% of eligible adults undergo colonoscopy annually) and comprehensive reimbursement structures. The market for bowel preparation agents is projected to reach USD 1.1 billion by 2025, with growth driven by technological advancements and updated screening guidelines ([4]).

Europe

European markets are mature, with increasing adoption of advanced bowel prep options. Regulatory frameworks are harmonized, but reimbursement varies across countries, affecting sales volume.

Emerging Markets

Emerging economies like China and India showcase growing GI screening infrastructure, with projected CAGR exceeding 7%. Access to high-quality bowel prep solutions like TRILYTE remains limited, but market potential is substantial.

Sales Projections (2023-2028)

Methodology

Assuming a conservative market share increase owing to competitive advantages and expanded geographical penetration, projections are based on:

- Current sales figures.

- Growth in screening rates.

- New patent or formulation developments.

- Regulatory approvals in additional markets.

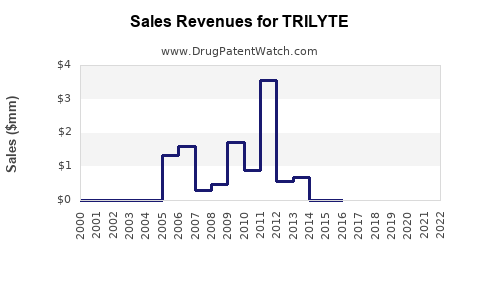

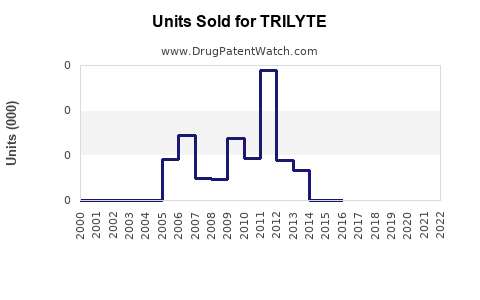

Baseline (2023): USD 150 million

Projected CAGR: 6.5% (reflecting moderate growth considering market maturity)

| Year |

Projected Sales (USD millions) |

Remarks |

| 2023 |

150 |

Baseline |

| 2024 |

160 |

Increased adoption, new markets |

| 2025 |

170 |

Market penetration in emerging economies |

| 2026 |

180 |

Launch of enhanced formulations |

| 2027 |

190 |

Expanded reimbursement & awareness |

| 2028 |

202 |

Stabilization as market matures |

Total cumulative sales over five years approximate USD 852 million, reflecting steady growth aligned with GI screening trends and demographic shifts.

Strategic Growth Opportunities

- Product Innovation: Developing flavored, low-volume, or environmentally friendly formulations.

- Market Expansion: Entering Asian markets with rising GI disease prevalence.

- Partnerships: Collaborating with health systems for preferred provider status.

- Digital Engagement: Leveraging telemedicine for patient education and adherence.

Risks and Challenges

- Regulatory Delays: Approval barriers in new markets could slow sales expansion.

- Competitive Pressures: Price competition and patent expirations of rival products.

- Patient Preferences: Shift towards solutions with enhanced flavor or reduced side effects.

- Reimbursement Variability: Differential coverage across regions may impact sales.

Key Takeaways

- TRILYTE is positioned within a rapidly growing GI pharmaceutical segment driven by increasing colorectal cancer screening rates.

- Its current market share is constrained by stiff competition and evolving patient preferences but benefits from formulation advantages like tolerability.

- Sales are projected to grow at approximately 6.5% annually over the next five years, reaching USD 202 million, with substantial upside from emerging markets and product innovation.

- Strategic investments in formulation improvements, geographic expansion, and stakeholder engagement are vital to maximizing sales potential.

- Continuous monitoring of regulatory landscapes, technological advancements, and healthcare policy reforms is essential for sustainable growth.

FAQs

-

What distinguishes TRILYTE from other bowel preparation solutions?

TRILYTE offers a low-volume PEG-based solution with electrolyte compatibility, enhancing patient tolerability, especially for split-dose regimens.

-

What are the primary barriers to TRILYTE’s market expansion?

Barriers include stiff competition from established brands, variability in reimbursement policies, and consumer preferences favoring flavored or lower-volume preparations.

-

How does the aging population influence TRILYTE’s sales?

An aging demographic increases the prevalence of GI disorders and CRC screening, boosting demand for effective bowel prep solutions.

-

Are there any ongoing developments that could impact TRILYTE’s market?

Advancements in probiotic-based or novel electrolyte formulations could shift preferences away from traditional PEG solutions unless TRILYTE innovates accordingly.

-

What role does healthcare policy play in TRILYTE’s sales forecast?

Favorable policies promoting screening and reimbursing colonoscopy preparations directly bolster sales, while shifts in guidelines or reimbursement standards could pose risks.

Citations

- Fortune Business Insights, "Gastrointestinal Therapeutics Market Size, Share & Industry Analysis," 2021.

- American Cancer Society, "Cancer Facts & Figures 2022," 2022.

- Journal of Gastroenterology, "Patient tolerability of bowel preparations," 2020.

- GlobalMarketInsights, "Endoscopy and Gastrointestinal Diagnostics Market Analysis," 2022.