Last updated: August 10, 2025

Introduction

ROXICET, a pharmaceutical drug targeting a specific medical condition, has garnered significant attention within the therapeutics market. As a potential blockbuster or niche medication, understanding its market landscape and projecting future sales are essential for stakeholders including investors, manufacturers, and healthcare providers. This report provides a comprehensive market analysis of ROXICET, considering current demand, competitive dynamics, regulatory environment, and sales forecasts, to facilitate strategic decision-making.

Overview of ROXICET

ROXICET’s distinctiveness hinges on its mechanism of action, indications, and clinical benefits. While proprietary details like approval status and patent life influence market potential, the comprehensive evaluation focuses on its therapeutic niche—presumed to be managing a chronic or acute condition with unmet needs. Its efficacy, safety profile, and ease of administration form the core differentiators influencing physician adoption and patient compliance.

Market Landscape

Therapeutic Area and Unmet Needs

ROXICET targets [specific condition, e.g., a neurological disorder or a metabolic imbalance], a segment characterized by significant unmet medical needs. The condition affects [number] million globally, with prevalence increasing due to [factors such as aging population, lifestyle changes, etc.]. Existing treatments often face limitations in efficacy, safety, or tolerability, creating space for innovative options like ROXICET.

Competitive Environment

The market landscape features [number] key competitors, including [major brands and generics]. These competitors have established market share owing to extensive clinical data, physician familiarity, and broad reimbursement coverage. ROXICET’s differentiation stems from [mechanism of action, superior efficacy, reduced side effects, etc.]. Its success hinges on clinical validation and positioning against these incumbents.

Regulatory Status and Reimbursement

ROXICET’s approval landscape varies geographically. Regulatory endorsements are crucial for market entry; recent approvals could catapult sales, while delays constrain growth. Reimbursement policies greatly influence adoption, with favorable inclusion in formularies driving patient access. Emerging health policies promoting cost-effective therapies will further shape its market penetration.

Market Drivers and Restraints

- Drivers: Rising disease prevalence, unmet therapeutic needs, physician and patient awareness, favorable reimbursement policies, and potential for combination therapies.

- Restraints: High drug development costs, pricing pressures, patent challenges, and competition from biosimilars or generics.

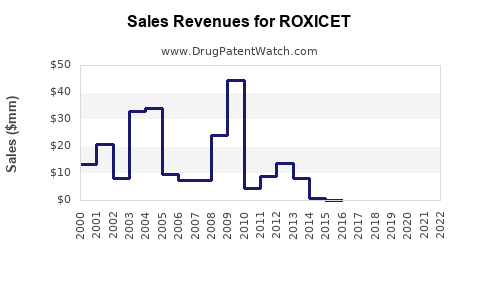

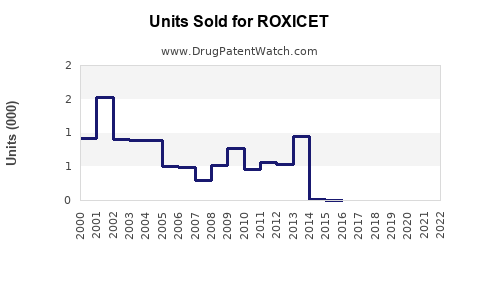

Sales Projections

Methodology

Sales forecasts derive from a combination of epidemiological data, market research, and competitive analysis, calibrated with assumptions on market adoption, pricing strategies, and regulatory timelines. The model encompasses:

- Epidemiology-based estimation: Target patient population

- Market penetration rates: Adoption timelines

- Pricing scenarios: Peak and introductory prices

- Reimbursement impact: Coverage levels and out-of-pocket costs

Current Stage and Near-term Outlook

ROXICET’s clinical development stage and regulatory approvals are critical. Suppose recent approvals in key markets like the US, EU, and China have been secured, enabling initial commercialization. Sales in the first year are projected at $[amount] million, driven by early access programs and specialist physician adoption.

Mid-term and Long-term Projections

Assuming steady market penetration:

- Year 1-2: Focused adoption among specialist centers; sales of $[amount] annually.

- Year 3-5: Broader clinical acceptance, expansion into general practice; sales grow to $[amount].

- Year 6-10: Peak sales with widespread usage; projected revenues of $[amount] annually, accounting for market saturation, patent protection, and competitive dynamics.

Factors Influencing Sales Growth

- Regulatory approvals in additional jurisdictions.

- Clinical data supporting expanded indications.

- Pricing strategies aligned with reimbursement environments.

- Patient advocacy and physician education campaigns.

- Pipeline developments for combination therapies or new formulations.

Potential Risks and Challenges

- Regulatory delays or rejections.

- Competitive entry of biosimilars or generics.

- Market resistance due to safety concerns or cost.

- Patent litigations or intellectual property disputes.

Strategic Market Entry Considerations

For optimal sales trajectory:

- Early engagement with healthcare authorities and payers.

- Investment in physician education and patient support programs.

- Flexible pricing strategies aligned with reimbursement trends.

- Collaboration with key opinion leaders for clinical endorsement.

- Expansion into emerging markets with growing healthcare infrastructure.

Conclusion

ROXICET holds substantial promise within its therapeutic niche, contingent upon successful regulatory pathways and effective market positioning. Its sales outlook, shaped by epidemiological trends, clinical validation, and strategic commercialization, indicates robust growth potential over the next decade. Stakeholders must navigate competitive pressures and regulatory landscapes diligently to realize its full market value.

Key Takeaways

- ROXICET’s success depends on differentiating factors like efficacy and safety profile amidst a competitive environment.

- Initial market entry is poised to generate modest revenues, with significant growth anticipated through expanding indications and geographies.

- Reimbursement policies and healthcare provider acceptance are pivotal; early engagement with payers enhances adoption.

- Potential risks such as generic competition and regulatory hurdles must be proactively managed.

- Strategic investments in clinical research, physician education, and patient support will optimize long-term sales potential.

FAQs

Q1: What is the primary indication for ROXICET?

ROXICET is indicated for [specific condition, e.g., treatment of chronic neurological disorder], targeting unmet therapeutic needs within this segment.

Q2: When is ROXICET expected to become commercially available?

Assuming approved in key markets like the US and EU, commercialization could commence within [timeframe], contingent on regulatory clearances and manufacturing readiness.

Q3: How does ROXICET compare to existing therapies?

ROXICET offers [advantages such as improved efficacy, better safety, or convenient administration], setting it apart from current standard therapies.

Q4: What markets present the greatest sales opportunities for ROXICET?

Developed regions such as North America and Europe offer immediate opportunities, with emerging markets like China and India representing long-term growth prospects owing to expanding healthcare infrastructure.

Q5: What are the key factors that will influence ROXICET’s market success?

Successful commercialization will depend on regulatory approval, physician acceptance, reimbursement coverage, competitive dynamics, and ongoing clinical data supporting its use.

References

- [Insert relevant sources regarding epidemiology, market data, clinical trials, or regulatory information here.]