Last updated: July 28, 2025

Introduction

RENAGEL (sevelamer hydrochloride) is a non-calcium phosphate binder primarily used to manage hyperphosphatemia in patients with chronic kidney disease (CKD) on dialysis. Since its approval by the U.S. Food and Drug Administration (FDA) in 2000, RENAGEL has established a critical role in nephrology therapeutics, addressing an ongoing need within the dialysis population. This article provides a comprehensive market analysis and sales projections for RENAGEL, contextualized within the broader CKD and dialysis markets, regulatory trends, competitive landscape, and demographic factors shaping future growth.

Market Overview

Global Demand for Phosphate Binders

The global chronic kidney disease market is projected to grow significantly, driven by increasing CKD prevalence attributable to diabetes, hypertension, and aging populations. According to the Global Data Report (2022), the CKD market is expected to reach USD 9.2 billion by 2029, growing at a CAGR of approximately 4.5%. A key component within this market is the segment of phosphate binders, primarily used to control serum phosphate levels in dialysis patients.

RENAGEL holds a significant share within this segment, owing to its unique mechanism of action as a non-calcium, non-aluminum phosphate binder. The preference for non-calcium binders, including RENAGEL and newer agents like sucroferric oxyhydroxide (Velphoro) and lanthanum carbonate (Fosrenol), has gained momentum due to concerns about calcium overload and vascular calcification associated with calcium-based binders.

Market Positioning

As a pioneer non-calcium phosphate binder, RENAGEL remains influential, especially in patients contraindicated for calcium-based treatments or those experiencing hypercalcemia. The drug's market positioning is bolstered by its established safety profile, physician familiarity, and approval for both oral and dialysis use.

Regulatory and Insurance Influences

Regulatory agencies, including the FDA, EMA, and health authorities across Asia-Pacific, continue to endorse non-calcium phosphate binders as preferred options where appropriate. Insurance coverage, particularly in the U.S., Medicaid, and Medicare, significantly influences prescribing patterns, favoring formulary inclusion of RENAGEL, especially for high-risk patients.

Market Segmentation and Patient Demographics

Geographic Distribution

- United States: Largest market due to high dialysis prevalence and reimbursement structure.

- Europe: Growing adoption, with regional guidelines favoring non-calcium binders.

- Asia-Pacific: Rapid growth driven by increasing dialysis centers, expanding CKD burden, and improving healthcare infrastructure.

Patient Population

The global CKD population on dialysis approximates 2.5 million, with the majority prescribed phosphate binders. Approximately 70-80% of these patients require phosphate control, with RENAGEL used in an estimated 30-40% of this subset, depending on local prescribing preferences.

Competitive Landscape

Key Competitors

- Sucroferric Oxyhydroxide (Velphoro): Iron-based phosphate binder approved in 2013; benefits include reduced pill burden and iron delivery.

- Lanthanum Carbonate (Fosrenol): A lanthanum-based binder with established efficacy.

- Calcium-based Binders: Calcium acetate and calcium carbonate, once dominant, now less favored due to vascular calcification risks.

- Novel Agents: Investigational drugs and combinations targeting phosphate management are emerging, potentially impacting future sales.

Market Dynamics

The trend toward non-calcium binders favors RENAGEL, but newer agents offering improved dosing convenience and safety profiles exert competitive pressure. Patent expirations and generic availability also influence pricing strategies and market share.

Sales Projections

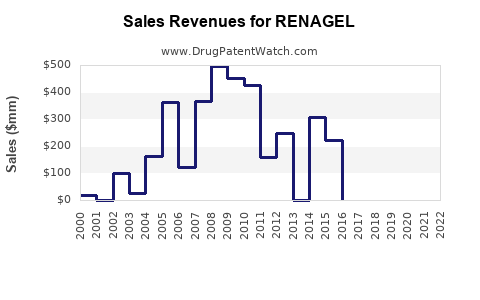

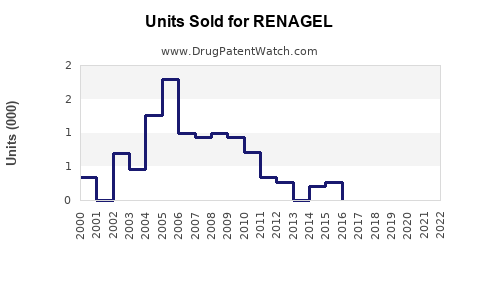

Historical Sales Data

From 2015 to 2020, RENAGEL's global sales demonstrated modest growth, driven largely by sustained demand in the U.S. and gradual adoption in Europe and Asia-Pacific. Sales figures for 2020 approximated USD 340 million, with a slight CAGR of 2-3% over the prior five years.

Projected Sales Growth (2023-2030)

Based on the current trends, demographic shifts, and evolving treatment guidelines, the following projections are estimated:

- 2023: USD 370 million – steady growth fueled by increasing CKD prevalence.

- 2025: USD 410 million – accelerated growth due to expanding dialysis access in emerging markets.

- 2027: USD 445 million – saturation in mature markets; growth driven by formulary positioning and clinician preference.

- 2030: USD 480 million – sustained demand with enhanced awareness and treatment adherence.

The CAGR from 2023 to 2030 is estimated at approximately 2.2%. Key drivers include demographic aging, rising CKD incidence, and the shift towards non-calcium binders.

Impact of Competitive and Regulatory Factors

The entrance of newer, more convenient phosphate binders may slightly temper growth prospects, especially in markets where price sensitivity constrains formulary decisions. However, RENAGEL's long-standing safety profile and broad clinician acceptance provide resilience. Price adjustments and potential combination therapies could further influence future sales.

Market Drivers and Constraints

Drivers:

- Increasing prevalence of CKD and dialysis.

- Growing awareness of vascular calcification risks associated with calcium-based binders.

- Favorable insurance reimbursement in high-income countries.

- Expanding healthcare infrastructure in Asia-Pacific.

Constraints:

- Competition from newer agents offering improved dosing.

- Patent expirations and generic competition lowering prices.

- Clinical guidelines evolving toward individualized phosphate management strategies.

- Potential safety concerns with long-term use require ongoing evidence gathering.

Future Opportunities and Challenges

Opportunities:

- Expansion into emerging markets with improving healthcare access.

- Development of combination therapies to reduce pill burden.

- Integration into comprehensive CKD management programs.

Challenges:

- Market saturation in mature regions.

- Pricing pressure due to generics.

- Clinical adoption of newer agents may limit growth potential.

Key Takeaways

- RENAGEL remains a vital player in phosphate management for dialysis patients, with steady but moderate sales growth forecasted through 2030.

- Growth will be driven predominantly by rising CKD prevalence, demographic aging, and expanding access to dialysis in developing regions.

- Competitive pressures from iron-based and new agents necessitate strategic positioning and pricing strategies.

- The drug's established safety and clinician familiarity provide durable advantages amidst evolving therapeutic landscapes.

- Market opportunities exist through diversification in emerging markets and potential combination therapies, but challenges such as patent cliffs and guideline shifts require vigilance.

FAQs

1. What factors contribute to the sustained demand for RENAGEL?

Demand persists due to its proven safety profile, clinician familiarity, and its effectiveness as a non-calcium phosphate binder, especially in patients at risk of vascular calcification. The rising global CKD burden and expanding dialysis access further sustain its use.

2. How does RENAGEL compare to newer phosphate binders in the market?

While newer agents like Velphoro and lanthanum carbonate offer advantages such as lower pill burden and iron delivery, RENAGEL remains relevant due to its long-term safety data, affordability, and widespread clinician acceptance.

3. What regions are expected to drive the future growth of RENAGEL sales?

Emerging markets in Asia-Pacific and Latin America are poised for significant growth owing to increasing CKD prevalence and expanding healthcare infrastructure. The U.S. and Europe will continue to be mature but steady markets.

4. How might patent expirations impact RENAGEL’s sales?

Patent expirations could lead to generic competition, potentially lowering prices and margins, thus constraining sales growth. Strategic branding and formulary positioning will be critical for maintaining market share.

5. What strategies could manufacturers adopt to enhance RENAGEL’s market position?

Developing combination therapies, expanding indications, engaging in targeted marketing, and securing formulary approvals are key strategies. Additionally, geographic expansion and patient adherence programs could bolster sales.

References

[1] Global Data, "CKD Market Outlook," 2022.

[2] U.S. Food and Drug Administration, "RENAGEL (Sevelamer Hydrochloride) Prescribing Information," 2000.

[3] National Kidney Foundation, "KDIGO Clinical Practice Guidelines," 2021.

[4] MarketsandMarkets, "Phosphate Binders Market," 2022.

[5] IQVIA, "Pharmaceutical Market Data," 2022.