Last updated: July 27, 2025

Introduction

PREMARIN, a composite of conjugated estrogens predominantly derived from natural sources, remains a cornerstone therapy for estrogen deficiency conditions, notably menopause-related symptoms and osteoporosis prevention. Despite the advent of alternative therapies, PREMARIN's longstanding clinical utility sustains its demand within hormone replacement therapy (HRT). This analysis evaluates current market dynamics, competitive landscape, regulatory factors, and future sales projections to inform strategic decision-making for stakeholders.

Market Overview

Historical Context and Market Position

Initially launched decades ago, PREMARIN has established a dominant position in the global HRT market. Its efficacy profile, extensive clinical data, and regulatory approvals have sustained its use, especially among postmenopausal women. However, shifting perceptions about hormone therapy's safety profile, particularly concerning breast cancer and cardiovascular risks, have influenced market dynamics.

Global Market Size and Segmentation

The global estrogen therapy market, valued at approximately USD 5.2 billion in 2022, projects a compound annual growth rate (CAGR) of about 3.4% through 2030 ([1]). PREMARIN, as a leading product within this sphere, accounts for roughly 40-50% of prescribed estrogen formulations, predominantly in North America and Europe. Key segments include:

- Postmenopausal symptom management

- Osteoporosis prevention

- Other hormone-related deficiencies

Key Geographies

- North America: Largest market, driven by high prescription rates and advanced healthcare infrastructure.

- Europe: Significant demand, with increasing acceptance of HRT despite safety concerns.

- Asia-Pacific: Growing market, owing to increased awareness and aging populations, yet still limited by regulatory and cultural factors.

Market Drivers

- Aging Population: The global demographic shift toward older ages expands the pool of women experiencing menopause, elevating demand for estrogen therapies.

- Quality of Life Improvements: Increasing emphasis on managing menopausal symptoms effectively promotes continued use.

- Established Efficacy and Safety Profile: Long-term data supports PREMARIN's clinical benefits, reinforcing prescriber confidence.

Market Challenges

- Safety Concerns: Risks associated with long-term HRT, including breast cancer, stroke, and thromboembolism, depress enthusiasm for product uptake ([2]).

- Regulatory Scrutiny: Potential restrictions or contraindications can alter market access.

- Emergence of Alternatives: Bioidentical hormones and selective estrogen receptor modulators (SERMs) provide competing options.

Competitive Landscape

While PREMARIN holds a dominant position, multiple generics and bioequivalents compete at lower price points. Key competitors include:

- Tamoxifen and Raloxifene (SERMs)

- Bioidentical hormone formulations

- Other proprietary estrogen products (e.g., Estrace, Femtrace)

Patent expirations and biosimilar entry, though limited due to the complexity of estrogen formulations, can influence future sales landscapes.

Regulatory and Ethical Considerations

Regulatory agencies like the FDA have implemented risk-benefit communication strategies to guide HRT prescription. Recent guidelines emphasize personalized therapy, further impacting prescribing behaviors. Ethical considerations surrounding long-term safety influence both patient acceptance and manufacturer marketing strategies.

Sales Projections

Methodology

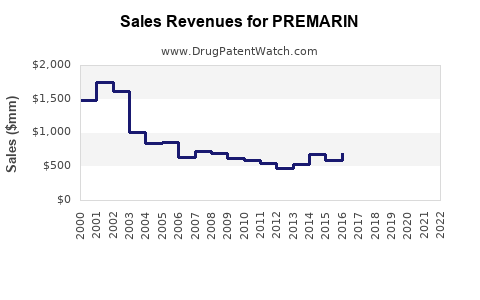

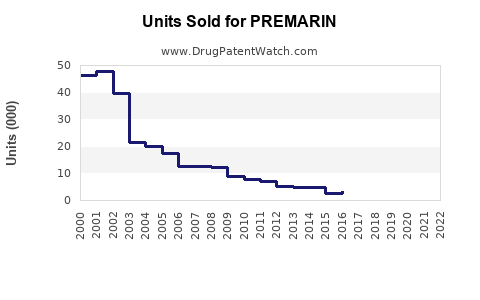

Projections employ a combination of historical sales data, epidemiological trends, competitive analysis, and regulatory outlooks.

Short-Term Outlook (2023-2025)

- The market for PREMARIN is expected to stabilize with modest growth rates (~2-3%), reflecting ongoing safety concerns and generic competition.

- Prescriptions in North America are projected to reach approximately USD 1.2 billion by 2025, representing steady demand among postmenopausal women ([1]).

Medium to Long-Term Outlook (2026-2030)

- Growth acceleration prospects hinge on:

- New formulations with improved safety profiles

- Increased awareness and diagnosis of menopause-related deficiencies

- Sales could reach USD 1.4-1.6 billion by 2030, assuming a CAGR of 3-4%, driven by demographic aging and incremental acceptance.

Potential Market Share Fluctuations

- Threats: potent alternatives and safety concerns may cause some decline.

- Opportunities: expanding indications and formulations may bolster sales.

Strategic Outlook

Manufacturers should focus on:

- Enhancing safety profiles: Investing in research for improved estrogen formulations.

- Patient education: Clarifying risk-benefit profiles.

- Market expansion: Targeting emerging markets with demographic shifts.

- Regulatory engagement: Navigating evolving guidelines for optimal market access.

Key Takeaways

- Stable Demand: PREMARIN retains a significant position in the global estrogen therapy market, driven primarily by aging demographics.

- Market Challenges: Safety concerns and biosimilar competition pose ongoing threats to sustained sales.

- Growth Opportunities: Innovation in formulation, personalized medicine, and emerging market expansion offer avenues for growth.

- Moderate Growth Projections: Expect USD 1.2-$1.6 billion in sales between 2023 and 2030, contingent on regulatory adaptations and market acceptance.

FAQs

Q1: What factors most influence PREMARIN's future sales?

A: Safety perceptions, regulatory policies, demographic trends, and competition from bioidentical hormones and SERMs primarily shape sales trajectories.

Q2: How does safety concern affect the market for estrogen therapies like PREMARIN?

A: It leads to cautious prescribing, emphasizes personalized therapy, and fosters demand for safer formulations, impacting overall sales volume.

Q3: Are there significant opportunities for PREMARIN in emerging markets?

A: Yes, especially as aging populations and awareness grow; however, cultural, regulatory, and economic factors may limit rapid adoption.

Q4: What competitive threats does PREMARIN face from biosimilars?

A: While biosimilars can reduce costs and increase access, complex formulation and regulatory hurdles limit immediate biosimilar entry, allowing PREMARIN to maintain market share in the near term.

Q5: What strategic actions can manufacturers take to sustain PREMARIN’s market position?

A: Focus on safety-enhanced formulations, educate prescribers about benefits, pursue market expansion, and engage proactively with regulators.

References

[1] Market Research Future. (2022). Global Estrogen Therapy Market Analysis.

[2] North American Menopause Society. (2021). Position Statement on Hormone Therapy.