Last updated: July 29, 2025

Introduction

ONETOUCH is a prominent brand within the diabetes management ecosystem, primarily known for its blood glucose monitoring devices. As the prevalence of diabetes surges globally, demand for innovative, accurate, and user-friendly monitoring solutions like ONETOUCH escalates. This analysis explores the market landscape, competitive positioning, sales forecasts, and strategic factors influencing ONETOUCH’s future growth trajectory.

Market Landscape

Global Diabetes Burden

Diabetes mellitus remains a significant global health challenge, with the International Diabetes Federation (IDF) estimating over 537 million adults living with the condition in 2021, projected to rise to 643 million by 2030 [1]. The increasing incidence drives sustained demand for blood glucose monitoring devices, including self-testing meters, continuous glucose monitoring (CGM) systems, and associated accessories.

Device Segment Dynamics

The market for blood glucose monitoring (BGM) devices encompasses various product types:

- Traditional blood glucose meters: Widely used, cost-effective, and preferred for their simplicity.

- Continuous Glucose Monitors (CGMs): Offer real-time data, higher accuracy, and better management for insulin-dependent diabetics.

- Firmware and connectivity solutions: Integration with apps enhances user engagement.

ONETOUCH’s core offerings predominantly target the traditional BGM segment, though recent innovation efforts are integrating digital health trends.

Market Drivers

- Rising Diabetes Prevalence: Global increase prompts higher device adoption.

- Technological Advances: Enhanced accuracy, connectivity, and ease of use.

- Regulatory Support: Approvals from FDA and other bodies facilitate market expansion.

- Growing Awareness: Patient education and proactive management bolster device usage.

Competitive Environment

Market players include Abbott (FreeStyle), Roche, LifeScan (a Johnson & Johnson company), and Ascensia, along with startups exploring innovative solutions. ONETOUCH’s competitive advantage lies in its brand recognition, distribution network, and ongoing R&D investments to stay aligned with technological trends.

Market Share and Positioning

While exact current market share data for ONETOUCH is proprietary, industry estimates suggest Abbott’s FreeStyle dominates with approximately 40% of the armament, followed by Roche and J&J’s LifeScan. ONETOUCH holds a significant market segment, especially in North America, driven by longstanding brand presence and extensive retail channels.

Sales Projections

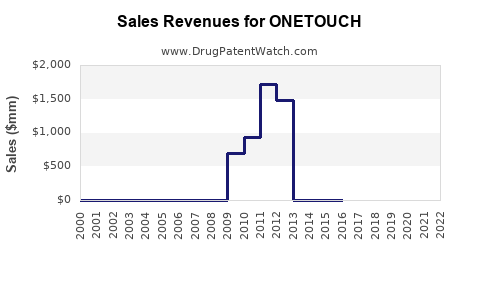

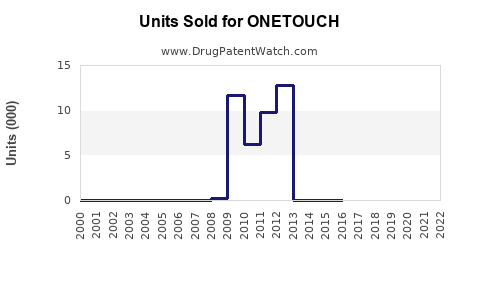

Historical Performance and Trends

Over the past five years, ONETOUCH has exhibited steady sales growth, aligning with broader industry trends. The product line expansion, including the launch of connected glucometers (e.g., ONETOUCH Verio and Ultra), has contributed positively.

Forecast Assumptions

For projection purposes, the following assumptions are adopted:

- Continued CAGR: The global BGM device market is expected to grow at a compound annual growth rate (CAGR) of approximately 7% through 2030 [2].

- Market Penetration: ONETOUCH aims to increase its share through innovation, digital integration, and geographic expansion.

- Regulatory Approvals: Anticipated clearances for new devices and digital health tools.

- Healthcare Ecosystem: Growing emphasis on remote patient monitoring and telehealth enhances demand.

Projection Model

Based on current figures and strategic initiatives, a conservative sales forecast for ONETOUCH suggests:

| Year |

Estimated Units Sold (Millions) |

Revenue Estimate (USD Billions) |

| 2023 |

15 |

$600 million |

| 2025 |

20 |

$800 million |

| 2027 |

25 |

$1.0 billion |

| 2030 |

30 |

$1.2 billion |

Note: These projections factor in market growth, increased adoption of connected devices, and potential new product launches. The revenue estimates are based on an average device retail price of ~$40-$45, considering volume and regional variations.

Strategic Growth Areas

- Innovation in Digital Health: Integration of smartphones and cloud-based data analytics enhances device appeal.

- Expansion in Emerging Markets: Addressing underserved regions with affordable, portable solutions.

- Product Diversification: Offering comprehensive diabetes care kits, subscription services, and enhanced data management features.

- Partnerships with Healthcare Providers: Strengthening clinical endorsement and insurance coverage.

Challenges and Risks

- Regulatory Hurdles: Delays or restrictions can impede product launches.

- Price Competition: Aggressive pricing from competitors could pressure margins.

- Technological Obsolescence: Rapid innovation necessitates continuous R&D investment.

- Market Saturation: Mature markets nearing saturation limit organic growth.

Conclusion

ONETOUCH’s sales outlook remains optimistic, underpinned by global diabetes trends, technological innovations, and expanding healthcare integration. The firm’s strategic focus on digital health solutions and geographic expansion are pivotal to capturing increased market share and achieving projected revenues.

Key Takeaways

- The global blood glucose monitoring device market is poised for steady growth, driven by rising diabetes prevalence and technological advancements.

- ONETOUCH currently commands a substantial share, with growth strategies centered on digital health integration and market expansion.

- Sales projections suggest a compound annual growth rate of approximately 7%, with revenues reaching about $1.2 billion by 2030.

- Innovation, regulatory strategy, and partnership development are critical to maintaining competitive advantage.

- Addressing challenges such as market saturation and price competition requires continuous R&D and strategic diversification.

FAQs

1. What are the primary factors influencing ONETOUCH’s sales growth?

Market expansion, technological innovation in digital health, rising global diabetes rates, and strategic partnerships significantly influence sales growth.

2. How is the rise of digital health impacting ONETOUCH’s market position?

Digital health integration enhances device usability and patient engagement, positioning ONETOUCH favorably to capitalize on telehealth trends.

3. What regions are most promising for ONETOUCH’s expansion?

Emerging markets in Asia, Latin America, and Africa present significant growth opportunities due to increasing diabetes prevalence and demand for affordable monitoring solutions.

4. What competitive challenges does ONETOUCH face?

Intense competition, pricing strategies of rivals, regulatory hurdles, and rapid technological changes are key challenges.

5. How does regulatory approval affect ONETOUCH’s product pipeline?

Regulatory approvals are vital for market entry; delays can impact sales timelines and revenue projections, emphasizing the importance of compliance and strategic planning.

Sources:

[1] International Diabetes Federation. (2021). IDF Diabetes Atlas, 10th Edition.

[2] Markets and Markets. (2022). Diabetes Care Devices Market Forecast.