Last updated: July 28, 2025

Introduction

Ofluoxacin, a broad-spectrum fluoroquinolone antibiotic, has historically played a significant role in treating various bacterial infections, including respiratory tract infections, urinary tract infections, and skin infections. As a potent antibacterial, its market performance is closely tied to the prevalence of bacterial infections, resistance trends, regulatory developments, and competitive dynamics within the antibiotic sector. This analysis explores the current market landscape for Ofloxacin, anticipates future sales trajectories, and provides strategic insights relevant to stakeholders.

Market Overview

Global Market Landscape

The global antibiotics market was valued at approximately USD 45 billion in 2022, with fluoroquinolones representing a substantial segment. Ofloxacin, introduced in the late 1980s, was once among the most widely prescribed fluoroquinolones worldwide owing to its efficacy and broad-spectrum activity[1]. Despite recent challenges such as increasing antibiotic resistance, regulatory restrictions, and shifts toward antimicrobial stewardship, Ofloxacin continues to maintain a significant market presence, especially in emerging markets.

Geographical Distribution

-

North America: Characterized by mature markets with high antibiotic stewardship programs, the use of Ofloxacin has declined considerably. Nonetheless, it remains prescribed in certain infections where resistance is manageable.

-

Europe: Similar to North America, regulatory bodies have tightened restrictions on fluoroquinolone use due to safety concerns, leading to modest sales.

-

Asia-Pacific: This region dominates Ofloxacin consumption due to high bacterial infection rates, limited regulatory restrictions, and over-the-counter availability. Countries such as India, China, and Southeast Asian nations represent the largest markets.

-

Latin America and Middle East: Growing healthcare infrastructure and rising infection burden contribute to steady demand in these regions.

Market Drivers

- High Prevalence of Bacterial Infections: Elevated infection rates in developing countries sustain demand.

- Cost-Effectiveness: Ofloxacin's affordability compared to newer antibiotics makes it a preferred choice in low-income settings.

- Over-the-Counter Availability: Ease of access in emerging markets bolsters sales.

Market Constraints

- Resistance Development: Increasing resistance diminishes clinical efficacy, leading to reduced prescriptions.

- Safety Concerns: Regulatory warnings regarding potential adverse effects (e.g., tendon rupture, neuropsychiatric effects) have led to restrictions and decreased use.

- Shift Toward Newer Agents: Greater focus on targeted antibiotics with fewer side effects impacts Ofloxacin's market share.

Market Segmentation and Demand Dynamics

Therapeutic Indications

- Urinary tract infections

- Respiratory infections

- Skin and soft tissue infections

- Gonorrhea

Formulations

- Oral tablets

- Injectable forms (less common)

Demographics

- Predominantly adult populations

- Use in outpatient settings, especially in regions with limited healthcare infrastructure

Market Trends

The market has shifted from widespread usage to more judicious application, driven by stewardship programs and safety concerns. Nevertheless, in resource-limited areas, the practice persists, maintaining steady sales volumes.

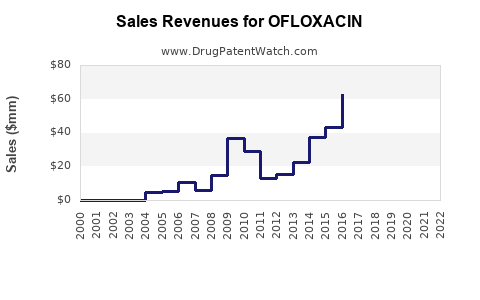

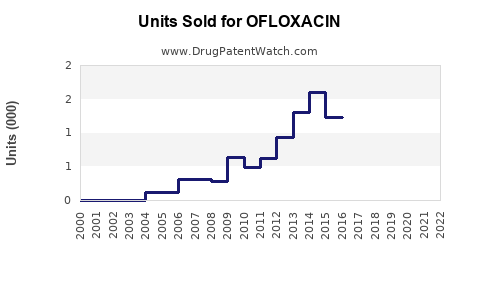

Sales Projections (2023-2032)

Methodology

Forecasting employs an integrated approach combining historical consumption data, epidemiological trends, resistance patterns, regulatory outlook, and market access considerations. The report assumes moderate growth in emerging markets and a decline in mature markets due to regulatory restrictions.

Short-term Outlook (2023–2026)

- Global sales: Estimated to remain around USD 1.5–2 billion annually, with regional variations.

- Key regions: High sales in India, China, and other Southeast Asian countries.

- Growth rate: Approximate CAGR of 2-3%, supported by increasing infection prevalence and access in emerging markets.

Medium to Long-term Outlook (2027–2032)

- Market contraction in developed regions: Due to regulatory restrictions and safety concerns.

- Resurgence in emerging markets: Driven by population growth, urbanization, and healthcare infrastructure development.

- Projected CAGR: 1.5-2% overall, with regional divergences; Asia-Pacific potentially exhibiting a higher CAGR (~3%) due to expanding access.

Impact of Resistance and Regulatory Changes

- Resistance: Rising resistance levels may lead to formulation restrictions, dosage modifications, or alternative therapies.

- Regulation: Stringent regulations in North America and Europe are likely to continue constraining sales, while regulatory environments in Asia remain more permissive.

Market Opportunities

- Formulation innovation: Developing formulations with improved safety profiles.

- Combination therapies: Pairing Ofloxacin with other agents to combat resistance.

- Extended indications: Exploring new therapeutic areas where bacterial infections are prevalent.

Competitive Landscape

Major pharmaceutical companies, such as Sanofi-Aventis (original producer), and generics manufacturers dominate the market. The availability of generic versions has driven down prices and facilitated accessibility, particularly in emerging markets. However, patent expirations and regulatory hurdles challenge traditional market players.

Regulatory and Safety Considerations

Regulatory agencies, including the FDA and EMA, have issued warnings about fluoroquinolone use, citing risks such as tendinitis, retinal detachment, and neuropsychiatric adverse effects. These advisories have led to decreased prescribing and increased scrutiny, especially in developed markets. Nonetheless, regulatory acceptance persists where benefit-risk profiles favor use, particularly for severe infections.

Conclusion

While Ofloxacin's traditional dominance has diminished in developed regions, it remains a vital agent in developing countries. The global market is anticipated to experience modest growth, fueled by increasing infection rates and expanding healthcare access in Asia and other emerging markets. Concurrently, resistance issues and safety concerns necessitate ongoing innovation and strategic repositioning.

Key Takeaways

- Ofloxacin currently generates approximately USD 1.5–2 billion annually, with prospects for slight growth in emerging markets.

- Regulatory restrictions in North America and Europe are constraining sales; Asia-Pacific remains the primary growth driver.

- Rising antibiotic resistance and safety concerns necessitate formulation enhancements and cautious prescribing practices.

- Investment opportunities include developing safer derivatives, combination therapies, and expanding indications.

- Strategic focus should be placed on balancing access in developing markets with stewardship and safety in developed regions.

FAQs

1. What factors are impacting the global sales of Ofloxacin?

Regulatory restrictions, increasing antibiotic resistance, safety concerns, and competition from newer antibiotics are key factors affecting sales. While demand persists primarily in emerging markets, developed regions exhibit declining use due to stringent guidelines.

2. Which regions are expected to drive future Ofloxacin sales?

Asia-Pacific is the principal growth region due to high infection prevalence, limited regulation, and over-the-counter availability. Africa and Latin America also contribute to steady demand.

3. How is antibiotic resistance influencing Ofloxacin's market?

Rising resistance reduces clinical efficacy, leading to decreased prescriptions and prompting regulatory agencies to impose restrictions. This trend compels manufacturers to innovate or reposition existing products.

4. What opportunities exist for pharmaceutical companies in the Ofloxacin market?

Opportunities include developing formulations with improved safety profiles, creating combination therapies to mitigate resistance, and expanding indications to new infection types.

5. Will Ofloxacin remain relevant in the coming decade?

Yes, particularly in resource-limited settings where alternatives are scarce. However, its market relevance will depend on addressing resistance and safety challenges through innovation and stewardship programs.

References

[1] European Centre for Disease Prevention and Control. Antibiotic Resistance Overview. 2021.