Last updated: July 29, 2025

Introduction

Methylin, a brand name for methylphenidate hydrochloride, is a stimulant primarily prescribed for attention deficit hyperactivity disorder (ADHD) and narcolepsy. Its established efficacy, FDA approval, and widespread use in pediatric and adult populations position it as a significant player in the CNS stimulant market. This report provides a comprehensive analysis of Methylin’s market landscape, competitive positioning, regulatory environment, and future sales forecasts.

Market Overview

Therapeutic Profile and Indications

Methylin’s primary indication is ADHD, the most prevalent neurodevelopmental disorder affecting children and adolescents, with estimated global prevalence rates of approximately 5-7% among children (CDC, 2022). It also treats narcolepsy, a sleep disorder characterized by excessive daytime sleepiness. Both conditions contribute to a steady demand for methylphenidate-based therapies.

Market Drivers

-

Rising ADHD Diagnosis Rates: Improved awareness and diagnostic practices have expanded the diagnosed population, augmenting demand (WHO, 2020).

-

Expanding Adult ADHD Treatment: Increasing recognition of adult ADHD has opened new markets, supporting sustained growth.

-

Competing Formulations: Methylin’s availability in various formulations (tablets, chewable, oral solution) enhances patient compliance and prescriber flexibility.

-

Research and Off-Label Applications: Emerging studies investigating methylphenidate for depression, cognitive decline, and other neuropsychiatric conditions may expand indications in the future.

Market Challenges

-

Regulatory Scrutiny: Behemoth regulatory agencies maintain strict controls over stimulant prescriptions due to abuse potential, influencing market accessibility.

-

Generic Competition: Several generic methylphenidate formulations have entered the market, eroding branded sales margins.

-

Abuse and Misuse: High abuse potential necessitates controlled distribution channels, impacting overall sales volume.

Competitive Landscape

Key competitors include:

-

Generic Methylphenidate Products: Major pharmaceutical companies leading market share via cost-competitiveness.

-

Other Stimulant Medications: Amphetamines like Adderall (amphetamine salts) and Dexedrine (dextroamphetamine).

-

Non-Stimulant Alternatives: Atomoxetine (Strattera), guanfacine, and modafinil, capturing segments hesitant to use stimulants.

Regulatory Environment

FDA Approvals and Patents

Methylin’s approval aligns with FDA’s standards for controlled substances, with patent protections influencing exclusive sales periods historically. However, patent expirations have facilitated generic competition, constraining market growth potential.

Legal and Ethical Considerations

Stringent prescribing regulations and monitoring programs like Prescription Drug Monitoring Programs (PDMPs) aim to curb abuse but can complicate supply chains and patient access.

Market Opportunities

-

Elderly and Adult Populations: Growing recognition of adult ADHD creates an untapped demographic segment.

-

New Formulation Development: Long-acting formulations or combination therapies could command premium pricing.

-

Market Expansion: Emerging markets in Asia, Latin America, and Africa demonstrate expanding healthcare infrastructure and increasing mental health awareness.

Sales Analysis (Historical and Projected)

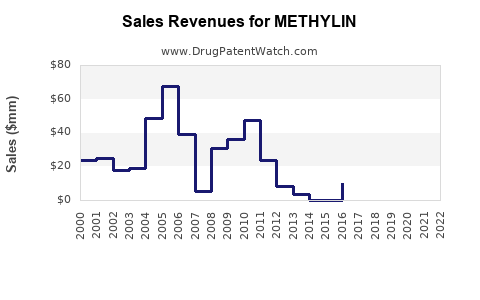

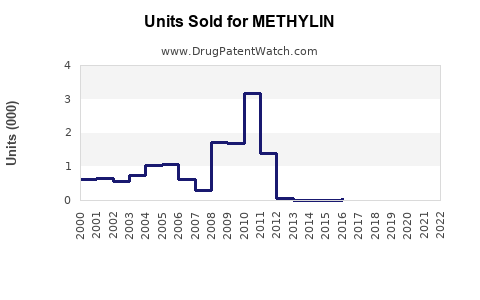

Historical Market Performance

From 2018 to 2022, sales of methylphenidate formulations, including Methylin, experienced moderate growth, driven by increased diagnoses and expanded formulations. In the U.S., the ADHD treatment market has grown at a compounded annual growth rate (CAGR) of approximately 4%, with methylphenidate contributing a substantial share (IQVIA, 2022).

Future Sales Projections (2023-2028)

Based on existing data, patient population growth, and market dynamics, Methylin’s global sales volume is expected to grow at a CAGR of approximately 3-4%. Factors influencing this projection include:

- Continued diagnosis increases (estimated 2% annual growth).

- Market penetration of adult ADHD treatments.

- Impact of generic competition leading to reduced unit prices.

- Regulatory restrictions influencing prescriber behavior.

In dollar terms, the global methylphenidate market, valued at approximately $3.2 billion in 2022, is projected to reach around $4.2 billion by 2028, with Methylin’s share likely to decrease proportionally due to intense generic competition but maintain stable sales through strategic formulation offerings and geographic expansion.

Strategic Considerations for Stakeholders

-

Brand Differentiation: Emphasize formulations with superior compliance profiles.

-

Geographic Diversification: Target emerging markets with rising healthcare investments.

-

Research Initiatives: Invest in clinical trials exploring novel indications, potentially extending patent life or creating new revenue streams.

-

Pricing Strategies: Balance between competitive pricing and maintaining margin integrity amid generics.

Key Market Segments and Customer Demographics

-

Pediatric Patients: The primary user base, constituting approximately 70% of prescriptions.

-

Adult Patients: Growing segment, estimated to constitute up to 30% of methylphenidate prescriptions by 2025.

-

Healthcare Providers: Psychiatrists, pediatric neurologists, general practitioners.

-

Caregivers/Parents: Critical influencers in pediatric medication adherence.

Global Market Outlook

North America remains the dominant market, accounting for over 65% of sales due to high diagnosis rates and robust healthcare infrastructure. Europe follows, with notable growth prospects in the UK, Germany, and France. Emerging markets demonstrate accelerating adoption, driven by increased mental health awareness and evolving prescribing practices.

Conclusion

Methylin stands at the intersection of mature market dynamics and growth opportunities driven by demographic trends and therapeutic innovations. While faced with generic competition and regulatory constraints, strategic positioning, formulation innovation, and geographic expansion can sustain its market presence. Sales projections indicate moderate but steady growth through 2028, emphasizing the importance of adaptability and ongoing research investment.

Key Takeaways

- Market growth hinges on increasing ADHD diagnoses, especially among adults.

- Generic competition pressures margins but supports broader access.

- Emerging markets and new formulations offer growth avenues.

- Regulatory concerns necessitate compliance and monitoring.

- Strategic focus on clinical research and geographic expansion is essential.

FAQs

Q1: How does the patent status of Methylin influence its sales?

Patent protections historically provided exclusive rights, enabling premium pricing. Once expired, generic competitors entered the market, diminishing Methylin's market share and profitability, emphasizing the need for formulary differentiation and innovation.

Q2: What demographic shifts are expected to impact methylphenidate sales?

An increasing diagnosis of adult ADHD is expanding the treated population, potentially doubling the adult segment within five years. This shift offers new revenue streams and requires tailored formulations.

Q3: How does regulatory scrutiny affect methylphenidate sales?

Strict prescribing restrictions, risk of misuse, and monitoring programs limit overprescription but also pose barriers to market expansion. Strategic compliance is essential to sustain sales.

Q4: What role do emerging markets play in Methylin’s future growth?

Emerging economies are experiencing rapid healthcare infrastructure development and increased mental health awareness, creating opportunities for market penetration and product adoption.

Q5: What future innovations could influence Methylin's market position?

Development of long-acting formulations, combination therapies, and extending indications to neurodegenerative or cognitive disorders could redefine its market landscape and sales trajectory.

References

[1] CDC. (2022). ADHD Prevalence Data. Centers for Disease Control and Prevention.

[2] WHO. (2020). International Review of ADHD. World Health Organization.

[3] IQVIA. (2022). Global Psychotropic Market Reports. IQVIA Pharmaceuticals Data.