Last updated: July 27, 2025

Introduction

JALYN is a combination medication comprising dutasteride and tamsulosin, primarily prescribed for benign prostatic hyperplasia (BPH). Approved by regulatory agencies such as the FDA, JALYN addresses the dual pathophysiological mechanisms of BPH—namely, prostate enlargement and smooth muscle tone. Its unique formulation offers potential advantages over monotherapies, positioning it as a strategic asset in the urology drug market.

This analysis offers an in-depth review of JALYN’s current market landscape, competitive positioning, emerging trends, and future sales projections, crucial for pharmaceutical stakeholders evaluating investment, marketing, or expansion opportunities.

Market Overview

Global Benign Prostatic Hyperplasia (BPH) Market

The BPH treatment market has exhibited robust growth, supported by an aging population globally. According to research reports, the market was valued at approximately USD 6.5 billion in 2022, with projections reaching USD 9.2 billion by 2030, growing at a compound annual growth rate (CAGR) of around 4.3% (Source: Grand View Research). The rising prevalence of BPH, coupled with increased awareness and acceptance of minimally invasive therapies, fuels this expansion.

Key Drivers

- Aging Population: Men over 50 years are increasingly diagnosed, with prevalence rates between 50-60% for men aged 60-70 years (Source: NIH).

- Advancements in Formulations: Enhanced drug efficacy and reduced side effects promote early pharmaco-therapy adoption.

- Patient Preference: Preference for oral medications over surgical options underscores demand for combination therapies.

Regulatory Approvals and Market Penetration

JALYN’s approval marks a significant milestone, with the medication gaining traction in the U.S. and Europe. Its approval is based on clinical studies demonstrating improved symptom relief and reduced prostate volume reduction compared to monotherapies.

Competitive Landscape

Existing Therapies

The BPH market’s primary therapeutic classes include 5-alpha-reductase inhibitors (e.g., finasteride, dutasteride), alpha-1 adrenergic blockers (e.g., tamsulosin, alfuzosin), and combination formulations. JALYN's main competitors include:

- Finasteride (Proscar): Monotherapy with proven efficacy but associated with sexual side effects.

- Dutasteride (Avodart): Similar mechanism; used alone or in combination.

- Tamsulosin (Flomax): Widely prescribed alpha-blocker.

- Generic combinations: Several generic dutasteride and tamsulosin formulations are available separately or as fixed-dose combinations.

Differentiation of JALYN

JALYN’s distinct advantage lies in its fixed-dose combination formulation designed to target both prostate growth and smooth muscle tone simultaneously. Clinical trials have demonstrated that JALYN achieves greater symptom relief and prostate volume reduction than either component alone, with a favorable side-effect profile.

Market Entry Challenges

- Generic Competition: U.S. patent expiration for some components challenges brand-loyal drug sales.

- Physician Prescription Habits: Preference for prescribing generic drugs or separate components can hinder uptake.

- Pricing and Reimbursement: Formulation costs and payer coverage significantly influence market penetration.

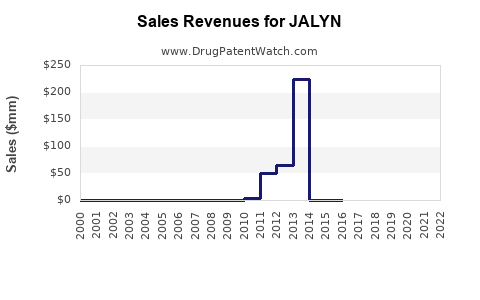

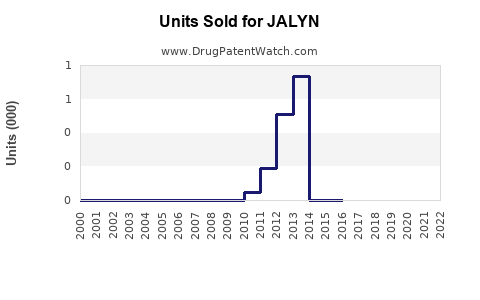

Sales Projections

Short-term Outlook (1-3 Years)

In the immediate term, JALYN’s sales are expected to grow modestly as awareness increases and prescriber familiarity develops. Assuming initial market capture of approximately 10% within established BPH markets, projected revenues could range between USD 200-300 million globally, contingent on geographic expansion and reimbursement policies.

Medium to Long-term Outlook (3-10 Years)

With sustained marketing efforts and competitive differentiation, JALYN could capture a significant portion of the BPH combination product segment. Considering the expanding BPH population and the shift towards combination therapies, annual sales could reach USD 600-1 billion worldwide. Key factors include:

- Market Penetration: Expansion into emerging markets (e.g., Asia-Pacific, Latin America).

- Regulatory Approvals: Approval for additional indications or formulations.

- Physician and Patient Acceptance: Enhanced clinical guidelines favoring combination therapy.

Factors Influencing Sales Trajectory

- Patent Life and Exclusivity: Patent life extension strategies, if applicable, are critical for revenue longevity.

- Competitive Innovations: Next-generation combination pills or novel agents may impact market share.

- Pricing Strategies: Balancing affordability with profitability in various markets.

Key Opportunities and Challenges

Opportunities

- Expanding Indications: Potential use in lower urinary tract symptoms (LUTS) management beyond BPH.

- Combination with Other Therapies: Research into triple or multi-drug regimens.

- Growing Older Male Population: Accelerating demand in aging demographics.

Challenges

- Market Saturation: Established monotherapies and generic options limit growth potential.

- Pricing Pressures: Payer negotiations may restrict price flexibility.

- Regulatory Barriers: Delays or rejection in new markets.

Market Strategy Recommendations

- Differentiation: Emphasize clinical benefits, safety profile, and convenience of JALYN’s fixed-dose formulation.

- Education & Awareness: Target urologists and primary care physicians regarding efficacy data.

- Market Access: Collaborate with payers to optimize reimbursement pathways.

- Geographic Expansion: Prioritize emerging markets with rising BPH prevalence.

Conclusion

JALYN’s market landscape is characterized by a growing BPH treatment segment, marked by steady demand for effective combination therapies. While faced with generic competition and market saturation in mature regions, the drug’s clinical advantages and strategic marketing can unlock substantial sales growth over the next decade. The outlook remains optimistic for investors and manufacturers willing to navigate market dynamics, regulatory frameworks, and competitive pressures effectively.

Key Takeaways

- The global BPH market is expanding at a CAGR of approximately 4.3%, driven by aging populations and advanced treatment options.

- JALYN’s unique fixed-dose combination positions it favorably, especially in markets prioritizing dual-action therapies.

- Near-term sales are expected to be modest, with substantial growth potential contingent on geographic expansion and market penetration.

- Generic competition and payer dynamics pose significant challenges, necessitating strategic differentiation and stakeholder engagement.

- Long-term success depends on ongoing clinical developments, market access strategies, and adaption to evolving treatment guidelines.

FAQs

-

What distinguishes JALYN from other BPH treatments?

JALYN combines dutasteride and tamsulosin in a single tablet, offering dual action—reducing prostate size and relaxing smooth muscle—beneficial for symptom relief and prostate volume reduction.

-

What is the current market penetration of JALYN?

As a relatively new entrant, JALYN’s market share is emerging, with a focus on prescriber awareness and geographic expansion potential.

-

How does patent status influence sales projections?

Patent exclusivity provides temporary market exclusivity, enabling premium pricing and sales growth; patent expirations or challenges can lead to generic competition, impacting revenue.

-

What are the key challenges for JALYN in the global market?

Challenges include competition from generics, reimbursement hurdles, physician preference for monotherapies, and regulatory delays in certain jurisdictions.

-

What strategies can maximize JALYN’s market potential?

Emphasizing clinical benefits, expanding indications, targeting emerging markets, and forming strategic partnerships for market access can boost sales.

References

- Grand View Research. "Benign Prostatic Hyperplasia Treatment Market Size, Share & Trends Analysis Report." 2022.

- National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK). "Benign Prostatic Hyperplasia." 2021.

- U.S. Food and Drug Administration (FDA). "JALYN (Dutasteride and Tamsulosin) Drug Approval Documents." 2022.