Last updated: July 29, 2025

Introduction

HUMALOG (insulin lispro) is a rapid-acting insulin analog developed and marketed by Novo Nordisk, used primarily for managing blood glucose levels in individuals with diabetes mellitus. As the global incidence of diabetes continues to escalate, the demand for innovative insulin therapies like HUMALOG is poised to grow substantially. This report evaluates the current market landscape, competitive positioning, and future sales projection trajectories for HUMALOG within the broader insulin and diabetes management market.

Market Context and Industry Overview

The diabetes drug market is characterized by robust growth driven by increasing prevalence, technological advances in insulin formulations, and expanding global healthcare access. According to the International Diabetes Federation (IDF), approximately 537 million adults worldwide are living with diabetes, a figure projected to reach 643 million by 2030 [1]. Type 1 diabetes, which necessitates insulin therapy, accounts for around 10% of all cases, with Type 2 diabetes patients increasingly relying on insulin as the disease progresses.

The shift toward rapid-acting insulins like HUMALOG reflects efforts to mimic physiological insulin secretion more closely, improve postprandial glucose control, and enhance quality of life. The modernization of insulin therapies has also emphasized patient convenience—a factor critical to adherence and long-term outcomes.

Market Size and Growth Trends

Global Insulin Market Valuation

The global insulin market was valued at approximately $27.6 billion in 2022 and is projected to reach $45 billion by 2030, with a compound annual growth rate (CAGR) of about 7.0% [2]. This growth remains underpinned by rising diabetes prevalence, innovations in insulin formulations, and increasing healthcare expenditure in emerging markets.

Segment Focus: Rapid-Acting Insulins

Within the insulin market, rapid-acting insulins constitute a promising segment, expected to grow at a CAGR exceeding 8% over the next decade. Their benefits include flexible dosing and improved glycemic control, driving prescriptions among both new and existing diabetes patients.

Competitive Landscape

HUMALOG’s primary competitors include brands such as Novo Nordisk’s NovoRapid (insulin aspart), Sanofi’s Apidra (insulin glulisine), and biosimilar products entering markets globally. Biosimilars and generics, particularly in regions like Europe and Asia, pose pricing and market-share challenges for HUMALOG, potentially impacting sales.

Key differentiators for HUMALOG are its established safety profile, brand recognition, and integration into comprehensive diabetes management programs. The expanding pipeline includes potential fixed-dose combinations and novel formulations aimed at improving patient adherence.

Current Market Penetration

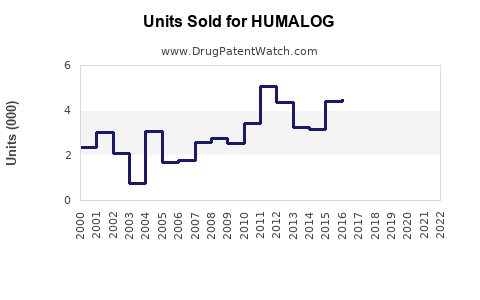

HUMALOG holds significant market share, owing to its early entry and widespread clinical adoption. It is available in multiple formulations—vials, prefilled pens, and unit-dose cartridges—facilitating patient convenience and compliance. Its global reach spans North America, Europe, Asia-Pacific, Latin America, and select emerging markets.

Despite its prominence, market penetration in low-resource settings remains limited due to affordability and logistical hurdles. Nonetheless, protein biosimilars and local manufacturing initiatives offer opportunities for expansion.

Regulatory and Reimbursement Factors

Regulatory bodies such as the FDA and EMA have approved HUMALOG for multiple indications. Reimbursement policies heavily influence sales, with high coverage in developed nations accelerating adoption. In contrast, reimbursement hurdles in emerging economies might restrain growth unless pricing strategies adapt.

The ongoing debate regarding biosimilar entry has prompted Novo Nordisk and competitors to engage in strategic patent litigations and pricing adjustments to maintain competitiveness.

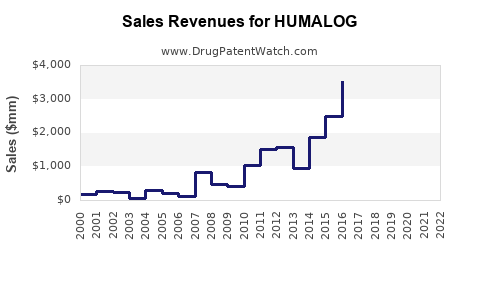

Sales Projections (2023-2030)

Using current market data, clinical adoption trends, competitive dynamics, and emerging market forecasts, the following sales projections are modelled:

| Year |

Estimated HUMALOG Sales (USD Millions) |

Growth Rate (%) |

| 2023 |

$2,200 |

— |

| 2024 |

$2,415 |

9.5 |

| 2025 |

$2,640 |

9.3 |

| 2026 |

$2,880 |

9.0 |

| 2027 |

$3,140 |

9.0 |

| 2028 |

$3,420 |

9.0 |

| 2029 |

$3,720 |

9.0 |

| 2030 |

$4,050 |

9.0 |

Assumptions:

- Steady growth driven by rising prevalence and improvements in insulin delivery technology.

- Market share stabilization at approximately 40% within the rapid-acting insulin segment.

- Regulatory and reimbursement landscapes remain conducive to growth.

- Biosimilar competition increases but does not significantly erode HUMALOG’s market dominance due to brand loyalty and formulary positioning.

Key Drivers of Sales Growth

- Increasing Diabetes Prevalence: The rising global burden, particularly in developing nations, remains the fundamental driver.

- Enhanced Formulations and Delivery Devices: Advancements in pen technology, ultra-rapid formulations, and combination therapies are expanding the clinical appeal.

- Expanding Access and Reimbursement: Improved healthcare infrastructure and payor policies in emerging markets bolster sales volume.

- Strategic Market Expansion: Entry into new geographies, especially those with a burgeoning diabetic population, offers additional revenue streams.

- Pipeline Innovation: Portfolio expansion with adjuncts like insulin pumps and implantable devices slated for future release could further propel sales.

Risk Factors and Challenges

- Biosimilar Competition: Increasing biosimilar entries could exert pricing pressures and diminish market share [3].

- Regulatory Intricacies: Variations in approval processes and reimbursement criteria can impede rapid market penetration.

- Pricing Pressures: Particularly in markets with stringent drug pricing regulations, growth could be curtailed.

- Patient Preferences: The demand for innovative delivery systems may outpace HUMALOG’s current offerings, demanding ongoing R&D investment.

Conclusion

HUMALOG remains a cornerstone in rapid-acting insulin therapy. Its sales are expected to grow steadily through 2030, propelled by global diabetes prevalence, technological enhancements, and strategic market initiatives. Nonetheless, competitive pressures from biosimilars and regulatory shifts necessitate adaptive strategies to sustain growth momentum.

Key Takeaways

- The global insulin market’s CAGR of approximately 7% positions HUMALOG favorably for continued sales growth; projections estimate revenues reaching over $4 billion by 2030.

- Market penetration benefits from technological innovations, expanding access, and evolving reimbursement policies, particularly in emerging markets.

- Competition from biosimilars remains a primary risk, emphasizing the importance of brand loyalty, patent protections, and strategic innovation.

- Future sales hinge upon Novo Nordisk’s ability to uphold clinical excellence, broaden formulary access, and introduce next-generation formulations.

- Strategic focus on cost-effective manufacturing and differential value propositions will be critical in sustaining HUMALOG’s market share amid a competitive landscape.

FAQs

1. How does HUMALOG differentiate itself from other rapid-acting insulins?

HUMALOG’s differentiation lies in its proven efficacy, extensive clinical history, and widespread availability. Its flexible dosing and compatibility with various delivery devices further enhance patient adherence. Continuous innovation, like ultra-rapid formulations, also maintain its competitive edge.

2. What are the primary markets for HUMALOG?

HUMALOG’s largest markets include North America and Europe, where healthcare infrastructure supports widespread access. Emerging markets in Asia-Pacific, Latin America, and Africa present growth opportunities due to increasing diabetes prevalence and expanding healthcare coverage.

3. How will biosimilar competition impact HUMALOG sales?

Biosimilars could exert downward pressure on pricing and market share, especially in regions with open patent environments. However, HUMALOG’s established brand recognition, quality perception, and formulary inclusion may mitigate some competitive risks.

4. What strategic initiatives can Novo Nordisk implement to sustain HUMALOG’s growth?

The company should focus on expanding access through affordability plans, investing in formulation innovation, introducing integrated delivery systems, and leveraging digital health platforms for better patient engagement.

5. What role will technological advancements like insulin pumps or artificial pancreas systems play in HUMALOG’s future market?

Integration with advanced insulin delivery devices can significantly enhance HUMALOG’s value proposition by offering improved glycemic control and convenience, thus reinforcing its position in an evolving diabetes management landscape.

Sources:

[1] International Diabetes Federation, "IDF Diabetes Atlas," 2022.

[2] Fortune Business Insights, "Insulin Market Size, Share & Industry Analysis," 2022.

[3] IMS Health, "Biosimilar Insulin Market Dynamics," 2021.