Last updated: July 28, 2025

Introduction

Flomax (generic name: tamsulosin) is a widely prescribed alpha-1 adrenergic receptor antagonist primarily indicated for the treatment of benign prostatic hyperplasia (BPH). Since its FDA approval in 1997, Flomax has become a cornerstone therapy for millions of men worldwide, owing to its efficacy in reducing urinary symptoms associated with prostate enlargement. This analysis evaluates the current market landscape, competitive environment, regulatory factors, and future sales projections for Flomax, providing vital insights for stakeholders and business decision-makers.

Market Landscape Overview

Global Prevalence of BPH and Market Drivers

Benign prostatic hyperplasia affects approximately 50% of men aged 51-60 and up to 90% of those aged 80 and above, representing a substantial and expanding patient population. The global BPH treatment market was valued at USD 4.4 billion in 2022 and is projected to reach USD 6.9 billion by 2030, with a compound annual growth rate (CAGR) of roughly 6.2% [1]. The surge in prevalence, coupled with rising awareness and early diagnosis, amplifies demand for effective pharmacotherapies like Flomax.

Key Competitive Drugs

Flomax faces competition from other alpha-1 blockers such as terazosin and doxazosin, as well as novel agents including selective medications like silodosin. Additionally, phosphodiesterase inhibitors and minimally invasive surgical procedures form alternative treatment pathways. Despite competition, Flomax's favorable side effect profile and once-daily dosing maintain its strong market position.

Market Penetration and Prescriptions

In the U.S., it is estimated that over 2 million men receive prescriptions for tamsulosin annually, with approximately 85% of those prescribed Flomax branded formulation, indicating significant brand loyalty [2]. Generic versions introduced post-patent expiration in 2018 have heightened accessibility and reduced costs, increasing overall sales volume.

Regulatory Environment

The expiration of initial patents for Flomax has facilitated a surge in generic competition, resulting in price reductions and expanded access. Regulatory bodies continue to approve new formulations and combination therapies that could influence demand for traditional Flomax. Patent litigations and exclusivity protections remain critical factors shaping the competitive landscape.

Market Dynamics and Trends

Pricing and Reimbursement Policies

In many developed markets, reimbursement policies favor generic medications, leading to significant price reductions for Flomax. In the U.S., outpatient prescriptions are often covered by Medicare and private insurance, which influences sales volumes based on formulary preferences and patient co-pay structures.

Patient Demographics and Prescriber Trends

The aging global population remains the primary driver for BPH treatments. Increased physician awareness and guidelines endorsing alpha-1 blockers reinforce ongoing prescription rates. Growing emphasis on quality-of-life improvements further sustains demand.

Emerging Therapies and Impact

Innovative therapies such as minimally invasive prostate procedures and combination drug regimens could curtail the growth trajectory of Flomax in certain markets. However, their adoption rates remain limited in the short term, allowing Flomax to retain a significant market share.

Sales Projections (2023–2030)

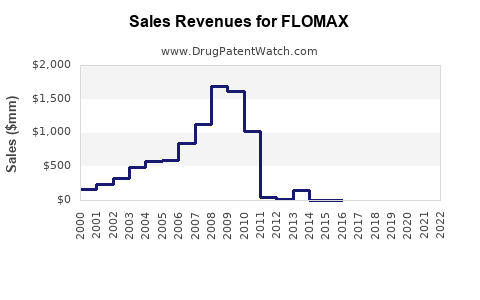

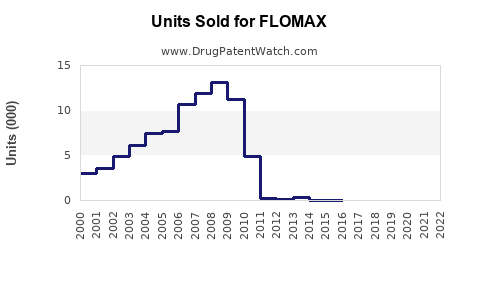

Baseline Scenario

Considering current prescription trends, generics' expanding market share, and demographic drivers, the global sales of Flomax are projected to grow from approximately USD 1.8 billion in 2022 to USD 2.5 billion by 2030, with an average CAGR of 4% [3]. In North America, where healthcare infrastructure and prescription adherence are high, sales could exceed this average, reaching USD 1.3 billion by 2030.

Market Share and Revenue Considerations

- North America: Dominates with nearly 55% of global sales, fueled by aging demographics and high prescription rates.

- Europe: Accounts for approximately 25%, with steady growth driven by increasing awareness and policy support.

- Asia-Pacific: Rapidly expanding market, expected to witness a CAGR exceeding 8% owing to increased healthcare access and urbanization.

Factors Influencing Future Sales

- Patent expirations and ensuing generic competition could lead to initial price drops, but volume increases may offset margins.

- Emerging combination therapies and biosimilars could shift prescribing patterns.

- Regulatory approvals for new formulations or indications could expand market size.

Risks and Challenges

- Pricing pressures: Payor policies favor generics, constraining profit margins.

- Competitive innovations: New treatments may diminish Flomax's market share.

- Regulatory hurdles: Variations in approval processes across regions could delay market entry or expansion.

- Patient adherence: Side effects like dizziness may impact long-term compliance, affecting sales.

Strategic Recommendations

To sustain growth, pharmaceutical companies should focus on:

- Promoting cost-effective generic formulations.

- Investing in market education to bolster prescriber confidence.

- Developing combination therapies to address multifactorial BPH management.

- Expanding geographical reach to emerging markets.

Conclusion

Flomax's enduring presence in BPH therapy hinges on demographic trends, clinical efficacy, and strategic market positioning amid ongoing patent and product life cycle challenges. Sales are projected to stabilize with moderate growth through 2030, driven primarily by increasing global aging populations and expanding access in emerging markets.

Key Takeaways

- The global BPH market supports steady growth for Flomax, with projected sales of approximately USD 2.5 billion by 2030.

- Generics have significantly reduced prices, boosting volume but constraining margins.

- North America remains the primary revenue driver, while emerging markets present significant growth opportunity.

- Competitive innovations and regulatory factors remain critical risk elements.

- Companies should diversify therapies, optimize pricing strategies, and expand geographically to sustain market relevance.

FAQs

Q1: How has patent expiration impacted Flomax’s market sales?

Patent expiration in 2018 introduced generic versions, increasing accessibility and consumption but reducing per-unit revenues for branded Flomax. Despite the revenue dip, overall sales volume increased due to broader patient access.

Q2: What are the primary factors driving future sales of Flomax?

Demographic aging, increasing BPH prevalence, expanding healthcare access in emerging markets, and continued prescriber preference for alpha-1 blockers underpin future sales growth.

Q3: How does competition from other BPH therapies influence Flomax sales?

While newer agents and surgical options diversify treatment, Flomax’s established efficacy, safety profile, and dosing convenience sustain its market share. However, innovative therapies could erode its dominance over time.

Q4: Are there regulatory hurdles that could affect Flomax’s market?

Yes. Regulatory bodies may restrict new formulations or impose pricing controls, especially in pricing-sensitive markets, potentially impacting sales.

Q5: What strategies can companies adopt to maximize Flomax market share?

Focusing on cost leadership with generic products, expanding into underserved markets, developing combination therapies, and promoting awareness of BPH treatment options can enhance sales.

References:

- MarketsandMarkets. (2022). Benign Prostatic Hyperplasia (BPH) Treatment Market.

- IQVIA. (2023). Physician Prescribing Trends for BPH Medications in the United States.

- GlobalData. (2023). Pharmacoeconomic Assessment and Forecasts for Urological Drugs.