Last updated: July 27, 2025

Introduction

Esomeprazole, a proton pump inhibitor (PPI), is widely used for the treatment of gastroesophageal reflux disease (GERD), peptic ulcers, Zollinger-Ellison syndrome, and other acid-related disorders. As a key successor to omeprazole, esomeprazole offers improved pharmacokinetic profiles, leading to increased efficacy and patient compliance. This analysis examines the current market landscape, competitive positioning, and future sales forecasts for esomeprazole over the next five years, emphasizing demand drivers, regulatory influences, competitive dynamics, and emerging market opportunities.

Market Landscape Overview

Global Market Size and Growth Trends

The global proton pump inhibitor market reached approximately USD 13 billion in 2022, with esomeprazole representing a significant segment owing to its broad clinical acceptance (1). The compound's market share stems from its high efficacy, favorable safety profile, and extensive patent protections, although generic competition has diminished exclusivity in mature markets.

The CAGR for the PPI segment is estimated at 4.5% from 2023 to 2028, driven by increasing prevalence of acid-related disorders, aging populations, and rising healthcare awareness (2). Esomeprazole, as a top-selling PPI, is poised to benefit from these growth initiatives, albeit facing challenges from patent expirations and generic entrants.

Key Markets and Regional Dynamics

-

North America: The largest market, driven by high GERD prevalence (~20% of the adult population), advanced healthcare infrastructure, and favorable reimbursement policies (3). Esomeprazole accounts for over 30% of prescription PPI sales here.

-

Europe: Open to growth, with a ~15% GERD prevalence. Rising awareness and prescription rates underpin market expansion.

-

Asia-Pacific: The fastest-growing region, with expanding healthcare access, increasing urbanization, and rising incidence of gastrointestinal disorders. Market penetration is projected to accelerate, driven by local pharmaceutical companies and increasing demand for cost-effective treatments.

-

Latin America and Middle East: Developing markets with growing prescription volumes and a shift towards branded medications, especially in higher-income segments.

Competitive Landscape

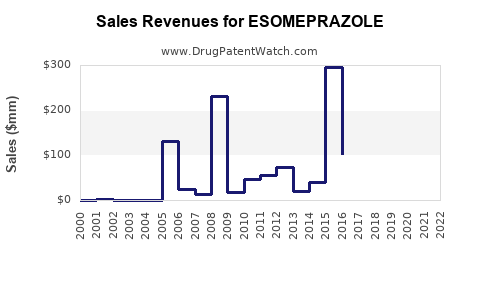

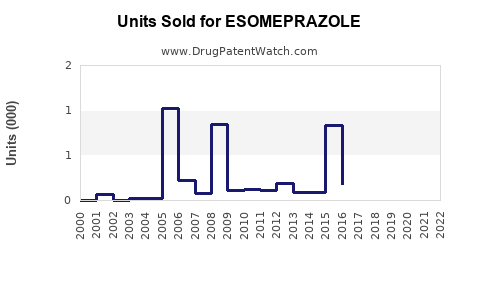

Patent Status and Generic Competition

Esomeprazole was originally marketed under Nexium by AstraZeneca, receiving orphan and patent protections until patent expiration in major markets (e.g., United States, Europe). The expiration directly impacted sales, as generic versions flooded the market starting around 2015–2016 (4). Generic manufacturers now hold significant market shares, with prices often dropping by 80%, pressuring brand-name revenues.

Major Players

-

AstraZeneca: Continues to market Nexium, focusing on formulations with improved bioavailability and combination therapies.

-

Generic Manufacturers: Multiple players, including Teva, Mylan, Sandoz, and Hikma, produce generic esomeprazole, offering lower-cost alternatives.

-

Emerging Biosimulation and Innovators: Companies exploring novel delivery mechanisms or extended-release formulations to extend patent protections or differentiate products.

Market Differentiators

Brand loyalty, patient perception of efficacy, and physician prescribing habits remain critical, despite widespread generic availability. Innovations such as combination drugs and higher-dose formulations are strategic tools to retain market share.

Demand Drivers

-

Rising Prevalence of GERD and Acid-Related Conditions: Approximately 20–30% of Western populations suffer from GERD symptoms, with increasing trends in Asia-Pacific (3).

-

Aging Population: Older adults are more susceptible to acid disorders, increasing outpatient demand.

-

Lifestyle Factors: Obesity, dietary habits, and smoking elevate GERD incidence.

-

Chronic Use in Disease Management: Long-term therapy with PPIs sustains ongoing demand.

-

Innovations and Line Extensions: Combination medications (e.g., esomeprazole with antibiotics for H. pylori), and over-the-counter (OTC) formulations expand accessibility.

Sales Projections (2023–2028)

Methodology and Assumptions

Projections incorporate historical sales data, patent expiry timelines, regional growth trends, and anticipated market penetration of generics. Assumptions include:

- Patent cliffs in mature markets leading to a decline in branded sales post-2016.

- Growth acceleration in Asia-Pacific due to expanding healthcare infrastructure.

- Stable demand in developed markets through chronic therapy adherence.

- Entry of biosimilars or novel formulations remains limited within the forecast horizon.

Forecast Summary

| Year |

Estimated Global Sales (USD billions) |

Growth Rate |

Key Factors Influencing Sales |

| 2023 |

USD 3.2 |

2.5% |

Continued generic penetration, moderate growth |

| 2024 |

USD 3.4 |

6.3% |

Increased adoption in Asia-Pacific, OTC expansion |

| 2025 |

USD 3.7 |

8.8% |

Demographic trends, new combination therapy launches |

| 2026 |

USD 4.0 |

8.1% |

Patent expiries in certain regions, price competition |

| 2027 |

USD 4.3 |

7.5% |

Market saturation in mature regions, emerging markets boost sales |

| 2028 |

USD 4.6 |

7.0% |

Innovation-driven growth, increased chronic use |

Total five-year CAGR: Approximately 7.1%.

Regional Breakdown

- North America: Expected to stabilize around USD 1.5 billion by 2028, with growth mainly from OTC sales and higher-dosage formulations.

- Europe: Projected to grow to USD 1.2 billion, driven by rising GERD prevalence and local manufacturing.

- Asia-Pacific: Fastest growth, potentially reaching USD 1.0 billion by 2028, leveraging expanding healthcare infrastructure and rising awareness.

- Other Regions: Incremental growth in Latin America and Middle East, contributing smaller yet significant sales increments.

Market Dynamics and Challenges

Pricing Pressures

Universal generic competition has driven down prices globally. Payers and insurance providers favor lower-cost generics, reducing the profitability margins of branded esomeprazole.

Regulatory Environment

Patent litigations, biosimilar policies, and reimbursement frameworks influence market access and pricing strategies. Emerging markets often have lenient regulations facilitating cheaper generics but also offer opportunities for biosimilar development.

Innovation and Differentiation Opportunities

Limited pipeline innovations threaten the long-term growth unless companies develop new delivery systems, combination therapies, or novel indications. Focused R&D on personalized medicine and new formulations such as sustained-release devices can provide competitive advantages.

Conclusion

Esomeprazole remains a vital player in managing acid-related disorders, with substantial current sales and optimistic future growth potential, primarily driven by demographic trends, increasing regional healthcare access, and segment innovations. However, market saturation in mature economies and rapid generic adoption require strategic adaptation, including diversification of formulations, treatment protocols, and entering emerging markets.

Key Takeaways

- The global esomeprazole market is projected to grow at approximately 7% CAGR from 2023 to 2028, reaching USD 4.6 billion.

- Patent expiries have shifted market dynamics toward generics, with price competition constraining brand revenues.

- Emerging markets, notably Asia-Pacific, offer the most significant growth opportunities due to rising GI disorder prevalence and expanding healthcare infrastructure.

- Innovation, such as new formulations or combination therapies, is crucial for maintaining market share amid aggressive generic competition.

- Market success will hinge on regional strategy localization, pricing management, and R&D investments in differentiation.

FAQs

1. Will patent expiration continue to threaten the sales of esomeprazole?

Yes. Patent expirations have historically led to a surge in generic entries, significantly reducing brand-name sales. Continued patent cliffs in various jurisdictions will sustain this pressure unless innovators develop new formulations or indications.

2. Which regions are expected to drive the most growth for esomeprazole?

Asia-Pacific is poised for the strongest growth due to expanding healthcare access, increased awareness, and higher disease prevalence. Emerging markets across Latin America and the Middle East also present sizable opportunities.

3. How are generic manufacturers impacting the esomeprazole market?

Generic entrants have sharply decreased prices and increased accessibility, thereby capturing larger market shares; however, brand manufacturers focus on differentiation through new formulations and loyalty programs to retain market presence.

4. Is there potential for new indications or formulations to revitalize esomeprazole sales?

Potential exists. Developing less invasive delivery systems, extended-release formulations, and combination therapies targeting complex conditions can help sustain growth and extend patent protections.

5. How do regulatory policies influence esomeprazole sales projections?

Regulatory frameworks impact market entry, pricing, and reimbursement. Deregulation or favorable subsidy policies facilitate growth, whereas stringent approvals or patent litigations can restrict market expansion.

Sources:

- [MarketResearch.com, 2023 Market Overview]

- [Grand View Research, Proton Pump Inhibitors Market Report, 2022]

- [World Gastroenterology Organization, 2021 Data on GERD Prevalence]

- [AstraZeneca Annual Reports, 2015–2022]