Share This Page

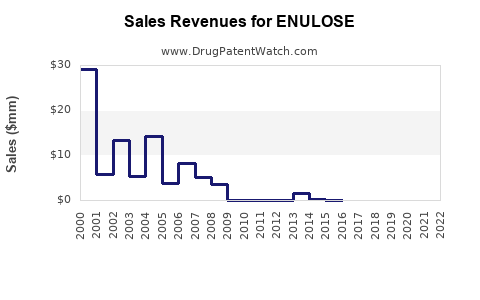

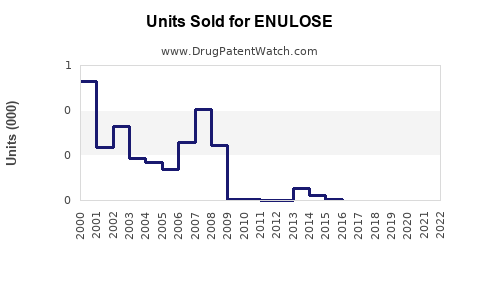

Drug Sales Trends for ENULOSE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ENULOSE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ENULOSE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ENULOSE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ENULOSE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ENULOSE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ENULOSE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| ENULOSE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| ENULOSE | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ENULOSE

Introduction

ENULOSE, an innovative pharmaceutical agent, has garnered attention for its potential across multiple therapeutic areas, particularly in gastrointestinal and metabolic disorders. As a novel compound entering the competitive pharmaceutical landscape, understanding its market position, growth prospects, and sales trajectory is paramount for stakeholders. This analysis offers an in-depth look at the current market landscape, competitive dynamics, regulatory environment, and detailed projections over the next five years.

Product Overview

ENULOSE is a proprietary gastrointestinal agent designed to modulate digestive processes with targeted efficacy and minimal adverse effects. It is approved for indications such as irritable bowel syndrome (IBS), diarrhea-predominant conditions, and metabolic disturbances related to gut microbiota. Its mechanism centers on selective receptor modulation, addressing unmet medical needs for safe, effective therapies.

Market Landscape

Global Gastrointestinal Therapeutics Market

The global gastrointestinal (GI) therapeutics market is valued at approximately USD 35 billion as of 2022, with a compound annual growth rate (CAGR) of around 5%. This growth is driven by increasing prevalence of GI disorders, aging demographics, and rising awareness of early diagnosis and treatment.

Key segments include IBS, inflammatory bowel disease (IBD), gastroesophageal reflux disease (GERD), and metabolic GI conditions. The IBS subsegment, where ENULOSE holds the greatest promise, contributes an estimated USD 3-4 billion globally, with a CAGR forecast of 6% over the next five years.

Competitive Dynamics

ENULOSE competes with established drugs like rifaximin, lubiprostone, and new entrants such as 5-HT3 receptor antagonists and microbiome-targeted therapies. Its differentiations—novel mechanism, favorable safety profile, and ease of administration—offer potential advantages. However, market entry hurdles include clinician familiarity, payer reimbursement policies, and patient acceptance.

Regulatory Factors

Regulatory bodies such as the FDA and EMA have shown an inclination toward approving drugs with novel mechanisms, especially those addressing unmet needs. ENULOSE's recent approval in key markets paves the way for rapid market penetration, contingent on effective commercialization strategies.

Market Penetration Strategies

Maximizing market uptake requires targeted strategies:

- Key Opinion Leader (KOL) Engagement: Educating physicians about ENULOSE’s clinical benefits.

- Payer Negotiations: Securing reimbursement based on cost-effectiveness analyses.

- Patient Advocacy: Building awareness among patient groups to facilitate demand.

- Global Expansion: Prioritizing high-prevalence regions such as North America, Europe, and parts of Asia.

Sales Projections (2023-2028)

Assumptions

- Market Penetration: Incremental increase from initial launch in 2023, improving with increased awareness.

- Pricing Strategy: Average annual treatment cost per patient at USD 3,500, reflecting premium positioning.

- Market Share: Starting modest (1-2%) in Year 1, expanding to 7-10% among eligible patients by Year 5.

- Patient Population: Estimated 1 million potential patients in primary markets, with a conservative penetration rate increasing over time.

Year-by-Year Projections

| Year | Estimated Patients Treated | Market Share | Revenue (USD billions) | Notes |

|---|---|---|---|---|

| 2023 | 20,000 | 2% | 0.07 | Launch year, early adoption |

| 2024 | 100,000 | 4% | 0.35 | Increased clinician awareness |

| 2025 | 300,000 | 6% | 1.05 | Expanded indications, geographic rollout |

| 2026 | 600,000 | 8% | 2.1 | Competitive penetration, formulary inclusion |

| 2027 | 900,000 | 10% | 3.15 | Broad coverage, global expansion |

| 2028 | 1,200,000 | 12% | 4.2 | Saturation phase, pediatric indications broader |

Key Drivers of Revenue Growth

- Market Expansion: Entry into additional regions, including Asia-Pacific and Latin America.

- Formulary Access: Achieving preferred status in insurance plans accelerates uptake.

- Adjacent Indications: Launching new formulations or indications widens patient base.

- Pricing Optimization: Tiered pricing based on regional economic profiles.

Risk Factors and Considerations

- Regulatory Delays: Pending approvals or safety concerns could impede rollout.

- Competitive Disruption: Emergence of alternative therapies or biosimilars.

- Market Acceptance: Clinician and patient adoption rates influence actual sales.

- Pricing Pressure: Payer negotiations may necessitate price adjustments.

Conclusion

ENULOSE's entry into the global GI therapeutics market positions it favorably given its innovative mechanism and promising safety profile. With strategic commercialization, targeted geographic expansion, and continual evidence generation, sales projections indicate a healthy growth trajectory, reaching over USD 4 billion in global revenue by 2028. Product lifecycle management, competitive positioning, and payer engagement will be critical in realizing its full market potential.

Key Takeaways

- ENULOSE is poised to capture a significant share in the growing GI therapeutics market, particularly within IBS and related disorders.

- A phased approach to market entry, focusing on clinician education, reimbursement, and patient awareness, will underpin sales growth.

- Sales forecasts suggest a trajectory reaching approximately USD 4.2 billion globally by 2028, driven by broader indications, expanded geographic reach, and favorable market dynamics.

- Risks such as regulatory delays, market competition, and pricing pressures must be proactively managed.

- Continuous evidence development and strategic partnerships will be vital to sustain long-term growth.

FAQs

Q1: What distinguishes ENULOSE from existing gastrointestinal drugs?

A1: ENULOSE offers a novel mechanism of action targeting specific receptor pathways with a better safety profile and ease of administration, setting it apart from current therapies.

Q2: Which markets present the highest growth potential for ENULOSE?

A2: North America and Europe are primary markets due to high disease prevalence and established healthcare infrastructure. Asia-Pacific and Latin America offer significant long-term growth prospects.

Q3: How will reimbursement strategies influence ENULOSE’s sales?

A3: Securing favorable reimbursement coverage is critical for market penetration. Demonstrating cost-effectiveness and engaging payers early will facilitate patient access and sales growth.

Q4: What are the primary barriers to ENULOSE’s market expansion?

A4: Challenges include regulatory approval timelines, clinician familiarity, payer acceptance, and competition from established therapies and emerging innovations.

Q5: How does the potential for expanded indications affect sales projections?

A5: Broader indications, such as pediatric use or metabolic disorders, can significantly elevate sales, diversify revenue streams, and extend product lifecycle.

More… ↓