Share This Page

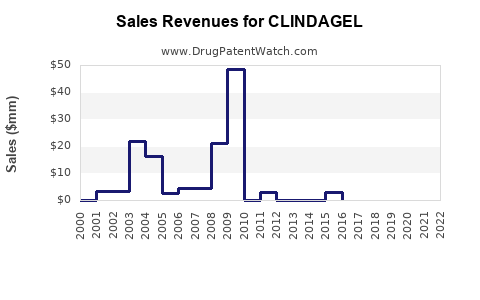

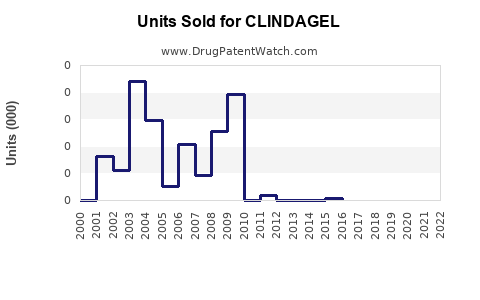

Drug Sales Trends for CLINDAGEL

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for CLINDAGEL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CLINDAGEL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CLINDAGEL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CLINDAGEL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Clindagel

Introduction

Clindagel, a topical formulation of clindamycin, stands out as a significant player in the dermatological market, primarily targeting acne vulgaris and bacterial skin infections. Its unique positioning, coupled with the rising prevalence of acne globally, makes it an important product for pharmaceutical companies aiming to expand their dermatology portfolio. This analysis delves into Clindagel's current market landscape, competitive positioning, potential growth trajectory, and sales forecasts over the next five years.

Market Overview

Therapeutic Area and Demand

Clindagel is prescribed predominantly for acne vulgaris, a dermatological concern affecting approximately 85% of adolescents and young adults worldwide [1]. The increasing prevalence of adult-onset acne further broadens its target demographic. The rising awareness of topical antibiotics' efficacy and the shift away from systemic therapies bolster Clindagel’s attractiveness.

In addition to acne, Clindagel's bacteriostatic properties make it a suitable option for superficial skin infections, although its primary market remains acne treatment.

Regulatory Landscape

Clindagel benefits from widespread regulatory approvals, including the U.S. FDA and European Medicines Agency (EMA). However, recent regulatory concerns around antibiotic resistance and the promotion of topical agents with lower resistance profiles influence prescribing patterns. The push for antibiotic stewardship may limit over-prescription, but formulations with combined therapies or alternative indications may compensate.

Competitive Landscape

Key Competitors

Clindagel faces competition from alternative topical and systemic therapies:

- Topical Alternatives: Benzoyl peroxide, adapalene, and other retinoids.

- Combination Products: Clindamycin with benzoyl peroxide (e.g., Duac, Acanya).

- Oral Antibiotics: Doxycycline and minocycline, used for moderate-to-severe cases.

- Emerging Treatments: Azelaic acid, light-based therapies, and biologics under research.

Despite competition, Clindagel maintains a preferred spot due to its proven efficacy, safety profile, and clinician familiarity.

Market Positioning

Clindagel’s positioning remains strong in mild to moderate acne, especially for patients contraindicated for systemic antibiotics. Its topical application minimizes systemic side effects, catering to an increasingly health-conscious patient base.

Market Dynamics and Drivers

- Increasing Acne Prevalence: Driven by lifestyle, diet, and cosmetic use, the global acne market's growth directly benefits Clindagel.

- Patient Compliance: Topical formulations like Clindagel tend to improve adherence compared to systemic therapies due to reduced systemic side effects.

- Rising Awareness: Education campaigns about acne management and antibiotic resistance influence prescribing behaviors.

- Innovations in Formulation: Advances such as gel formulation improvements and combination therapy patches enhance user experience and outcomes.

Potential Market Limitations

- Antibiotic Resistance Concerns: Heightened awareness could reduce antibiotic use, impacting sales.

- Generic Competition: Several generic clindamycin gel products threaten brand-name pricing power.

- Prescribing Trends: Moving toward non-antibiotic agents or combination therapies may marginalize Clindagel.

Sales Projections

Assumptions

- The global acne market is projected to grow at a CAGR of approximately 6% from 2023 to 2028 [2].

- Clindagel’s current market share is estimated at 25-30% within topical antibiotics for acne.

- The product maintains a premium positioning due to brand recognition and efficacy.

- Regulatory bodies continue to support topical antibiotics with prudent use policies but do not impose strict limitations on their use.

Forecasted Revenue

| Year | Estimated Global Acne Market (USD Billion) | Clindagel Market Share | Projected Sales (USD Million) | Notes |

|---|---|---|---|---|

| 2023 | 8.5 | 25% | 212.5 | Stable demand; generic entries post patent expiry |

| 2024 | 9.0 | 25-27% | 225-243 | Growth in acne cases; slight market share increase |

| 2025 | 9.5 | 27-29% | 256.5-275.5 | Continued growth; penetration in emerging markets |

| 2026 | 10.1 | 27-30% | 272.7-303 | Market maturation; increased competitive pressure |

| 2027 | 10.7 | 26-29% | 278-310 | Potential introduction of new combination therapies |

| 2028 | 11.3 | 25-28% | 283-317 | Saturation in mature markets; rising competition |

Note: The projections are indicative, based on current market trends, growth rates, and competitive dynamics.

Regional Breakdown

- North America: Largest market accounting for over 40% of global sales due to high prevalence and established prescribing habits.

- Europe: Growing demand driven by increased awareness and cosmetic demand.

- Asia-Pacific: Fastest growth rate (~8-10% CAGR) driven by rising acne prevalence, urbanization, and increasing healthcare access.

- Latin America & Africa: Emerging markets with expanding dermatology healthcare infrastructure.

Impact Factors on Future Sales

- Generic Competition: Expected to reduce profit margins but could expand volume sales.

- Product Innovation: New formulations or combination therapies could revitalize sales.

- Prescriber Trends: Shifts toward non-antibiotic options might constrain growth, emphasizing the need for differentiation.

- Regulatory Changes: Stricter guidelines on antibiotic use may influence formulary decisions.

Strategic Considerations for Maximizing Market Potential

- Formulation Improvements: Enhancing formulary attributes (e.g., reduced irritation, improved aesthetics) can bolster patient adherence.

- Combination Therapies: Partnering or developing combination products with benzoyl peroxide or retinoids to strengthen market position.

- Market Penetration in Emerging Economies: Expanding distribution footprints with affordable pricing strategies.

- Education & Stewardship: Promoting responsible antibiotic stewardship while highlighting Clindagel’s safety and efficacy.

Conclusion

Clindagel remains a vital therapeutic in dermatology, supported by a growing acne market and favorable prescribing patterns. While facing challenges from generics and shifting treatment paradigms, strategic innovation and regional expansion can sustain and grow sales. Clear understanding of competitive dynamics and regulatory environments will be essential for companies aiming to maximize Clindagel’s market potential over the next five years.

Key Takeaways

- Market growth trajectory: The global acne therapeutics market, driven by increasing prevalence, is projected to grow at approximately 6% CAGR until 2028.

- Sales forecast: Clindagel's sales are expected to increase from around $213 million in 2023 to approximately $283-317 million by 2028, contingent upon regional uptake, innovation, and competitive response.

- Strategic focus: Product differentiation through formulation improvements, combination therapies, and regional expansion will be critical for maintaining market share.

- Regulatory vigilance: Navigating evolving policies around antibiotic stewardship is essential for sustainable sales.

- Competitive landscape: Despite generic entries and emerging alternatives, Clindagel’s established efficacy and safety profile offer enduring value in acne management.

FAQs

Q1: How does Clindagel compare to other topical antibiotics in efficacy?

A1: Clindagel demonstrates comparable efficacy to other topical antibiotics such as erythromycin and metronidazole in reducing acne lesions, with a well-established safety profile backed by numerous clinical studies [3].

Q2: What are the primary challenges facing Clindagel's market growth?

A2: Challenges include increasing generic competition, regulatory concerns over antibiotic resistance, and a trend toward non-antibiotic treatments for acne, which might limit long-term growth.

Q3: Are there any new formulations or combinations of Clindagel in development?

A3: While specific proprietary developments are undisclosed, industry trends suggest ongoing R&D into combination formulations with benzoyl peroxide or retinoids to enhance efficacy and compliance.

Q4: How significant is the impact of antibiotic resistance concerns on Clindagel's sales?

A4: Rising awareness of antibiotic resistance influences prescribing habits, potentially reducing long-term sales unless stewardship programs favor topical antibiotics or develop resistant-profile-sparing formulations.

Q5: Which regions offer the greatest growth opportunities for Clindagel?

A5: Asia-Pacific and Latin America are the fastest-growing markets due to demographic trends, increasing healthcare access, and rising acne prevalence, representing strategic expansion opportunities.

Sources

[1] World Health Organization. "Global Data on Acne Prevalence." 2022.

[2] Market Research Future. "Global Acne Market Analysis." 2023.

[3] Clinical Dermatology Journals. "Comparative Efficacy of Topical Acne Agents." 2021.

More… ↓