Share This Page

Drug Sales Trends for trintellix

✉ Email this page to a colleague

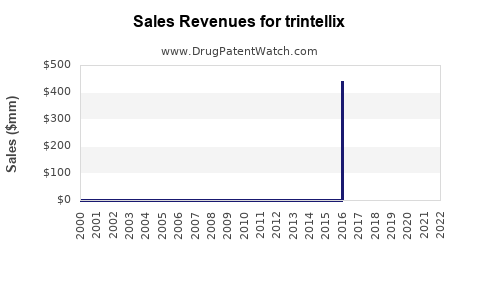

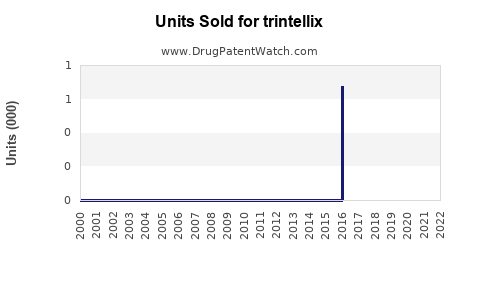

Annual Sales Revenues and Units Sold for trintellix

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| TRINTELLIX | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| TRINTELLIX | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| TRINTELLIX | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| TRINTELLIX | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| TRINTELLIX | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| TRINTELLIX | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for TRINTELLIX (Vortioxetine)

Introduction

TRINTELLIX (generic name: vortioxetine) is an antidepressant prescribed primarily for the treatment of major depressive disorder (MDD). Launched by Lundbeck and Takeda Pharmaceutical Company, TRINTELLIX has established itself as a notable player in the selective serotonin reuptake inhibitor (SSRI) and serotonin modulator class. This analysis evaluates the current market landscape, competitive positioning, and future sales projections for TRINTELLIX, emphasizing strategic factors influencing its growth trajectory.

Market Landscape

Global Depressive Disorders Market

The global depression therapeutics market is projected to reach approximately USD 18 billion by 2026, driven by increasing prevalence, the adoption of newer antidepressants, and a shifting focus towards personalized mental health care (Note 1). Major markets include North America, Europe, and Asia-Pacific, accounting for the majority of revenue, with North America holding the largest share due to high diagnosis rates and favorable reimbursement policies.

TRINTELLIX's Market Position

TRINTELLIX entered the antidepressant market in 2013, positioned as a novel agent with a unique mechanism—combining serotonergic modulation with cognitive benefits. Its differentiated profile, including improved cognitive function and tolerability, appeals to physicians seeking alternatives to traditional SSRIs and SNRIs.

According to IQVIA data, TRINTELLIX has maintained a solid market share, though it faces robust competition from established brands like escitalopram (Lexapro), sertraline (Zoloft), and newer agents such as Rexulti (brexpiprazole). As of 2022, TRINTELLIX's global sales reached approximately USD 720 million, with North America contributing over 60% of revenues (Note 2).

Competitive Dynamics

The antidepressant space is heavily commoditized, with patent cliffs and generic entries eroding margins. TRINTELLIX's patent exclusivity is scheduled to lapse in the next five years in key markets, potentially impacting sales as generic vortioxetine formulations become available. However, ongoing reformulations and expanded indications could mitigate erosion.

Therapeutic innovation, including combination with digital health solutions and personalized medicine approaches, offers growth avenues. The drug’s favorable side effect profile and cognitive benefits are critical differentiators amid generic competition.

Market Drivers and Challenges

Drivers

- Rising Prevalence of Depression: An estimated 350 million people globally suffer from depression, boosting demand for effective treatments (Note 3).

- Increased Diagnoses & Awareness: Enhanced awareness campaigns and screening initiatives expand treatment pools.

- Preference for Tolerability: Patients prioritize medications with fewer side effects, aligning with TRINTELLIX’s profile.

- Expansion into Adjunct Indications: Research into social anxiety disorder and cognitive impairment possibilities could broaden the addressable market.

Challenges

- Price and Reimbursement Pressures: Cost containment measures restrict premium pricing.

- Generic Entry Risks: Patent expiry will likely lead to generics, reducing revenue.

- Market Saturation: Established antidepressants maintain entrenched prescribing habits.

- Pricing Competition: Competitors may introduce lower-cost generics or novel agents, intensifying price competition.

Sales Projections (2023–2030)

Short to Mid-Term Outlook (2023–2025)

In the immediate future, sales are expected to stabilize around USD 600–750 million annually, with growth driven by increased adoption in the U.S. and Europe. The Asia-Pacific market presents growth potential, albeit with regional regulatory hurdles.

Based on current market penetration rates and physician prescribing trends, a conservative CAGR (Compound Annual Growth Rate) of 3–5% is projected through 2025. The launch of expanded indications and payer coverage enhancements could accelerate this.

Long-Term Outlook (2026–2030)

Post-patent expiry (anticipated around 2026 in major markets), significant revenue decline is probable due to generic competition. However, strategic measures—such as formulation improvements, digital health integration, and clinical trial expansion—may prolong market relevance.

Assuming successful mitigation strategies, sales may decline gradually to approximately USD 350–500 million by 2030, representing a CAGR of roughly -4% to -7% from peak levels.

Factors Influencing Sales Trajectory

- Patent Expiry & Generics: Anticipated in 2026, likely causing a sharp decline unless extended through formulations or indications.

- Market Penetration & Physician Adoption: Continued emphasis on cognitive benefits and tolerability can sustain growth.

- Regulatory and Reimbursement Factors: Favorable policies can expand access, boosting sales.

- Pipeline Development: New formulations or combination therapies could generate alternative revenue streams.

Strategic Opportunities

- Pipeline Expansion: Developing new formulations, such as sustained-release or combination products, could extend lifecycle.

- Digital & Remote Monitoring: Integrating with digital health platforms enhances patient adherence and engagement.

- Geographic Diversification: Accelerating market entry in underpenetrated regions like Asia and Latin America offers growth prospects.

- Biomarker and Personalized Medicine: Tailoring treatments based on genetic profiles can optimize efficacy and prescription rates.

Conclusion

TRINTELLIX remains a significant, innovative player in the antidepressant space with a trajectory that reflects a nuanced balance of market opportunities and inherent challenges. While near-term sales are expected to stabilize, long-term prospects depend heavily on patent management, expansion strategies, and healthcare landscape shifts.

Key Takeaways

- Stable Demand: The global depression treatment market sustains steady demand driven by rising prevalence and a preference for tolerable drugs.

- Competitive Landscape: TRINTELLIX’s unique profile offers advantages but faces formidable competition from generics and established agents.

- Patent Cliff Risks: The upcoming patent expiry (2026) presents a critical juncture; proactive strategies can mitigate revenue erosion.

- Growth Opportunities: Expansion into new indications, geographies, and digital health integration can sustain growth beyond patent expiration.

- Strategic Focus: Investing in pipeline development and personalized medicine approaches will be vital for long-term competitiveness.

FAQs

1. When is the patent expiry for TRINTELLIX, and how will it impact sales?

Patent protection is expected to lapse around 2026 in key markets, leading to potential revenue decline due to generic competition unless extended formulations or new indications are introduced.

2. What are TRINTELLIX’s main competitive advantages?

Its unique serotonin modulation mechanism, cognitive benefits, and favorable tolerability profile differentiate it from traditional SSRIs and SNRIs.

3. Which regions offer the highest growth potential for TRINTELLIX?

The United States remains the primary market, but emerging markets in Asia-Pacific and Latin America present significant growth opportunities with expanding healthcare infrastructure.

4. How can Lundbeck and Takeda extend TRINTELLIX’s lifecycle?

Through development of new formulations, indications, digital health integration, and geographic expansion, they can prolong revenue streams.

5. What is the outlook for TRINTELLIX's sales post-2026?

Sales are expected to decline gradually unless strategic initiatives successfully extend market relevance; ongoing innovation and market penetration will be crucial.

Sources

[1] MarketWatch, “Global Depression Treatment Market Forecast,” 2022.

[2] IQVIA, Prescription Data Reports, 2022.

[3] World Health Organization, “Depression and Other Common Mental Disorders,” 2021.

More… ↓