Last updated: July 28, 2025

Introduction

Lisinopril, an angiotensin-converting enzyme (ACE) inhibitor, is widely prescribed for treating hypertension, heart failure, and post-myocardial infarction management. Since its introduction in the early 1990s, lisinopril has established itself as a core component of cardiovascular therapy, underpinned by its proven efficacy and favorable safety profile. Given its longstanding presence in clinical practice and its broad therapeutic indications, understanding the current market dynamics and future sales projections is vital for pharmaceutical companies, investors, and healthcare stakeholders.

Market Overview

Global Market Size and Growth

The global antihypertensive drugs market, which includes lisinopril, was valued at approximately USD 14.5 billion in 2021 and is projected to reach USD 20.2 billion by 2028, with a Compound Annual Growth Rate (CAGR) of around 5.3% over the forecast period (2022-2028) [1]. Lisinopril constitutes a significant share of the ACE inhibitor segment, driven by its substantial prescriptions, cost-effectiveness, and extensive approval portfolio.

Key Markets and Demographics

The primary markets for lisinopril include the United States, Europe, and emerging economies like China and India. The U.S. dominates due to high prevalence rates of hypertension and well-established healthcare infrastructure. According to the American Heart Association, approximately 45% of adults in the U.S. have hypertension, with many prescribed ACE inhibitors like lisinopril [2].

The aging global population, increasing prevalence of cardiovascular disease, and rising awareness of hypertension management are primary drivers fueling demand. Additionally, increased treatment adherence owing to the drug's safety and efficacy profile supports sustained sales.

Market Share and Competitive Landscape

Lisinopril's market share remains robust within the ACE inhibitor class due to its patent expiration in many regions, which facilitated generic formulations. Major generic manufacturers like Teva, Mylan, and Sandoz dominate the market, offering affordable alternatives that have expanded access globally. Nonetheless, branded versions from Pfizer and other pharmaceutical firms retain market segments in certain regions owing to brand recognition and trust.

Market Drivers

-

Prevalence of Hypertension and Cardiovascular Diseases: Rising global hypertension cases directly influence the demand for ACE inhibitors such as lisinopril.

-

Cost-Effectiveness of Generics: Post-patent expiration, generic lisinopril has significantly reduced treatment costs, expanding its use, especially in emerging markets.

-

Clinical Guidelines Endorsement: Prominent cardiology guidelines consistently recommend ACE inhibitors for various cardiovascular conditions, bolstering prescriptions.

-

Broad Therapeutic Indications: Aside from hypertension, lisinopril’s applications in heart failure and post-MI care diversify its market potential.

-

Oral Administration and Good Tolerability: Ease of use enhances patient compliance, further bolstering sales.

Market Challenges

-

Competition from Other Drug Classes: Angiotensin receptor blockers (ARBs) like losartan and newer agents challenge ACE inhibitors in some indications due to differing side-effect profiles.

-

Side Effects: Notable adverse effects, such as cough and hyperkalemia, may limit prescribing in some populations.

-

Regulatory and Patent Dynamics: Patent expiry has led to increased generic options but also heightened price competition.

-

Patient Adherence: Despite efficacy, long-term adherence remains challenging due to side effects or complacency.

Sales Projections: 2023-2030

Methodology

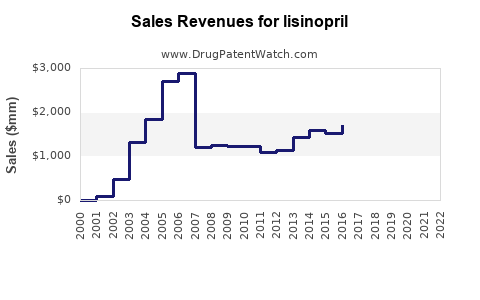

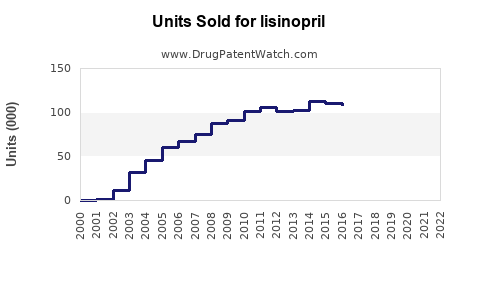

Projections utilize historical sales data, prevalence rates, demographic trends, and pipeline considerations. Market analysts project a steady growth trajectory, primarily driven by expanding hypertension prevalence and increased acceptance in emerging markets.

Projected Sales Trends

| Year |

Estimated Global Sales (USD Billion) |

Growth Rate |

Key Factors |

| 2023 |

1.5 |

3.8% |

Continued generic penetration, new regimens adoption |

| 2024 |

1.55 |

3.3% |

Increased coverage, evolving clinical guidelines |

| 2025 |

1.65 |

6.4% |

Accelerated uptake in Asia-Pacific, aging populations |

| 2026 |

1.78 |

7.3% |

Expansion into emerging markets |

| 2027 |

1.92 |

8.0% |

Broader inclusion in hypertension management plans |

| 2028 |

2.05 |

7.3% |

Market maturity, increased awareness |

| 2029 |

2.20 |

7.3% |

Technological integration, adherence strategies |

| 2030 |

2.36 |

7.3% |

Long-term demand sustains growth |

Note: The projections assume sustained patent off-label off-patent status with stable generic pricing, increased prevalence, and clinical guideline reinforcement.

Regional Breakdown

-

North America: Sales continually increase due to high hypertension prevalence and mature healthcare infrastructure, accounting for approximately 35-40% of global sales.

-

Europe: Similar trends with moderate growth; strict regulations may influence pricing and market penetration.

-

Asia-Pacific: Anticipated to experience the highest CAGR (~8%) due to population growth, urbanization, and expanding healthcare access.

-

Rest of the World: Latin America, Africa, and the Middle East will see increased adoption, driven by policy reforms and increased awareness.

Future Market Dynamics

Pipeline and Product Innovation

While several new antihypertensives have entered the market, lisinopril’s entrenched position ensures it remains a mainstay. However, innovations such as fixed-dose combinations or biosimilars could influence future sales, either by expanding therapeutic options or through price competitiveness.

Regulatory Trends

Regulatory agencies prioritize safety and efficacy, with ongoing evaluations of side-effect profiles. In regions where safety concerns persist about ACE inhibitors, alternative therapies may gain prominence, impacting lisinopril's market share.

Integration with Digital Health

With increasing adoption of digital medicine, adherence programs, and remote monitoring, lisinopril's straightforward regimen could benefit from these trends, potentially improving patient outcomes and sustaining sales.

Key Takeaways

- Stable Market Position: Lisinopril remains a cornerstone in cardiovascular therapy with consistent demand driven by high prevalence rates and clinical endorsements.

- Growth Opportunities: Expanding into emerging markets and integrating digital adherence strategies present significant growth avenues.

- Competitive Pressures: The increased availability of generics and alternatives like ARBs necessitate strategic positioning and potential differentiation.

- Price Sensitivity: Appropriateness of pricing and formulary inclusion in healthcare systems directly influence sales trajectories.

- Pipeline and Innovation: Ongoing research into combination therapies and biosimilars may reshape future market dynamics.

Concluding Remarks

Lisinopril’s market outlook remains favorable over the next decade, buoyed by global demographic shifts and continued reliance in hypertension and heart failure management. Stakeholders leveraging its cost-effectiveness, widespread acceptance, and the scope to integrate new health technologies will likely sustain its market presence. Nevertheless, vigilant monitoring of regulatory, competitive, and clinical developments is essential for strategic planning.

FAQs

Q1: What is the expected impact of generic versions of lisinopril on future sales?

A1: Generic versions significantly reduce treatment costs, expanding accessibility and potentially increasing overall sales volume, despite pressure on unit pricing. They also contribute to wider adoption in emerging markets.

Q2: How does lisinopril compare to ARBs in the hypertension treatment landscape?

A2: While both classes effectively lower blood pressure, ARBs generally have fewer side effects like cough. However, lisinopril remains widely prescribed due to its efficacy, affordability, and clinical guideline endorsement.

Q3: What are the primary driving factors for lisinopril sales in Asia-Pacific?

A3: Demographic shifts, rising hypertension prevalence, improving healthcare access, and government policies promoting affordable treatment options are key drivers.

Q4: Could pipeline innovations threaten lisinopril's market share?

A4: Biosimilars, combination therapies, and novel agents could challenge lisinopril, but its established safety profile and cost advantages offer continued competitiveness.

Q5: How might digital health interventions influence lisinopril sales?

A5: Digital adherence tools and remote monitoring can improve compliance, leading to better outcomes and sustained demand for lisinopril as a first-line therapy.

Sources

[1] MarketWatch. (2022). Antihypertensive Drugs Market Size, Share & Trends Analysis Report

[2] American Heart Association. (2021). Hypertension Prevalence and Control Trends.