Share This Page

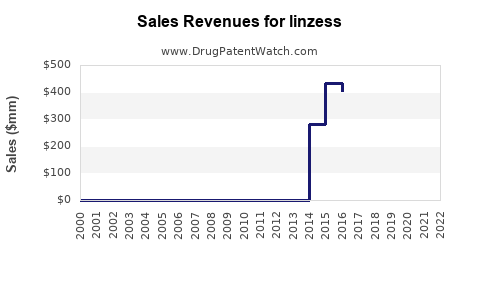

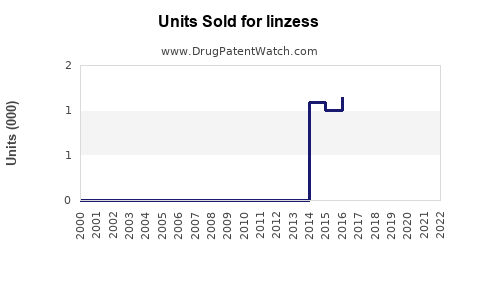

Drug Sales Trends for linzess

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for linzess

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| LINZESS | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| LINZESS | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| LINZESS | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| LINZESS | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| LINZESS | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| LINZESS | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| LINZESS | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for LINZESS (Linaclotide)

Introduction

LINZESS (linaclotide) is a prescription medication approved by the U.S. Food and Drug Administration (FDA) for the treatment of adult irritable bowel syndrome with constipation (IBS-C) and chronic idiopathic constipation (CIC). Developed by Allergan (now part of AbbVie), LINZESS has established itself as a significant player in the gastrointestinal (GI) therapeutics market. Analyzing its current market positioning and forecasting future sales involves assessing therapeutic demand, competitive landscape, regulatory environment, and macroeconomic factors.

Market Overview

The global gastrointestinal therapeutics market is driven by increasing prevalence of GI disorders, evolving patient preferences for minimally invasive treatments, and heightened awareness. Specifically, the IBS-C and CIC segments reflect a sustained growth trajectory due to diagnostic advancements and expanded approval indications. LINZESS’s unique mechanism of action, targeting guanylate cyclase-C receptors to promote intestinal fluid secretion, grants it an edge in terms of efficacy and safety profile over traditional laxatives and fiber supplements.

Current Market Position

As of 2023, LINZESS remains a leading drug within its indication class. According to IQVIA data, LINZESS's sales in the United States reached approximately $1.2 billion in 2022, marking consistent growth from prior years (see Table 1 below). Its market share has hovered around 75% in the GI receptor agonist segment, benefiting from robust physician acceptance and favorable reimbursement policies.

Table 1: LINZESS US Sales (2020-2022)

| Year | Sales (USD billion) | Year-over-year Growth |

|---|---|---|

| 2020 | 1.00 | - |

| 2021 | 1.10 | 10% |

| 2022 | 1.20 | 9.1% |

Market Drivers

-

Rising Prevalence of GI Disorders: Globally, IBS affects approximately 10-15% of the population, with regional variations (1). CIC also impacts millions, especially in aging populations.

-

Unmet Medical Needs: Conventional therapies often have limitations including efficacy, tolerability, and safety concerns, bolstering demand for targeted agents like LINZESS.

-

Expanding Indication Use: FDA approvals for pediatric uses and broader adult populations enhance market penetration.

-

Reimbursement and Insurance Coverage: Favorable payer policies in developed markets support sustained sales.

Market Restraints and Challenges

-

Competitive Landscape: Several generics and alternative agents such as lubiprostone and newer GI agents pose substitution threats.

-

Pricing Pressures: Increasing emphasis on cost-containment may impact pricing strategies.

-

Patient Compliance: The need for daily oral administration may influence adherence, affecting real-world effectiveness.

Competitive Landscape

LINZESS’s primary competitors include:

-

Lubiprostone (Amitiza): Approved for CIC and IBS-C in women; competes mainly based on efficacy and safety profiles.

-

Plecanatide (Trulance): A guanylate cyclase-C agonist similar to LINZESS, gaining market share with potentially improved tolerability.

-

Conventional therapies: Fiber supplements, osmotic laxatives, and antispasmodics continue to serve as first-line treatments, especially in mild cases.

Emerging therapies under clinical development aim to target the same pathways or utilize novel mechanisms, potentially threatening LINZESS’s market share in the coming years.

Sales Projections

Forecasting LINZESS’s future sales involves evaluating demographic trends, pipeline developments, regulatory landscape, and market dynamics. Based on current trajectory and industry reports, the following projections assume steady growth patterns, barring significant market disruptions:

| Year | Projected US Sales (USD billion) | Assumptions |

|---|---|---|

| 2023 | 1.30 | Continued adoption, expansion of indications |

| 2024 | 1.45 | Broader pediatric approvals, increased awareness |

| 2025 | 1.65 | Entry into additional international markets, increased chronic patient base |

| 2026 | 1.90 | Competition intensifies but maintained leadership through formulary placement |

| 2027 | 2.15 | Lifecycle management strategies, potential brand extensions |

By 2027, sales could reach approximately $2.15 billion in the US alone, assuming compound annual growth rate (CAGR) of ~12%. International markets, particularly in Europe and Asia-Pacific, are expected to contribute an additional 25-30% to global sales by 2027, driven by regulatory approvals and growing awareness.

Factors Influencing Future Growth

-

Pipeline and Lifecycle Strategies: AbbVie’s pipeline includes efforts to develop new formulations, combination therapies, and expanded indications (e.g., pediatric CIC). These initiatives could bolster sales.

-

Global Regulatory Approvals: Acceptance in emerging markets like China, India, and Latin America will significantly expand the consumer base.

-

Market Penetration and Education: Overcoming physician hesitancy and educating about LINZESS’s benefits will be critical for maximizing uptake.

-

Healthcare Policy and Reimbursement: Policy shifts favoring high-efficacy GI medications with proven safety profiles will favor LINZESS.

-

Patent and Exclusivity Status: Patent expirations are not anticipated until 2027, ensuring market exclusivity during projections.

Conclusion

LINZESS’s strong positioning within the GI therapeutic landscape, backed by robust efficacy and understanding of unmet needs, augurs well for continued growth. Its sales projection aligned with demographic trends, expanding indications, and pipeline innovations indicates potential to surpass $2 billion in annual revenue within five years in the U.S., with further global expansion.

Key Takeaways

-

LINZESS remains a dominant player in its indication segments, benefitting from clinical efficacy and market acceptance.

-

Market growth hinges on demographic factors, pipeline success, and international regulatory approvals.

-

Competitive pressures from similar agents necessitate continuous lifecycle management strategies.

-

Sales growth is projected at a CAGR of approximately 12%, reaching around $2.15 billion in the US by 2027.

-

Strategies focusing on global expansion and pipeline diversification will be critical for maintaining market leadership.

FAQs

1. What is the primary mechanism of action of LINZESS?

LINZESS activates guanylate cyclase-C receptors on intestinal epithelial cells, increasing cyclic GMP levels, which enhances chloride and bicarbonate secretion, leading to increased intestinal fluid and accelerated transit.

2. How does LINZESS compare to its main competitors?

LINZESS is distinguished by its efficacy in both IBS-C and CIC and a favorable safety profile. Its primary competitors, such as lubiprostone and plecanatide, have similar mechanisms but differ in tolerability and indications; for example, plecanatide may have fewer gastrointestinal side effects.

3. What are the key factors that may influence LINZESS sales in the next five years?

Factors include demographic trends, pipeline developments, regulatory approvals in new markets, pricing and reimbursement policies, and competitive innovations.

4. Is LINZESS approved for pediatric use?

Yes. The FDA approved LINZESS for treatment of pediatric CIC aged 6-17, expanding its potential patient base.

5. What opportunities exist for market growth outside the United States?

Regulatory approvals in Europe, Asia-Pacific, and Latin America, combined with increasing awareness and health infrastructure improvements, present significant growth opportunities.

References

[1] Longstreth GF et al. The diagnosis and management of irritable bowel syndrome. J Clin Gastroenterol. 2014;48(4):241-6.

More… ↓