Last updated: July 28, 2025

Introduction

Fenofibrate, a lipid-lowering medication primarily prescribed for hypertriglyceridemia and dyslipidemia, has maintained a critical position within the cardiovascular therapeutic landscape. As metabolic disorders surge worldwide, market dynamics for fenofibrate reveal complex patterns driven by regulatory environments, patent landscapes, healthcare trends, and demographic shifts. This analysis examines current market conditions and forecasts fenofibrate sales, emphasizing factors influencing future growth, competition, and commercial opportunities.

Global Market Overview

Current Market Size

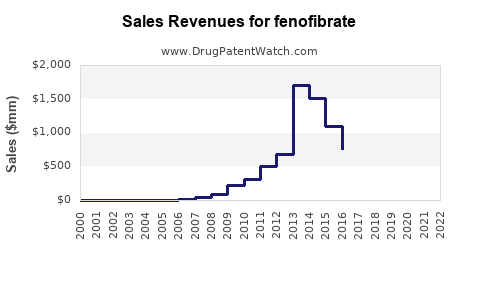

The global fenofibrate market was valued at approximately USD 1.1 billion in 2022. North America dominates, accounting for nearly 45% of sales, driven by high prevalence of hyperlipidemia, widespread healthcare infrastructure, and extensive adoption of lipid-lowering therapies. Europe follows, with an estimated 25% share, and the Asia-Pacific region exhibits the fastest growth, projected at a CAGR exceeding 8% from 2023 to 2030, propelled by increasing awareness and rising cardiovascular disease (CVD) burden.

Market Segmentation

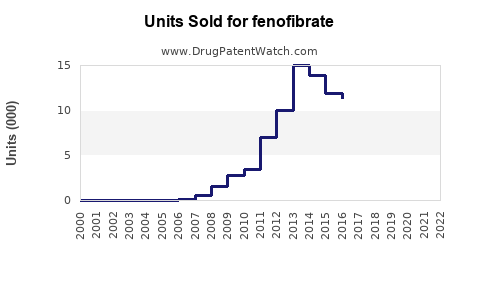

Fenofibrate is available both as brand-name products (e.g., TriCor, Fenoglide, Antara) and generics. The market segmentation shows generics comprising roughly 70% of sales, reflecting patent expiries, while branded formulations maintain premium pricing in developed markets. The shift to generics intensifies price competition but expands accessibility.

Drivers and Restraints

Drivers:

- Rising Prevalence of Dyslipidemia: The growing global incidence of cardiovascular risk factors, including obesity, diabetes, and metabolic syndrome, fuels demand for lipid management therapies, including fenofibrate.

- Expanded Indications: Recent research suggests potential benefits of fenofibrate in conditions like diabetic retinopathy and non-alcoholic fatty liver disease (NAFLD), broadening its utility.

- Generic Market Penetration: Patent expiries have unlocked cost-effective options, spurring usage in emerging markets and increasing overall consumption.

Restraints:

- Evolving Treatment Guidelines: Elevated concerns over potential adverse effects (e.g., muscle toxicity, hepatic concerns) have led to more conservative prescribing practices.

- Availability of Alternatives: Statins remain the first-line therapy; fenofibrate faces competition from newer fibrates and novel lipid-modifying agents like PCSK9 inhibitors.

- Regulatory Challenges: Variability in approval and labeling across countries might influence market penetration.

Regional Market Dynamics

North America

The U.S. maintains dominance due to high lipid disorder prevalence, favorable reimbursement policies, and a mature healthcare setup. The market is expected to grow modestly at a CAGR of 3-4% through 2030, driven by a combination of generic sales and occasional innovations in formulation.

Europe

European markets exhibit similar trends, with gradual growth aligned with demographic aging and heightened cardiovascular risk awareness. Reimbursement policies and evolving clinical guidelines temper accelerated growth.

Asia-Pacific

This region exhibits the highest growth potential, with a CAGR exceeding 8% from 2023 to 2030. Factors include rising urbanization, Westernization of diets, increasing screening programs, and expanding healthcare infrastructure. China and India contribute significantly, with increased approval and adoption of fenofibrate-based generics.

Latin America & Middle East & Africa

Market expansion is driven by improving healthcare access and growing incidence of metabolic syndromes. However, affordability remains a key challenge impacting actual sales volumes.

Sales Projections (2023-2030)

Baseline Scenario

Considering current growth trends, patent expiries, and regional adoption rates, global fenofibrate sales are projected to reach approximately USD 1.8 billion by 2030, representing a CAGR of around 6%. Asia-Pacific is anticipated to emerge as the fastest-growing segment, driven by increased generic penetration and healthcare infrastructure development.

Optimistic Scenario

An accelerated adoption driven by expanded indications, aggressive marketing of generic formulations, and supportive guideline updates could elevate sales to USD 2.3 billion by 2030, with a CAGR hovering near 8%.

Conservative Scenario

Regulatory hurdles, market saturation, or shifts toward alternative therapies could constrain growth, capping sales at around USD 1.5 billion, with a CAGR below 4%.

Competitive Landscape

Major players include AbbVie, Mylan, Teva, and Sun Pharma, with competitive pricing and broad distribution networks. Patent expiries for key formulations in the late 2010s have catalyzed generic proliferation. Innovations in drug delivery (e.g., sustained-release formulations) and combination therapies may influence future market shares.

Emerging Trends

- Formulation Innovations: Lipid nanoparticle delivery systems and combination pills with statins aim to improve patient adherence.

- Pharmacogenomics: Personalized medicine approaches could optimize patient selection, potentially expanding usage.

- Regulatory Approaches: Countries focusing on non-communicable disease control and drug affordability will impact fenofibrate market access and sales.

Key Factors for Investors and Stakeholders

- Patent and Regulatory Status: Vigilance on patent cliffs and regional approval differences influences market entry timings.

- Healthcare Policy and Reimbursement: Favorable policies promote adoption, while cost-containment measures may suppress sales.

- Demographics: Aging populations and rising metabolic disorders constitute long-term growth drivers.

- Competition: Differentiation through formulations and indications is critical as generic availability increases.

Key Takeaways

- Fenofibrate's global market is poised for steady growth, with Asia-Pacific leading due to demographic and healthcare expansion.

- Market expansion hinges on regulatory approvals, evolving clinical guidelines, and innovative formulations.

- The aging population and rising metabolic syndrome incidence will sustain long-term demand.

- Patent expiries have catalyzed the proliferation of generics, intensifying price competition but broadening access.

- Strategic focus on expanding indications and optimizing formulations can unlock new revenue streams.

FAQs

1. How will patent expirations influence fenofibrate sales?

Patent expirations have facilitated the entry of generic competitors, leading to price reductions and increased accessibility. While this may reduce per-unit profit margins for brand-name manufacturers, total sales volume often rises, promoting overall market growth.

2. What alternative therapies compete with fenofibrate in lipid management?

Statins remain the first-line agents. Newer fibrates, omega-3 fatty acids, and emerging therapies like PCSK9 inhibitors offer alternative or adjunct options, potentially impacting fenofibrate's market share.

3. Are there new indications expanding fenofibrate’s clinical use?

Research suggests benefits in diabetic retinopathy and NAFLD, yet these are still under investigation. Approval for such indications could further propel sales.

4. Which regions offer the highest growth potential for fenofibrate?

The Asia-Pacific region demonstrates the highest growth prospects due to increasing metabolic disorders, healthcare infrastructure development, and supportive regulatory environments.

5. How do regulatory uncertainties affect the fenofibrate market?

Differences in national regulatory environments can delay approvals or alter labeling, impacting market penetration and sales. Harmonization efforts can mitigate these effects.

References

- MarketsandMarkets. "Lipid-Lowering Drugs Market by Drug Class, Distribution Channel, and Region," 2022.

- GlobalData Healthcare. "Fenofibrate Market Outlook," 2023.

- Pfizer Annual Report 2022.

- European Medicines Agency. "Approved Lipid-Lowering Drugs," 2022.

- World Health Organization. "Cardiovascular Diseases Fact Sheet," 2022.

Conclusion

Fenofibrate remains a vital component of lipid management, with a favorable outlook driven by demographic trends, expanding indications, and increasing global access to generic formulations. While competition and regulatory shifts pose challenges, strategic innovation and market expansion efforts position fenofibrate for steady growth through 2030. Stakeholders should monitor regional developments, evolving guidelines, and technological advancements to capitalize on emerging opportunities.