Last updated: July 28, 2025

rket Analysis and Sales Projections for Dexamethasone

Introduction

Dexamethasone, a synthetic glucocorticoid, is widely utilized for its anti-inflammatory and immunosuppressant properties. Its versatile applications span a range of therapeutic areas, including oncology, autoimmune diseases, allergic reactions, and COVID-19-related respiratory complications. As one of the most established corticosteroids, dexamethasone’s market dynamics are shaped by medical advancements, regulatory landscapes, and shifting clinical guidelines. This report provides a comprehensive market analysis and sales projections to aid stakeholders in assessing revenue potential and strategic positioning.

Market Overview

Global Market Size and Growth Trends

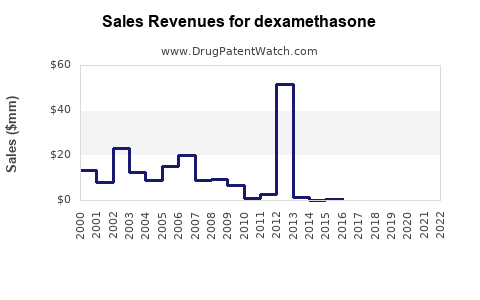

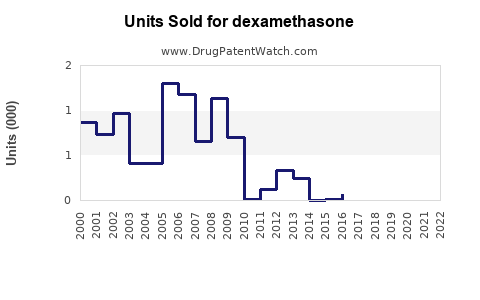

The global dexamethasone market was valued at approximately USD 800 million in 2022. It is projected to grow at a compound annual growth rate (CAGR) of 4.0% from 2023 to 2030, driven by increasing prevalence of target diseases, expanded therapeutic indications, and ongoing research into novel formulations. The market's primary segments include pharmaceuticals for clinical use, biosimilars, and veterinary applications.

Key Drivers

- Expanding therapeutic indications: The utilization of dexamethasone in treating COVID-19, especially post-RECOVERY trial findings demonstrating reduced mortality in severe cases, significantly expanded its usage (RECOVERY Collaborative Group, 2020).

- Rising chronic diseases: Autoimmune disorders such as rheumatoid arthritis, lupus, and asthma are becoming more prevalent globally, fueling demand.

- Growing geriatric population: Elderly demographics are more susceptible to conditions requiring corticosteroid therapy.

Market Constraints

- Price and reimbursement pressures: Governmental and insurance reimbursement policies influence market penetration.

- Side-effect profile: Long-term corticosteroid toxicity limits chronic use, impacting sales in some indications.

- Generic competition: The availability of low-cost generics suppresses prices and margins.

Regulatory Status

Dexamethasone’s patent expiry in several regions has facilitated proliferation of generic versions, reducing costs and widening access. Regulatory agencies, including the FDA and EMA, continue to approve new formulations and indications, enhancing market prospects.

Market Segmentation

By Application

- Oncology (e.g., lymphoma, leukemia)

- COVID-19 respiratory therapy

- Autoimmune disorders (e.g., rheumatoid arthritis, multiple sclerosis)

- Allergic reactions and dermatology

- Endocrinology (adrenal insufficiency)

- Veterinary medicine

By Formulation

- Injectable preparations (e.g., dexamethasone phosphate)

- Oral tablets and solutions

- Topical formulations

- Suspensions and ophthalmic solutions

By Region

- North America (largest share, driven by COVID-19 and autoimmune diseases)

- Europe (steady growth, extensive clinical applications)

- Asia-Pacific (rapid expansion, increasing healthcare infrastructure)

- Latin America and Middle East & Africa (emerging markets with growing access to corticosteroids)

Competitive Landscape

The market hosts several key players, predominantly generic pharmaceutical companies, including:

- Teva Pharmaceuticals

- Mylan (now part of Viatris)

- Sun Pharmaceutical Industries

- Pfizer

- Sandoz (Novartis)

Emerging manufacturers focus on novel delivery mechanisms, such as sustained-release formulations and novel ophthalmic preparations, to differentiate offerings.

Strategic Trends:

- Mergers and acquisitions aim to consolidate market share.

- Investment in biosimilars and advanced formulations to improve patient compliance.

- Expansion into emerging markets to capitalize on unmet needs.

Sales Projections (2023–2030)

2023-2025:

Post-pandemic normalization influences the market, with moderate growth driven by sustained use in COVID-19 and increased autoimmune disease management. Sales are projected to reach approximately USD 1.05 billion by 2025, reflecting a CAGR of around 4%.

2026-2030:

Growth accelerates as new indications emerge, particularly in oncology and neuroinflammation, supported by ongoing clinical trials. Sales are forecasted to approach USD 1.35 billion by 2030, with a CAGR of approximately 4.5%. The adoption of cost-effective generics in developing regions will be pivotal in expanding access and sales volume.

Key Regional Insights:

- North America will continue to lead sales, especially in COVID-19 management and oncology.

- Asia-Pacific will experience the fastest growth rates, largely driven by increasing healthcare investment and rising disease prevalence.

- Europe’s growth will remain steady, benefiting from stable healthcare infrastructure and regulatory approval of new formulations.

Market Opportunities and Challenges

Opportunities

- Expanding into emerging markets with rising healthcare spending.

- Developing combination therapies involving dexamethasone to enhance efficacy.

- Innovating delivery systems to optimize patient adherence and reduce side effects.

- Leveraging data from COVID-19 research to promote broader indications.

Challenges

- Regulatory hurdles in approval of new formulations.

- Managing long-term toxicities and side-effect profiles.

- Competition from biosimilars and alternative corticosteroids.

- Achieving cost-effectiveness amidst price pressures.

Conclusion

Dexamethasone’s market remains robust, buoyed by its broad therapeutic applications and expanded indications amid the COVID-19 pandemic. The global outlook indicates steady growth, with considerable opportunities in emerging regions and specialty applications. Strategic investments in formulation innovation and market expansion will be essential for stakeholders aiming to maximize sales potential in this mature yet evolving market.

Key Takeaways

- The global dexamethasone market is expected to grow at a CAGR of approximately 4.0%–4.5% through 2030, driven by increased clinical use and expanding indications.

- Post-pandemic reliance on dexamethasone for COVID-19 treatment sustains near-term demand, with long-term prospects hinging on new therapeutic applications.

- Generic competition is intensifying, emphasizing the importance of formulation differentiation and strategic market expansion.

- Emerging markets in Asia-Pacific and Latin America present significant growth opportunities fueled by rising healthcare access and disease prevalence.

- Ongoing regulatory developments and concerns over side effects necessitate continual innovation and efficacy enhancements.

FAQs

1. How has COVID-19 influenced the demand for dexamethasone?

The RECOVERY trial’s findings in 2020 demonstrated dexamethasone’s efficacy in reducing mortality in severe COVID-19 cases, rapidly increasing its demand and establishing it as a standard supportive treatment (RECOVERY Collaborative Group, 2020). This surge elevated global sales, with pandemic-driven demand sustaining through 2022.

2. What are the key therapeutic indications for dexamethasone?

Dexamethasone is primarily used in oncology, autoimmune diseases, allergic reactions, and neurological conditions. Its use in COVID-19 respiratory therapy also represents a significant recent application.

3. What are the main competitive threats in the dexamethasone market?

The primary threats include generic price competition, the potential emergence of biosimilars, and the development of alternative corticosteroids. Regulatory challenges and side-effect profiles also influence market dynamics.

4. Which regions present the most growth potential for dexamethasone?

The Asia-Pacific region is poised for the highest growth rates owing to increasing healthcare infrastructure and disease burden. Latin America and Middle Eastern markets also offer expanding opportunities due to rising healthcare access.

5. What innovations could influence the future sales trajectory of dexamethasone?

Development of novel delivery systems (e.g., sustained-release injections), combination therapies, and targeted formulations aimed at reducing side effects are key innovation areas that could enhance future sales.

References

[1] RECOVERY Collaborative Group. (2020). Dexamethasone in hospitalized patients with Covid-19. The New England Journal of Medicine, 384(8), 693–704.