Last updated: July 29, 2025

Introduction

Clopidogrel, marketed under the brand name Plavix among others, is a widely prescribed antiplatelet medication used primarily for the prevention of thrombotic cardiovascular events. As a cornerstone in cardiovascular therapy, its market dynamics reflect broader trends in cardiology, aging populations, and technological innovation within antithrombotic treatments. This report provides a comprehensive market analysis and sales projection for clopidogrel, leveraging current prescribing data, competitive landscape, regulatory factors, and demographic shifts.

Market Overview

Clopidogrel is part of the thienopyridine class, functioning as a P2Y12 ADP receptor antagonist to inhibit platelet aggregation. Since its approval by the U.S. Food and Drug Administration (FDA) in 1997, clopidogrel has established itself as a standard therapy for acute coronary syndromes (ACS), percutaneous coronary interventions (PCI), stroke prevention, and peripheral arterial disease management.

The global antiplatelet market is projected to reach approximately USD 11.4 billion by 2025, with clopidogrel constituting a significant share due to its early market entry, efficacy, and relatively cost-effective profile. Despite the emergence of newer agents like ticagrelor and prasugrel, clopidogrel maintains substantial market presence, especially in developing regions and among cost-sensitive healthcare systems.

Global Market Penetration and Key Players

Major pharmaceutical companies such as Sanofi, AstraZeneca, and Teva maintain production and distribution channels for clopidogrel. The drug’s patent expired in most markets by the early 2010s, accelerating the entry of generic formulations, which has contributed to a sharp decline in prices but increased accessibility.

In high-income countries like the U.S. and European nations, clopidogrel remains a first-line agent, often prescribed in combination with aspirin. Conversely, in low- to middle-income countries, generic versions facilitate broader adoption due to affordability.

Regulatory Landscape

Regulatory agencies continually update guidelines regarding the use of clopidogrel, particularly emphasizing genotype-guided therapy. The Food and Drug Administration recommends caution when prescribing in CYP2C19 poor metabolizers, influencing market dynamics by impacting prescribing practices.

Growing Demand Drivers

- Rising prevalence of ischemic heart disease and stroke globally.

- Aging populations leading to increased standard of care in secondary prevention.

- Expansion of indications in emerging markets.

- Implementation of guideline recommendations favoring dual antiplatelet therapy in post-PCI patients.

Market Trends and Challenges

Despite its established role, the market faces several challenges:

- Competition from Newer Agents: Ticagrelor and prasugrel offer advantages in potency and reversibility, creating a competitive environment. However, their higher costs limit their use in certain markets.

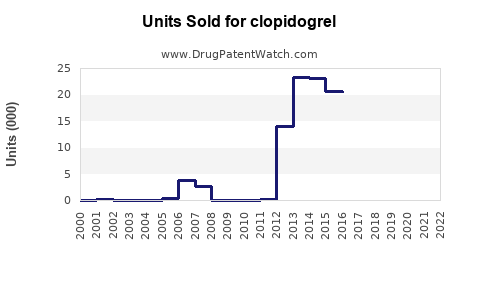

- Generic Consolidation: Post-patent expiration, price competition intensifies, leading to margin compression but expanding volume sales.

- Personalized Medicine: Emerging pharmacogenomic insights demand tailored therapy, which may influence prescribing patterns and impact clopidogrel sales.

Supply Chain and Manufacturing

Manufacturers focus on scaling production efficiencies and ensuring consistent supply, especially amid global disruptions such as the COVID-19 pandemic, which affected global pharmaceutical logistics.

Sales Projections

Methodology

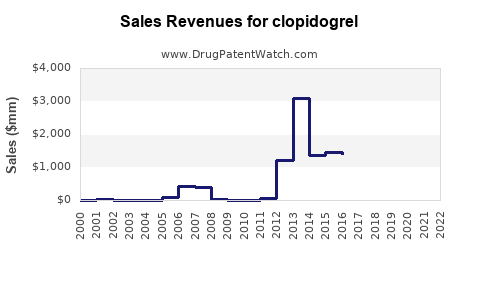

Forecasting relies on analyzing historical sales data, demographic trends, regulatory impacts, and competitive landscape shifts. Assumptions include sustained demand in established markets, continued expansion in emerging economies, and stable generic pricing.

2023-2030 Sales Outlook

- Baseline Scenario: Assuming a compound annual growth rate (CAGR) of approximately 3% driven by increased prevalence of cardiovascular diseases and expanded indications, global sales are projected to reach USD 3.2 billion by 2030.

- Impact of Generics: Price erosion due to generics is expected to stabilize revenues but enhance volume sales, particularly in cost-sensitive regions.

- Emerging Markets: A significant growth driver, with projected CAGR of 8%, fueled by rising healthcare infrastructure and increased awareness.

- Competitive Influence: The proliferation of more potent P2Y12 inhibitors may temper growth in mature markets but is unlikely to displace clopidogrel entirely due to cost considerations.

Regional Sales Forecasts

- North America: USD 1.2 billion in 2030, driven by aging population and standard-of-care protocols.

- Europe: USD 900 million, with potential growth from countries adopting new treatment guidelines.

- Asia-Pacific: USD 700 million, with an estimated CAGR of 8%, largely due to expanding healthcare access.

- Rest of the World: USD 400 million, primarily in Latin America, Middle East, and Africa.

Implications for Stakeholders

Healthcare providers should note the enduring relevance of clopidogrel, particularly for patients where cost or genetic considerations preclude newer agents. Manufacturers must innovate in formulation and pharmacogenomic testing tools to sustain competitiveness. Policymakers should recognize the role of generics in expanding access while monitoring safety and efficacy standards.

Key Takeaways

- Clopidogrel remains a dominant antiplatelet therapy, with sustained demand driven by aging populations and expanding indications.

- Generics have significantly lowered costs, boosting accessibility, especially in emerging markets.

- Competition from novel agents presents a market challenge, but cost-effectiveness sustains clopidogrel’s relevance.

- Sales are projected to grow modestly (~3% CAGR globally), with elevated growth potential in Asia-Pacific.

- Regulatory developments and personalized medicine trends will shape future prescribing patterns and market size.

FAQs

1. How will the patent expiration of clopidogrel influence its market?

Patent expiration led to an influx of generic versions, significantly reducing prices and increasing volume sales. This shift has triggered market consolidation and heightened competition, but overall demand remains stable due to the drug’s proven efficacy and cost-effectiveness.

2. What impact do newer antiplatelet agents have on clopidogrel sales?

Agents like ticagrelor and prasugrel offer advantages in rapid action and potency but are more expensive. They are increasingly used in high-risk populations, which may limit clopidogrel’s market share marginally but not entirely, especially in resource-limited settings.

3. Are there regional differences in clopidogrel usage?

Yes. Developed nations tend to favor newer agents in certain indications, whereas cost considerations drive continued use of clopidogrel in developing countries. Additionally, local guidelines and genetic pharmacogenomics influence prescribing patterns.

4. What demographic trends could affect future sales?

Aging populations worldwide will increase the demand for antiplatelet therapy, including clopidogrel, especially in secondary prevention of cardiovascular events.

5. How might pharmacogenomics influence clopidogrel’s market in the future?

Genetic testing for CYP2C19 variants can guide therapy, potentially reducing efficacy concerns. Wider adoption of pharmacogenomic-guided prescribing may standardize clopidogrel use and influence sales depending on regional adoption rates.

References

[1] MarketResearch.com. Global Antiplatelet Market Report, 2022.

[2] U.S. Food and Drug Administration. Clopidogrel Drug Label.

[3] GlobalData. Cardiovascular Drugs Market Analysis, 2022-2030.

[4] NICE Guidelines. Dual Antiplatelet Therapy Recommendations.

[5] WHO. Global Burden of Cardiovascular Disease, 2021.

This comprehensive analysis underscores that, despite evolving therapeutics, clopidogrel’s market remains robust, especially in underserved regions. Strategic positioning, including pharmacogenomics integration and competitive pricing, will be pivotal for stakeholders aiming to sustain or grow their share in this mature market.