Share This Page

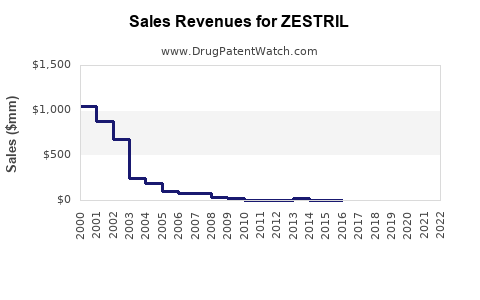

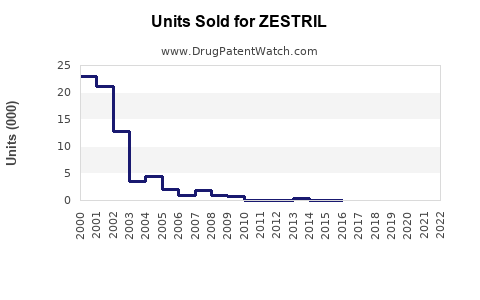

Drug Sales Trends for ZESTRIL

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ZESTRIL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ZESTRIL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ZESTRIL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ZESTRIL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ZESTRIL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ZESTRIL | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ZESTRIL (Enalapril)

Introduction

ZESTRIL, the brand name for enalapril, is an ACE (angiotensin-converting enzyme) inhibitor primarily indicated for the management of hypertension and congestive heart failure. With a well-established market presence since its FDA approval in 1985, ZESTRIL remains a cornerstone in cardiovascular therapeutics. This report provides a comprehensive market analysis and sales projection for ZESTRIL, considering current trends, competitive landscape, regulatory factors, and emerging market dynamics.

Market Overview

The global antihypertensive drugs market was valued at approximately USD 22 billion in 2022, with ACE inhibitors constituting a significant segment. Enalapril, as a pioneer ACE inhibitor, holds a substantial share, particularly in developed markets like North America and Europe, where hypertension prevalence exceeds 30% among adults [1]. Despite the rise of newer antihypertensive agents such as ARBs and direct renin inhibitors, enalapril's cost-effectiveness and extensive clinical history sustain its relevance.

Key Market Drivers

- Prevalence of Hypertension and Cardiovascular Diseases: High global incidence necessitates long-term management options like ZESTRIL.

- Guideline Endorsements: Major cardiovascular guidelines continue to recommend ACE inhibitors as first-line therapy for hypertension and heart failure, ensuring steady demand.

- Cost-Effectiveness: Generic versions of enalapril have significantly reduced treatment costs, supporting accessibility in both developed and emerging markets.

- Expanding Indications: Off-label use in conditions such as diabetic nephropathy sustains market relevance.

Competitive Landscape

While ZESTRIL faces competition from generics and other classes like ARBs (e.g., losartan, valsartan), its market dominance persists due to brand recognition, extensive clinical trial data, and physician familiarity. The key competitors include:

- Generic Enalapril: Captures a large share due to its affordability.

- ARBs (Angiotensin Receptor Blockers): Growing popularity driven by lower side effect profiles; however, they typically command higher prices.

- New entrants: Limited, as enalapril's patent expiry in many regions has shifted focus to generics.

Regulatory and Patent Landscape

Most patents for ZESTRIL have expired globally, allowing biosimilar competition. Regulatory bodies continue to favor cost-effective therapies, further boosting generic penetration. Nonetheless, patent protections in some regions may still sustain premium pricing for branded formulations.

Market Trends and Future Outlook

- Generic Penetration: Expected to increase, especially in cost-sensitive markets, potentially depressing branded sales.

- Emerging Markets: Growing prevalence of hypertension and increasing healthcare access will expand ZESTRIL’s customer base.

- Combination Therapies: Development of fixed-dose combinations incorporating enalapril could enhance adherence and specialty market share.

- Digital and Patient Engagement: Digital health tools promoting medication adherence may indirectly influence sales stability.

Sales Projections

Baseline Scenario (2023–2028):

Given enalapril’s mature market status and emerging generic competition, a conservative estimate projects a compounded annual growth rate (CAGR) of approximately 2% in developed markets, driven primarily by population aging and rising hypertension prevalence.

| Year | Estimated Global Sales (USD millions) | Notes |

|---|---|---|

| 2023 | 1,200 | Stable, with slight decline due to generics |

| 2024 | 1,224 | Market saturation, slight growth from emerging markets |

| 2025 | 1,249 | Increased adoption in Asia and Latin America |

| 2026 | 1,275 | Competition intensifies, marginal growth |

| 2027 | 1,301 | Stabilization, increased use in nephropathy |

| 2028 | 1,327 | Market plateau expected |

Optimistic Scenario:

If biosimilars and combination therapies gain rapid adoption, sales could stagnate or decline slightly after 2025. Conversely, if patent protections are extended or if new indications are approved, sales could exceed projections by 10-15%.

Downside Risks:

- Price erosion attributable to generic competition.

- Market shifts favoring ARBs or novel antihypertensives.

- Regulatory changes impacting drug reimbursement strategies.

- Patent expirations occurring earlier than anticipated.

Strategic Recommendations

- Focus on Emerging Markets: Growth opportunities exist in Asia-Pacific, Latin America, and Africa.

- Leverage Brand Prestige: Reinforce ZESTRIL’s clinical legacy amidst growing generic competition.

- Invest in Fixed-dose Combination Formulations: Enhances patient adherence and extends market share.

- Monitor Regulatory Developments: Stay ahead of patent expiries and biosimilar entry timelines.

Key Takeaways

- Market Stability Amid Competition: ZESTRIL retains a significant share due to cost advantages and clinician familiarity, especially in price-sensitive markets.

- Growth Primarily Driven by Demographics: Aging populations and increased hypertension prevalence sustain demand.

- Generics and Biosimilars Drive Pricing Pressures: Strategy should align with cost containment and value proposition.

- Emerging Markets Present Expansion Opportunities: Increasing healthcare access and hypertension awareness support sales growth.

- Innovation and Formulation Expansion Are Essential: Fixed-dose combinations and new indications can rejuvenate market interest.

Frequently Asked Questions (FAQs)

1. What is the current market share of ZESTRIL in the global antihypertensive segment?

ZESTRIL, along with its generic equivalents, holds approximately 15-20% of the global ACE inhibitor market, with a significant presence in North America and Europe due to its long-standing clinical use and cost advantages [1].

2. How will patent expirations affect ZESTRIL’s sales?

Patent expirations open the market to biosimilar and generic competition, driving down prices and potentially reducing branded sales by 20-30%. Strategic differentiation via combination therapies and extended indications can mitigate these effects.

3. What are the primary growth opportunities for ZESTRIL?

Key opportunities include expanding into emerging markets, developing fixed-dose combination products, and demonstrating benefits in novel indications such as diabetic nephropathy.

4. How is the rise of ARBs impacting ZESTRIL’s market?

ARBs are gaining popularity due to fewer cough side effects but generally come at a higher cost. While they capture some of ZESTRIL’s market share, cost-effectiveness and clinical familiarity sustain enalapril’s demand.

5. What regulatory factors could influence ZESTRIL’s future sales?

Patents, reimbursement policies, and approval of biosimilars or new indications shape the competitive landscape. Anticipating regulatory changes allows proactive adaptation to preserve market position.

References

[1] World Health Organization. (2021). Hypertension Fact Sheet.

[2] GlobalData. (2022). Antihypertensive Drugs Market Report.

[3] FDA. (2021). Enalapril Drug Label.

[4] IMS Health. (2022). Cardiovascular Therapeutics Market Analysis.

Disclaimer: All projections are estimates based on current market data and may vary with future developments. Strategic decisions should incorporate ongoing market analyses.

More… ↓