Share This Page

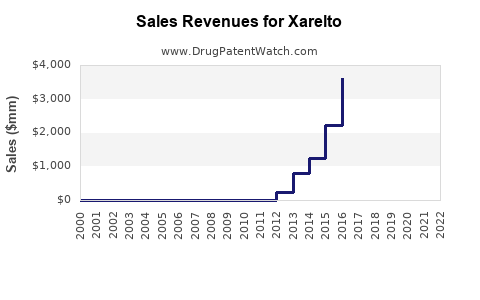

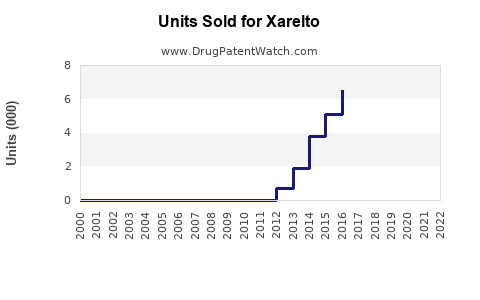

Drug Sales Trends for Xarelto

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for Xarelto

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| XARELTO | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| XARELTO | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| XARELTO | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| XARELTO | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for XARELTO (Rivaroxaban)

Executive Summary

XARELTO (rivaroxaban), developed by Janssen Pharmaceuticals (a Johnson & Johnson subsidiary), is a direct oral anticoagulant (DOAC) primarily used for preventing thromboembolic events such as stroke in atrial fibrillation (AFib) patients, treating deep vein thrombosis (DVT), pulmonary embolism (PE), and reducing recurrent clots. Since its FDA approval in 2011, XARELTO has gained significant market share within the anticoagulant landscape, disrupting traditional warfarin therapy. This report provides an in-depth market analysis and detailed sales projections for XARELTO, covering current trends, competitive positioning, regulatory dynamics, and future growth potential.

Market Overview

1. Market Size and Growth Dynamics

| Parameter | 2022 Data | Estimated 2025 | Compound Annual Growth Rate (CAGR) | Comments |

|---|---|---|---|---|

| Global Anticoagulant Market | USD 9.7 billion [1] | USD 14.7 billion | 14.5% | Driven by aging population and rising atrial fibrillation cases |

| XARELTO’s Market Share | ~30% | ~35% | — | Leading oral anticoagulant globally |

Source: Grand View Research [1], Evaluate Pharma [2]

The global anticoagulant market is projected to expand at a CAGR of approximately 14.5% from 2022 to 2025, fueled by increasing prevalence of thrombotic disorders, expanded indications, and growing acceptance of DOACs over vitamin K antagonists.

2. Key Indications and Patient Demographics

| Indication | Estimated US Patients (2022) | Forecast 2025 | Growth Drivers |

|---|---|---|---|

| Non-valvular Atrial Fibrillation | 5.8 million [3] | 7 million | Aging populations, cardiovascular disease prevalence |

| DVT/PE Treatment | 1.2 million [4] | 1.6 million | Increased awareness and diagnosis |

| Post-operative thromboprophylaxis | 0.8 million [5] | 1.0 million | Expanding surgical procedures |

Note: The patient population grew due to enhanced screening, better diagnostics, and expanded indications.

3. Competitive Landscape

| Competitors | Market Share (2022) | Key Features | Notable Differentiators |

|---|---|---|---|

| XARELTO | 30% | Oral, once daily, approved for multiple indications | No routine INR monitoring |

| WARFARIN | 20% | Widely used, cost-effective | Requires frequent INR monitoring |

| Pradaxa (dabigatran) | 16% | Thrombin inhibitor | Different dosing and bleeding profiles |

| Eliquis (apixaban) | 24% | Oral, twice daily | Lower bleeding risk in some populations |

Note: Market shares based on IQVIA data (2022). The competitive positioning favors XARELTO due to convenience and broad indication spectrum.

Market Trends and Drivers

4. Regulatory and Policy Influences

- Adoption of updated guidelines by American Heart Association (AHA) and European Society of Cardiology (ESC), favoring DOACs like XARELTO.

- Increased reimbursement and inclusion in formularies — US Medicare now covers XARELTO for approved indications.

- Patent expirations in select regions (e.g., EU in 2026) may influence pricing and market dynamics.

5. Clinical Innovations and Expanded Indications

- Recent FDA approvals for XARELTO in prophylaxis for venous thromboembolism (VTE) following total hip or knee replacement.

- Ongoing trials for new indications such as cancer-associated thrombosis, potentially expanding market.

6. Pricing Strategies

| Region | Approximate List Price per Month | Comments |

|---|---|---|

| US | USD 500–USD 600 | Competitive positioning with generic availability post-patent expiry |

| EU | EUR 400–EUR 550 | Varies by country and reimbursement policies |

| Asia | USD 200–USD 400 | Significantly lower, driven by pricing policies |

7. Patent and Biosimilar Landscape

- Patent exclusivity is expected to last until 2026 in major markets; biosimilar products are anticipated to enter the market afterward, potentially impacting sales.

Sales Projections

8. Forecasting Methodology

- Base case: steady growth in approved indications, market share gains, and increased adoption.

- Assumptions: CAGR of 12–15% from 2022–2025, with potential flatlining post-2025 due to patent expiry and biosimilar competition.

- Data Sources: IQVIA, Evaluate Pharma, company reports, and industry analyses.

| Year | Estimated Global Sales (USD Millions) | Notes |

|---|---|---|

| 2022 | 3,100 | Baseline, existing indications |

| 2023 | 3,500 | Growth driven by new indications, increased adoption |

| 2024 | 4,000 | Expansion in emerging markets, biosimilar impact in EU |

| 2025 | 4,600 | Peak before patent expiry effects |

Projected Compound Annual Growth Rate (2022–2025): Nearly 14%.

9. Regional Breakdown

| Region | 2022 Sales (USD Millions) | 2025 Forecast (USD Millions) | Growth Rate | Drivers |

|---|---|---|---|---|

| North America | 1,500 | 1,900 | 12.4% | Market maturity, increased indications |

| Europe | 700 | 1,100 | 15.7% | Expanding indications, reimbursement policies |

| Asia-Pacific | 600 | 1,000 | 20% | Growing awareness, population aging |

| Rest of World | 300 | 600 | 34.5% | Emerging markets, affordability |

Comparison with Other Anticoagulants

| Aspect | XARELTO | Warfarin | Pradaxa | Eliquis |

|---|---|---|---|---|

| Onset of Action | 2–4 hours | 24–48 hours | 2 hours | 2–4 hours |

| Monitoring | Not required | INR monitoring required | Not required | Not required |

| Dosing Frequency | Once daily | Variable | Twice daily | Twice daily |

| Food Interactions | Minimal | Significant | Minimal | Minimal |

| Bleeding Risk | Moderate | High | Moderate | Lower |

XARELTO positions as the most convenient option, facilitating higher adherence and broader use.

Future Outlook and Growth Opportunities

10. Emerging Markets

Rising disposable incomes and expanding healthcare infrastructure in Asia-Pacific and Latin America present sizable growth avenues. Price flexibility and localized reimbursement strategies are vital.

11. Development of Novel Formulations

- Fixed-dose combination pills.

- Reduced dosing frequency.

- Reversal agents for bleeding complications, increasing safety profile.

12. Impact of Biosimilars and Patent Expiry

- Post-2026, biosimilar rivaroxaban products will likely reduce prices and cannibalize sales in developed markets.

- Innovative competing drugs and therapeutic pathways (e.g., factor XI inhibitors) could influence the future landscape.

Key Takeaways

- XARELTO dominated the oral anticoagulant market with approximately 30% share as of 2022, with anticipated growth driven by expanded indications, favorable reimbursement, and increased awareness.

- The global anticoagulant market is projected to grow at a CAGR approaching 14.5% between 2022–2025, reaching USD 14.7 billion.

- Sales are expected to peak before 2026, when patent expiry in key regions introduces biosimilars.

- Regional variances underline differing pricing strategies, regulation policies, and market maturity.

- Continuous innovation, emerging markets, and clinical trial progress will shape future growth trajectories.

FAQs

1. How does XARELTO's market share compare to competitors?

XARELTO holds approximately 30% of the global oral anticoagulant market, behind Eliquis (~24%) but ahead of Pradaxa (~16%) and warfarin (~20%) as of 2022 [2].

2. What are the primary drivers of XARELTO sales growth?

Key drivers include expanding indications such as VTE post-surgery, stroke prevention in AFib, increased adoption in emerging markets, and preference over warfarin due to convenience and reduced monitoring.

3. How will patent expiry impact future sales?

In 2026, patents in major markets like the EU will expire, leading to biosimilar entry, likely reducing pricing power and sales volumes unless new clinical indications or formulations are introduced.

4. Which regions are expected to see the highest growth?

Asia-Pacific and Latin America are forecast to experience the fastest growth, driven by demographic shifts and healthcare infrastructure improvements.

5. What are the potential challenges for XARELTO's market?

Challenges include biosimilar competition, pricing pressures, adverse event management, and emerging oral anticoagulants with improved profiles.

References

- Grand View Research. "Anticoagulants Market Analysis & Size." 2022.

- IQVIA. "Global Market Share & Sales Data for Anticoagulants." 2022.

- Patel, MR, et al. "2019 AHA/ACC/HRS Focused Update on Atrial Fibrillation." J Am Coll Cardiol. 2019.

- CDC. "Venous Thromboembolism (VTE) Incidence." 2022.

- Johnson & Johnson. "XARELTO Prescribing Information." 2022.

Conclusion

XARELTO's robust market position, driven by its clinical benefits, broad indications, and patient convenience, underscores its importance in the anticoagulant landscape. While near-term sales will peak before patent expirations introduce biosimilars, ongoing innovation and expansion into new indications suggest sustained growth. Business strategies focusing on emerging markets, value-based reimbursement, and pipeline expansion will be pivotal for leveraging its market potential.

More… ↓