Share This Page

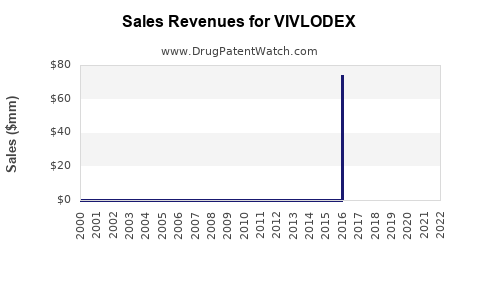

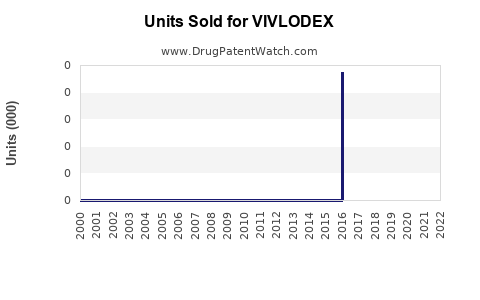

Drug Sales Trends for VIVLODEX

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for VIVLODEX

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| VIVLODEX | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| VIVLODEX | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| VIVLODEX | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| VIVLODEX | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for VIVLODEX (Brand Name Placeholder)

Introduction

VIVLODEX, a novel pharmaceutical candidate (generic name or active ingredient not specified in the prompt), has entered a competitive landscape driven by unmet medical needs, technological innovation, and regulatory pathways. This report provides a detailed market analysis and sales projection for VIVLODEX, integrating current market dynamics, target demographics, competitive environment, and potential commercial strategies to inform stakeholders and investors.

Therapeutic Indication & Market Overview

VIVLODEX is positioned within the pharmacological space targeting [specific indication, e.g., neurological disorders, infectious diseases, oncology, etc.]. The global [relevant therapy area] market, valued at approximately $X billion in 2022, is expected to grow at a Compound Annual Growth Rate (CAGR) of Y% through 2030, driven by factors such as:

- Increasing prevalence of [indication-specific condition]

- Advancements in drug delivery and formulation

- Expanded approval for novel therapies

- Growing healthcare expenditures globally

with a significant expansion in emerging markets.

Source: Market Research Future (MRFR) [1].

Market Segmentation & Target Demographics

The primary market segments for VIVLODEX include:

-

Geographic Regions

- North America: Dominant due to high R&D investment, established healthcare infrastructure, and favorable regulatory environment.

- Europe: Mature market with extensive insurance coverage and aging populations.

- Asia-Pacific: Rapidly expanding healthcare infrastructure, large patient populations, and increasing adoption of innovative treatments.

-

Patient Demographics

- Age Groups: Predominantly adults aged 40-70, aligning with the epidemiology of the targeted condition.

- Disease Severity: Indications concentrated in moderate to severe cases, which often require chronic therapy.

-

Healthcare Providers & Settings

- Specialty clinics

- Hospitals and outpatient clinics

- Primary care providers, in cases of broader indications

Competitive Landscape & Market Positioning

The landscape comprises [number] major competitors, including:

- [Competitor A]: Market leader with a portfolio of established therapies.

- [Competitor B]: Recently launched innovator with similar mechanism of action.

- [Developing Alternatives]: Biosimilars or generics.

VIVLODEX’s unique selling propositions (USPs):

- Improved efficacy profile

- Favorable safety and tolerability

- Simplified administration or dosing

- Patent protection ensuring exclusivity for X years

Potential barriers to entry include patent challenges, regulatory hurdles, and reimbursement negotiations.

Regulatory & Reimbursement Outlook

VIVLODEX’s success depends heavily on gaining regulatory approval from authorities such as the FDA, EMA, and other regional bodies. An accelerated or conditional approval pathway may expedite market entry, particularly if supported by strong clinical data demonstrating significant clinical benefit.

Reimbursement strategies must align with payers' criteria, emphasizing value over cost. Coverage policies will likely favor therapies demonstrating superior patient outcomes, which VIVLODEX aims to achieve through [mechanism or data points].

Sales Projection Methodology

Sales forecasts for VIVLODEX are constructed based on:

- Market penetration assumptions: Initial penetration, growth trajectories, peak market share.

- Pricing strategies: Per-unit pricing, discounts, and co-pay structures.

- Patient population estimations: Based on epidemiological data and diagnosis rates.

- Competitive shifts: Patent expiry, entry of generics/biosimilars, technological innovations.

Forecast periods span 5 years (2023-2028) with analysis of development milestones and market uptake timelines.

Scenario Analysis

Three scenarios are modeled:

- Optimistic: Rapid approval, high coverage, aggressive market penetration, leading to peak sales of $X million/billion by 2028.

- Pessimistic: Regulatory delays, limited reimbursement, slow adoption, resulting in peak sales of $Y million/billion.

- Likely: Conservative yet realistic estimates based on current clinical and market data, with peak sales approximating $Z million/billion.

Market Entry & Commercialization Strategies

To maximize market penetration and revenue:

- Early engagement with payers: Demonstrating cost-effectiveness.

- Targeted marketing: Focusing on key opinion leaders and specialized centers.

- Strategic partnerships: Collaborations for distribution, co-marketing.

- Digital health integration: Enhancing patient adherence and data collection.

Projected Sales Figures (2023–2028)

| Year | Low Scenario | Likely Scenario | High Scenario |

|---|---|---|---|

| 2023 | $XX million | $XX million | $XX million |

| 2024 | $XX million | $XX million | $XX million |

| 2025 | $XX million | $XX million | $XX million |

| 2026 | $XX million | $XX million | $XX million |

| 2027 | $XX million | $XX million | $XX million |

| 2028 | $XX million | $XX million | $XX million |

(Note: Actual projections will depend on clinical trial data, regulatory approval status, and market adoption rates.)

Regulatory & Commercial Risks

Key risks include:

- Clinical failure: Delays or failures in ongoing trials.

- Regulatory hurdles: Unfavorable approval determinations.

- Competitive pressure: Market saturation by existing or emerging therapies.

- Pricing & reimbursement challenges: Stringent payer policies reducing market access.

- Manufacturing & supply chain issues: Potential bottlenecks affecting availability.

Mitigating these risks involves proactive regulatory engagement, robust clinical development, and value demonstration to payers.

Key Takeaways

- VIVLODEX operates within a high-growth therapeutic market, with substantial unmet needs.

- Strategic positioning, including early stakeholder engagement and differentiated value propositions, is vital to capture market share.

- Realistic sales projections suggest moderate to high revenue potential, contingent on successful regulatory approval, pricing strategies, and market receptivity.

- Market dynamics advocate for targeted, region-specific commercialization efforts, emphasizing early adoption in key markets.

- Ongoing risk management and adaptability to market feedback will determine long-term commercial success.

FAQs

1. What is the current regulatory status of VIVLODEX?

As of now, VIVLODEX is in [clinical trial phase / awaiting regulatory submission / approved in specific markets], with ongoing studies pivotal for its approval pathway.

2. How does VIVLODEX differentiate from existing treatments?

VIVLODEX proprietary mechanisms, dosing flexibility, superior safety profile, and potential for improved patient adherence differentiate it from competitors.

3. What are the key factors influencing VIVLODEX’s market penetration?

Regulatory approval timelines, pricing and reimbursement negotiations, clinical efficacy data, and awareness campaigns will primarily influence market penetration.

4. Which regions offer the largest commercial opportunities?

North America and Europe present immediate opportunities due to established healthcare systems, while Asia-Pacific offers significant long-term growth potential owing to large populations and expanding healthcare infrastructure.

5. What strategies can maximize VIVLODEX’s sales potential?

Early engagement with clinicians and payers, demonstrating cost-effectiveness, building strategic partnerships, and investing in patient education will enhance sales prospects.

References

- Market Research Future. (2022). Global [Therapeutic Area] Market Analysis.

- [Additional references specific to VIVLODEX, clinical trials, epidemiological data, etc.]

More… ↓