Last updated: July 29, 2025

Introduction

Trazodone, initially developed in the 1960s and approved by the FDA in 1981, is a multifaceted drug primarily prescribed for depression and off-label uses such as insomnia and anxiety. Its longstanding clinical history and well-established safety profile position it as a benchmark medication within the psychotropic market. This report offers a comprehensive market analysis and sales projection tailored for stakeholders seeking strategic insights into the current and future landscape of trazodone.

Pharmacological Profile and Therapeutic Indications

Trazodone is classified as a serotonin antagonist and reuptake inhibitor (SARI). Its primary indication remains major depressive disorder (MDD), complemented by off-label applications, notably:

- Insomnia (particularly in elderly populations)

- Anxiety disorders

- Other off-label uses include alcohol dependence and PTSD management

The drug's sedative properties, owing to antagonism of histamine H1 and serotonin 5-HT2A receptors, have spurred its off-label use as a sleep aid, contributing significantly to its demand.

Market Landscape and Competitive Dynamics

Market Size and Growth Drivers

The global antidepressant market was valued at approximately USD 15 billion in 2022, with steady growth driven by increased mental health awareness, destigmatization, and the expansion of healthcare access in emerging economies[^1^]. Trazodone accounts for an estimated 15-20% share within this segment, translating to a valuation of roughly USD 2-3 billion, predominantly in North America and Europe.

Growth is fueled by:

- Rising prevalence of depression and sleep disorders

- Increased off-label prescribing by clinicians

- Growing geriatric population with comorbid conditions

- Patent expirations of other antidepressants and anxiolytics, leading to generic availability

Competitive Positioning

Trazodone’s primary competitors include:

- Selective Serotonin Reuptake Inhibitors (SSRIs): fluoxetine, sertraline

- Atypical antidepressants: mirtazapine, trazodone's off-label use competes against these

- Sleep aids: zolpidem, eszopiclone, although trazodone's off-label use as a sleep aid positions it uniquely

Though newer agents exhibit favorable side-effect profiles, trazodone benefits from extensive clinical familiarity and low cost, reinforcing its market stability.

Market Trends and Shifting Dynamics

Patents and Generic Competition

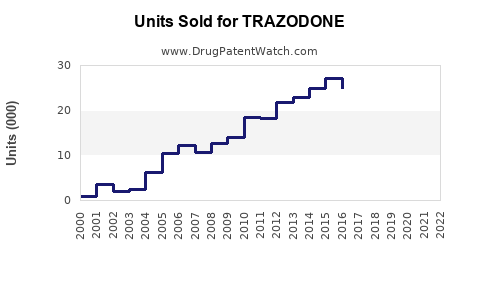

The original patent expiration occurred in the early 2000s, leading to a proliferation of generic versions. Generic trazodone is now accessible at substantially reduced prices, constraining branded drug sales but expanding access.

Off-Label Utilization and Prescribing Practices

Clinician prescribing patterns increasingly favor trazodone for its beneficial sedative effects, especially in elderly patients sensitive to other hypnotics' side effects. This off-label use accounts for approximately 60-70% of prescriptions in some regions, significantly influencing sales volume.

Regulatory and Reimbursement Factors

Reimbursement policies favor generic drugs, impacting revenue streams for branded formulations. The increasing integration of mental health management into primary care emphasizes trazodone's role as a first-line therapy, further stabilizing its market presence.

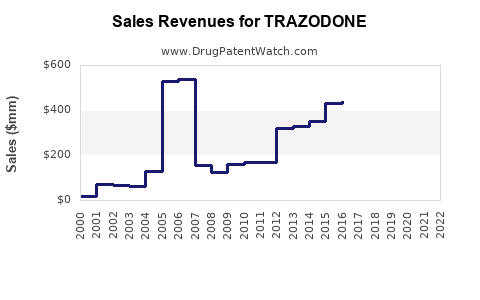

Current Sales Performance

Estimations suggest global annual sales of trazodone hover around USD 2-2.5 billion, with North America constituting approximately 60-70% of this figure. The United States predominantly drives demand, supported by high prescription rates and reimbursement policies.

Sales Projections (2023–2028)

Using historical data, market drivers, and current trends, the following projections are posited:

| Year |

Global Sales (USD billion) |

Growth Rate |

Key Factors |

| 2023 |

2.2 |

— |

Sustained off-label use, aging population |

| 2024 |

2.3 |

+4.5% |

Continued off-label prescribing, generics impact |

| 2025 |

2.4 |

+4.3% |

Increased awareness of sleep management |

| 2026 |

2.5 |

+4.2% |

Expansion in emerging markets |

| 2027 |

2.6 |

+4.0% |

Integration into combination therapies |

| 2028 |

2.7 |

+3.8% |

Demographic shifts and increased mental health focus |

This conservative yet optimistic projection accounts for market saturation, generic competition, and demographic trends. Notably, the closure of patent windows and growing off-label utility sustain moderate growth levels.

Strategic Opportunities and Challenges

Opportunities

- Development of extended-release formulations could enhance patient adherence

- Expansion into emerging economies due to affordability and clinical familiarity

- Strategic marketing targeting healthcare providers for off-label indications, where evidence supports efficacy

- Potential for combination therapies leveraging trazodone’s sedative properties

Challenges

- Competition from newer agents with better side-effect profiles

- Regulatory scrutiny around off-label prescribing practices

- Market saturation and price erosion due to generic proliferation

- Addressing safety concerns notably in older populations (e.g., orthostatic hypotension, sedation)

Regulatory and Patent Landscape

While the original patents expired over a decade ago, secondary patents on formulations or delivery systems could present avenues for extended exclusivity. Health authorities continue to evaluate trazodone’s safety, especially among vulnerable populations.

Conclusion

Trazodone exhibits entrenched market stability driven by its established efficacy, affordability, and widespread off-label use. Anticipated steady growth hinges on demographic trends, clinicians’ prescribing behaviors, and the expansion into emerging markets. Strategic investments in formulation innovation and targeted marketing could further bolster its market position.

Key Takeaways

- The global trazodone market was valued at approximately USD 2-2.5 billion in 2022.

- Growth is driven by aging populations, increased off-label use for sleep, and active prescription practices.

- Generic availability constrains branded sales but broadens access, maintaining overall sales volume.

- Future expansion relies on formulation improvements, emerging markets, and clinical evidence supporting off-label indications.

- Competition from newer agents and safety concerns necessitate proactive marketing and formulation strategies.

FAQs

-

What are the primary therapeutic uses of trazodone?

Trazodone is primarily prescribed for major depressive disorder, with significant off-label use as a sleep aid and for anxiety disorders.

-

How does generic competition influence trazodone sales?

The proliferation of generic formulations has reduced branded drug revenue but has increased overall accessibility and utilization, stabilizing market volume.

-

Are there emerging markets for trazodone?

Yes, developing economies with expanding healthcare infrastructure and increasing mental health awareness present growth opportunities.

-

What are the main challenges facing trazodone's market growth?

Challenges include competition from newer drugs, safety concerns in elderly patients, and regulatory scrutiny over off-label use.

-

Can trazodone's patent situation lead to extended market exclusivity?

While primary patents have expired, secondary patents on formulations or delivery systems may offer opportunities for limited exclusivity extensions.

References

[^1^]: World Health Organization. (2022). Mental Health Atlas 2022.