Share This Page

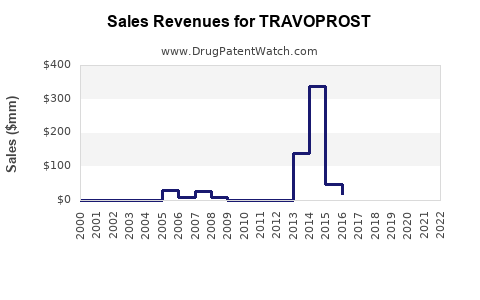

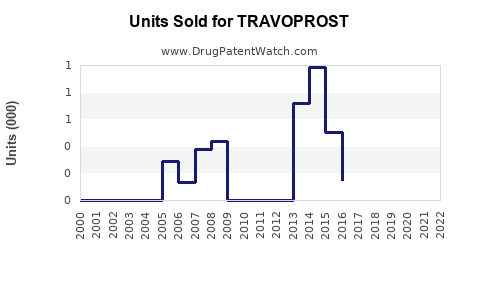

Drug Sales Trends for TRAVOPROST

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for TRAVOPROST

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| TRAVOPROST | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| TRAVOPROST | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| TRAVOPROST | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| TRAVOPROST | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| TRAVOPROST | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| TRAVOPROST | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for TRAVOPROST

Introduction

TRAVOPROST, a prostaglandin analogue used primarily to manage glaucoma and ocular hypertension, has established a significant footprint within the ophthalmic therapeutics sector. As the global burden of glaucoma continues to escalate due to aging populations and increased prevalence of risk factors, the demand for effective intraocular pressure (IOP)-reducing agents like TRAVOPROST is poised to grow. This analysis examines the market landscape, key drivers, competitive dynamics, and revenue outlook for TRAVOPROST over the next five years.

Market Overview

Globally, glaucoma affects roughly 76 million individuals, a number projected to reach 111 million by 2040, emphasizing an urgent need for effective pharmacological interventions[^1^]. TRAVOPROST emerged as a first-line agent following its approval, owing to its efficacy, once-daily dosing, and favorable safety profile.

Currently, the drug is marketed under various brand names, with generic formulations increasing accessibility and driving market expansion. The ophthalmic drug market, valued at approximately USD 24 billion in 2022, is expected to grow at a compound annual growth rate (CAGR) of 4-6%, with specific prominence in the prostaglandin analogue segment.

Key Market Players and Competitive Landscape

Major pharmaceutical companies, including Allergan (now part of AbbVie), Sandoz, and Cipla, manufacture TRAVOPROST formulations. Competition hinges upon certification of bioequivalence, pricing strategies, and regional regulatory approvals. Patent expiration and the proliferation of generics have introduced price competition, impacting profit margins but expanding market size.

Regulatory Environment

Regulatory bodies such as the U.S. FDA and EMA have maintained a conducive environment for ophthalmic generics, streamlining approval processes and fostering market entry. Moreover, expanding indications, such as for ocular surface diseases, could diversify the application spectrum of TRAVOPROST.

Market Segmentation and Geographic Dynamics

1. Geographic Markets

- North America: The dominant market, driven by high glaucoma prevalence, established healthcare infrastructure, and comprehensive insurance coverage.

- Europe: Similar dynamics as North America, with high adoption rates and a mature ophthalmic market.

- Asia-Pacific: The fastest-growing segment, fueled by rising aging populations, increasing disease awareness, and expanding healthcare access—particularly in China, India, and Southeast Asia.

- Latin America and Middle East: Growing markets with increased ophthalmology services and rising chronic disease burden.

2. End-User Segments

- Hospitals and clinics: Primary distribution channels, especially in urban areas.

- Optometry and ophthalmology specialists: Key prescribers for glaucoma management.

- Retail pharmacies: Important in regions with widespread distribution networks and direct-to-consumer sales.

Market Drivers

- Aging Population: The rise in elderly populations correlates with increased glaucoma prevalence[^2^].

- Disease Awareness: Enhanced screening programs and patient education campaigns bolster diagnosis and treatment initiation.

- Product Advantages: Once-daily dosing, favorable side effects profile, and proven efficacy strengthen TRAVOPROST’s position.

- Pricing Strategies: The availability of generics has substantially reduced treatment costs, widening access.

- Regulatory Approvals: Expanded approvals in emerging markets bolster sales scope.

Market Restraints

- Generic Competition: Erosion of patent protections prompts pricing pressures.

- Patent Litigation: Potential patent disputes could limit market exclusivity.

- Price Sensitivity: Especially in low- and middle-income regions, impacting profit margins.

- Emerging Alternatives: New drug classes like rho kinase inhibitors and neuroprotective agents pose competitive threats.

Sales Projections (2023-2028)

Baseline Assumptions

- CAGR: 5.5% (reflective of the prostaglandin market segment, adjusted for regional expansion and generic competition).

- Market penetration: Continuing growth in North America and Europe; rapid expansion in Asia-Pacific.

- Market share: Maintains dominant position among prostaglandin analogues owing to brand recognition and clinician familiarity.

Projected Sales Growth

| Year | Estimated Global Sales (USD million) | Notes |

|---|---|---|

| 2023 | 1,200 | Current baseline, with stable market presence |

| 2024 | 1,270 | Introduction of new formulations in emerging markets |

| 2025 | 1,340 | Increased penetration due to pricing and awareness campaigns |

| 2026 | 1,410 | Further market expansion, particularly in Asia-Pacific |

| 2027 | 1,490 | Possible entry into adjacent indications or combination therapies |

| 2028 | 1,580 | Maturation of market growth and increased adoption |

Key Variables Influencing Sales

- Regulatory approvals in new jurisdictions.

- Pipeline innovations potentially augmenting efficacy or reducing side effects.

- Market penetration strategies by manufacturers.

- Pricing and reimbursement policies in different healthcare systems.

- Competitive threats from emerging therapies.

Strategic Outlook

Prostanoid analogues like TRAVOPROST will remain cornerstones in glaucoma treatment. The expected steady CAGR underscores consistent demand fuelled by demographic trends and expanding access in emerging markets. Manufacturers that innovate in formulation, reduce costs, and navigate regulatory pathways will sustain growth trajectories.

The future landscape could witness combination products to enhance compliance, drugs targeting neuroprotection, and personalized ophthalmic therapies shaping sales strategies.

Key Takeaways

- Market stability and growth: TRAVOPROST’s role as a first-line therapy ensures sustained demand, with a projected CAGR of approximately 5.5% over the next five years.

- Regional dynamics: North America and Europe will continue to dominate sales; however, Asia-Pacific presents the fastest growth opportunities due to demographic and healthcare infrastructure developments.

- Competitive pressures: Patent expirations and generic manufacturing are expected to compress profit margins but increase overall market size.

- Innovation and market expansion: Opportunities exist in new formulations, combination therapies, and expanded indications, which can drive future sales.

- Strategic focus: Firms should prioritize region-specific regulatory strategies, cost management, and patient-centric product development to capitalize on market trends.

FAQs

1. What are the primary factors driving demand for TRAVOPROST globally?

The increasing prevalence of glaucoma, aging populations, and the drug’s once-daily dosing regimen are principal drivers. Additionally, the availability of affordable generics broadens access, further boosting demand.

2. How does patent expiry influence TRAVOPROST’s market prospects?

Patent expirations allow generic manufacturers to produce lower-cost alternatives, increasing market competition and potentially reducing prices but expanding the total market size.

3. What are the main regional opportunities and challenges for TRAVOPROST sales?

North America and Europe offer mature markets with high penetration but face pricing pressures. Asia-Pacific presents rapid growth potential due to demographic shifts and increasing disease awareness but requires navigating regulatory approvals and distribution channels.

4. How might emerging therapies impact TRAVOPROST sales?

Innovations such as Rho kinase inhibitors and neuroprotective agents could offer alternative or adjunct options, potentially substituting TRAVOPROST in some regions, which underscores the need for continuous product differentiation.

5. What strategies could manufacturers adopt to maximize TRAVOPROST’s market potential?

Developing combination formulations, expanding indications, optimizing pricing, enhancing patient adherence, and expanding into underserved markets will be vital strategies.

References

[^1^]: Tham YC, et al. "Global Prevalence of Glaucoma and Projections of Blindness Burden." The Lancet Global Health, 2014.

[^2^]: Kanski JJ, et al. "Clinical Ophthalmology," 9th Edition. Elsevier, 2014.

More… ↓