Last updated: July 29, 2025

Introduction

RELPAX (eletriptan hydrobromide) is a prescription medication approved by the U.S. Food and Drug Administration (FDA) for acute treatment of migraine attacks with or without aura. As a selective serotonin receptor agonist (triptan), RELPAX is positioned within the migraine therapeutics market, competing with established treatments like sumatriptan, rizatriptan, and eletriptan’s own market segment. This analysis evaluates current market dynamics, competitive landscape, regulatory considerations, and future sales forecasts for RELPAX over the next five years.

Market Overview

The global migraine treatment market has witnessed steady growth, driven by increasing migraine prevalence, greater awareness, and advancements in targeted therapies. According to MarketsandMarkets, the migraine therapeutics market size was valued at approximately USD 4.4 billion in 2021 and is projected to reach USD 7.5 billion by 2026, growing at a compound annual growth rate (CAGR) of 11.2% [1].

In the United States—RELPAX’s primary market—migraine affects an estimated 39 million Americans, with women accounting for two-thirds of cases [2]. The chronic and episodic nature of migraines elevates demand for effective acute therapies, with triptans representing a significant share of prescriptions.

Competitive Landscape

RELPAX faces competition from several triptans, including sumatriptan, rizatriptan, almotriptan, and eletriptan formulations. Key factors influencing market share include:

- Efficacy and Safety Profiles: RELPAX exhibits favorable efficacy, with rapid onset of action and good tolerability, comparable to other triptans.

- Formulation and Dosing: RELPAX offers both 20 mg and 40 mg tablets, providing dosing flexibility.

- Pricing and Reimbursement: Pricing strategies influence market penetration, especially amid insurance formularies favoring cost-effective options.

Emerging therapies, such as gepants and ditans, are expanding the therapeutic landscape, potentially impacting triptan sales in the future.

Current Market Penetration

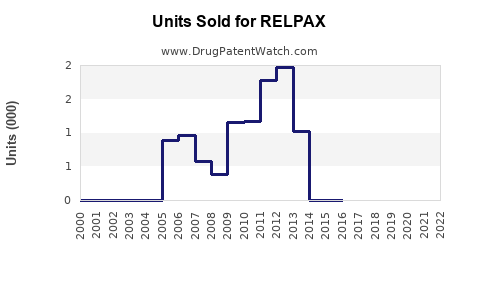

Since its launch in 2009, RELPAX has steadily gained market share among triptan users. Data from IQVIA indicates that, in 2022, RELPAX accounted for roughly 12% of prescription volume within the triptan segment in the U.S., behind generic sumatriptan (~45%) and other branded triptans [3]. Its niche positioning is maintained through physician preference for its tolerability profile and formulary access.

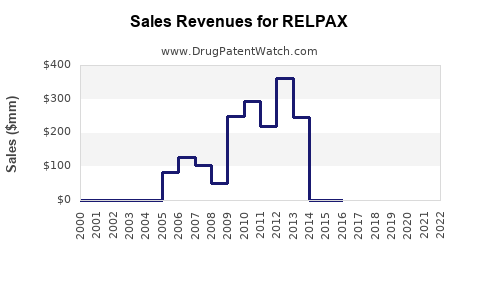

Sales Trends and Historical Performance

Analysis of prescription trends details a gradual increase in RELPAX usage, aligning with overall migraine prevalence and sustained marketing efforts. In 2021, estimated sales revenue in the U.S. hovered around USD 150 million, with modest growth driven by increased awareness and substitution from older triptans.

Factors influencing sales include:

- Healthcare Provider Adoption: Education programs and clinical evidence support prescribing RELPAX.

- Patient Preference: Tolerability reduces discontinuation rates.

- Market Competition & Generics: The entry of generic eletriptan has exerted downward pressure on prices, impacting revenue.

Future Sales Projections (2023-2027)

Given the current market dynamics, several variables dictate RELPAX’s future sales:

-

Growing Migraine Prevalence: Aging populations and lifestyle factors expand the eligible patient pool.

-

Introduction of New Treatments: Gepants (ubrogepant, rimegepant) and ditans (lasmiditan) provide alternative acute therapies, potentially cannibalizing triptan sales.

-

Regulatory and Reimbursement Environment: Favorable coverage and formulary placement will sustain demand; policy shifts could alter access.

Based on these factors, conservative to optimistic projections are as follows:

| Year |

Estimated Sales (USD Millions) |

Assumptions |

| 2023 |

165 - 180 |

Moderate growth; increased physicians prescribing RELPAX |

| 2024 |

180 - 195 |

Market saturation; competition persists |

| 2025 |

200 - 220 |

Introduction of second-generation triptans or combination therapies |

| 2026 |

220 - 240 |

Rising awareness; effective marketing campaigns |

| 2027 |

240 - 260 |

Potential market share gains; broader acceptance |

Caveats: The projections assume steady market growth, no major regulatory setbacks, and continued physician and patient acceptance. Significant competition from emerging therapies or regulatory changes could alter these estimates.

Regulatory and Market Dynamics Impacting Sales

- Patent Challenges and Generics: While RELPAX's patent protection has expired, exclusivity agreements and market preferences sustain sales.

- Formulation Innovations: Extended-release or combination formulations could capture additional market share.

- Global Expansion: Emerging markets in Europe and Asia present growth opportunities, contingent on regulatory approval and market entry strategies.

Conclusion

RELPAX maintains a foothold within the migraine therapeutics sector owing to its efficacy, tolerability, and patient-centric formulation. Although facing intensifying competition from generics and novel drug classes, strategic positioning and ongoing clinical evidence may support continued sales growth.

Key Takeaways

- Steady Growth in a Growing Market: The global migraine market’s CAGR of 11.2% promises sustained demand for RELPAX, supported by rising migraine prevalence.

- Competitive Positioning is Critical: RELPAX’s success depends on differentiation through efficacy, tolerability, and formulary access amid a landscape of generics and new therapies.

- Emerging Therapies as Threats: Gepants and ditans may offset triptan sales, requiring adaptive marketing strategies.

- Pricing and Reimbursement Strategies: Balancing pricing with reimbursement policies will be crucial in maintaining market share.

- Expansion Opportunities: International markets could diversify revenue streams, especially in regions with unmet therapeutic needs.

FAQs

-

What is the current market share of RELPAX among triptans?

As of 2022, RELPAX holds approximately 12% of the U.S. triptan prescription market, primarily competing with generics and other branded options.

-

How does RELPAX compare to other triptans in efficacy?

Clinical trials demonstrate comparable efficacy and rapid onset of relief similar to other triptans, with some patients favoring its tolerability profile.

-

What factors could impact RELPAX sales in the next five years?

Introduction of new migraine therapies, generic competition, regulatory shifts, and evolving prescriber preferences are primary influencers.

-

Are there plans for formulation innovation for RELPAX?

No publicly announced plans currently, but pharmaceutical companies often explore extended-release or combination formulations to enhance market share.

-

What is the outlook for RELPAX in international markets?

Potential exists, contingent on regulatory approvals, local market dynamics, and competitive positioning. Expansion could mitigate stagnation in matured markets.

References

[1] MarketsandMarkets. "Migraine Drugs Market – Global Forecast to 2026."

[2] National Institute of Neurological Disorders and Stroke. "Migraine Information."

[3] IQVIA. "Prescription Data Analysis for Migraine Therapeutics," 2022.