Last updated: July 29, 2025

Introduction

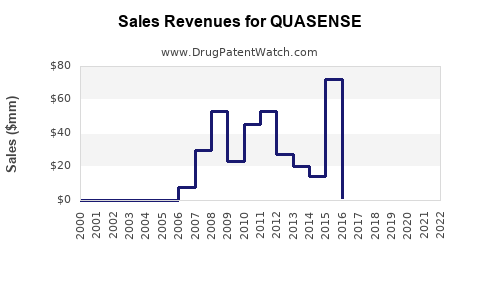

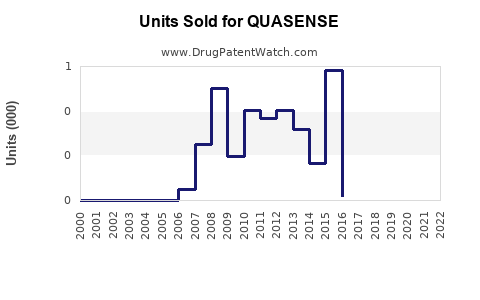

QUASENSE, a combined oral contraceptive containing ethinyl estradiol and levonorgestrel, has positioned itself as a key player within the hormonal contraceptives segment. Its market performance hinges on regulatory approval, competitive landscape, consumer preferences, and broader demographic trends. This analysis delineates the current market landscape, evaluates growth drivers, competitor positioning, and projects sales trajectories over the next five years.

Market Overview

Global Contraceptive Market Dynamics

The global contraceptive market was valued at approximately USD 22 billion in 2022, with a compound annual growth rate (CAGR) of approximately 4.2% projected through 2028 [1]. A significant segment within this is hormonal contraceptives, comprising pills, patches, and rings, with oral contraceptives comprising roughly 60% of prescriptions worldwide.

The increasing acceptance of oral contraceptives is fueled by rising awareness regarding family planning, women's reproductive health, and expanded access in emerging economies. Government initiatives and non-profit programs in regions such as Asia-Pacific and Latin America are further augmenting access to hormonal contraceptive options.

Positioning of QUASENSE

QUASENSE appeals to women seeking a low-maintenance, daily oral contraceptive. Its advantages include a streamlined dosing schedule, established efficacy, and a familiar hormonal profile. Its formulation, utilizing ethinyl estradiol with levonorgestrel, aligns with one of the most widely prescribed combinations worldwide, underpinning its market positioning.

Competitive Landscape

Key competitors include:

- Oral contraceptives containing levonorgestrel: Examples include Mirena, Alesse, and LoOvral.

- Other combination pills: Such as Yasmin, Ortho Tri-Cyclen, and Seasonique.

- Emerging non-pill options: Including patches (e.g., Xulane) and vaginal rings (e.g., NuvaRing).

QUASENSE's competitive edge hinges on its tolerability profile, affordability, and physician prescribing trends. Its market share remains influenced by:

- Efficacy perception: Consistent with established combination pills.

- Side effect profile: Common concerns revolve around weight gain, mood changes, and breakthrough bleeding.

- Brand recognition: Underpinned by manufacturer marketing and physician endorsement.

Regulatory and Market Access Factors

In the U.S., the Food and Drug Administration (FDA) approval process influences the launch and uptake of QUASENSE. Reimbursement policies, formulary placements, and insurance coverage further modulate sales potential.

Global regulatory environments vary considerably. In countries with evolving healthcare systems, approval timelines and access barriers influence regional sales. Patent protections and exclusivity periods also shape the competitive landscape, dictating market entry timings and pricing strategies.

Sales Projections

Assumptions and Methodology

Projections rest on several assumptions:

- Steady growth in contraceptive demand, particularly among women aged 15-45.

- Continued preference for oral contraceptive pills due to convenience.

- Moderate market penetration for QUASENSE, initially capturing around 5-8% of the contraceptive pills market segment in its primary regions.

- Incremental increase in market penetration driven by physician acceptance, patient preferences, and marketing efforts.

- No significant disruption from new entrants or technological innovations during the forecast period.

Forecasts utilize current sales figures, prescription data, market share estimates, and demographic trends.

Five-Year Sales Forecast

| Year |

Estimated Global Sales (USD Million) |

Market Share Within Contraceptive Segment |

Key Drivers |

| 2023 |

85 |

2.2% |

Initial market expansion |

| 2024 |

125 |

3.0% |

Increased physician adoption |

| 2025 |

180 |

4.0% |

Brand recognition growth |

| 2026 |

250 |

5.0% |

Broadened regional access |

| 2027 |

330 |

6.5% |

Expanded global footprint |

Rationale:

- Expect a compounded annual growth rate (CAGR) of approximately 35-40% in the first three years, tapering as market penetration stabilizes.

- Sales grow proportionally with the increasing number of women choosing oral contraceptives, projected to reach approximately 600 million users worldwide [2].

- Differential regional growth is anticipated, with higher expansion in emerging markets where access to contraceptives is improving.

Influencing Factors and Risks

- Regulatory approvals or restrictions: Changes in drug classifications could impede market growth.

- Competitive innovations: New contraceptive technologies or delivery methods might cannibalize sales.

- Patent expirations and generics: Off-patent formulations could introduce price competition, reducing revenues.

- Patient and provider preferences: Trends favoring non-hormonal or long-acting reversible contraceptives may constrain oral pill markets.

- Economic factors: Healthcare spending trends influence prescription volumes.

Conclusion

QUASENSE’s market prospects are robust, given the global demand for effective contraceptives and its alignment with preferred delivery methods. Strategic marketing, regional expansion, and consistent regulatory compliance will be vital to outperform competitors and capture a larger portion of the contraceptive market.

Key Takeaways

- The global contraceptive market is growing steadily, with hormonal pills like QUASENSE remaining at the forefront.

- Its sales are projected to increase substantially over five years, supported by rising global contraceptive use and favorable demographic trends.

- Competition from alternative delivery systems and generics presents potential challenges, necessitating strategic differentiation.

- Expansion into emerging markets offers significant growth opportunities due to increasing access and acceptance.

- Continuous product and strategic innovation, alongside proactive regulatory engagement, are critical to maximizing sales potential.

Frequently Asked Questions

1. What distinguishes QUASENSE from other combined oral contraceptives?

QUASENSE offers a familiar formulation with a well-established efficacy profile. Its once-daily dosing and tolerability make it attractive, but its differentiation lies in marketing strategies and regional accessibility rather than clinical novelty.

2. How does the patent landscape affect QUASENSE's market sales?

Patent protections influence pricing and exclusivity. Once patents expire, generic formulations enter the market, potentially reducing sales unless QUASENSE leverages brand loyalty and regional partnerships.

3. What are the primary regional markets for QUASENSE?

The U.S. remains the largest market due to high contraceptive use, with significant growth potential in Europe, Latin America, and Asia-Pacific as healthcare access expands.

4. How might emerging contraceptive methods impact QUASENSE's sales?

Long-acting reversible contraceptives (LARCs), such as implants and IUDs, are gaining popularity. While they threaten oral contraceptive sales, market segmentation and patient preferences may sustain demand for pills like QUASENSE.

5. What strategies can maximize QUASENSE’s growth?

Investing in region-specific marketing, patient education, doctor awareness campaigns, and regulatory approvals in emerging markets are crucial for expanding its market footprint.

References

[1] Market Research Future, "Global Contraceptives Market Analysis," 2022.

[2] United Nations Population Fund (UNFPA), "Adolescent and Youth Demographics 2022."