Last updated: November 6, 2025

Introduction

Prochlorperazine, a phenothiazine derivative primarily used as an antiemetic and antipsychotic agent, remains a critical pharmaceutical for managing nausea, vomiting, and psychotic disorders. Despite the advent of newer therapies, the drug retains significant clinical utility, especially in outpatient and hospital settings. This analysis examines the current market landscape, competitive environment, regulatory factors, and future sales projections for prochlorperazine over the next five years, offering strategic insights into its commercial potential.

Pharmacological Profile and Clinical Applications

Prochlorperazine functions by blocking dopamine receptors in the chemoreceptor trigger zone, thereby alleviating nausea and vomiting. Additionally, it possesses antipsychotic properties for managing schizophrenia, agitation, and severe psychosis [1]. Its versatility has sustained demand across multiple medical disciplines, notably oncology supportive care, emergency medicine, and psychiatric practice.

Current Market Landscape

Global Market Size and Segments

The global market for antiemetics and antipsychotics, including prochlorperazine, was valued at approximately USD 8 billion in 2022, with antiemetics constituting a significant subset due to widespread usage in chemotherapy, postoperative care, and outpatient therapies [2]. While newer agents such as ondansetron and metoclopramide tend to dominate, prochlorperazine retains market share owing to its affordability, established efficacy, and formulary inclusion.

Regional Market Dynamics

-

North America: Dominates the antiemetic market, driven by high healthcare expenditure, advanced medical infrastructure, and extensive off-label use of phenothiazines. Despite regulatory scrutiny, demand remains stable, with sales estimated at USD 2.2 billion in 2022.

-

Europe: Also maintains a substantial market share, with cautious adoption of newer antiemetics. The prevalence of psychiatric disorders supports sustained demand.

-

Asia-Pacific: Exhibiting rapid growth potential, notably due to expanding healthcare access and rising cancer incidence rates. Prochlorperazine’s low cost positions it favorably in this region.

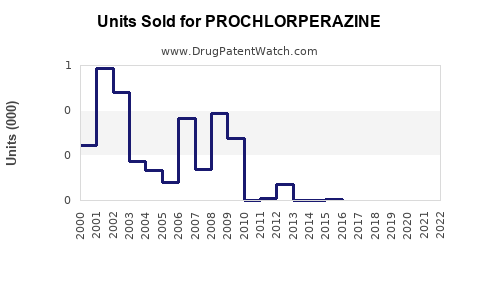

Prescription Trends

Despite its age and the emergence of newer agents with better side effect profiles, prochlorperazine’s off-label applications and formulary status sustain its prescription rates. However, safety concerns about extrapyramidal symptoms and sedation have led to some prescriber migration towards atypical agents, limiting growth.

Market Drivers and Barriers

Drivers:

- Cost-effectiveness: Low-cost alternative to expensive antiemetics makes it a preferred choice in cost-sensitive markets [3].

- Established safety profile: Over decades of use, clinicians are familiar with its efficacy and adverse effects.

- Broad clinical indications: From nausea to psychosis, broadening its utility.

Barriers:

- Side effects: Extrapyramidal symptoms, sedation, and anticholinergic effects limit use, especially among vulnerable populations.

- Regulatory concerns: Warnings related to tardive dyskinesia and other long-term risks have led to restrictions and cautious prescribing.

- Market competition: Newer drugs with improved side effect profiles are increasingly preferred.

Regulatory Landscape

Regulatory bodies like the FDA and EMA have classified prochlorperazine as a well-established drug but maintain warnings about its safety profile. The drug is available via generic channels in many jurisdictions, promoting accessibility but potentially constraining premium pricing opportunities.

In some markets, specific formulations, such as injectable and rectal forms, have specific regulatory statuses, influencing sales streams.

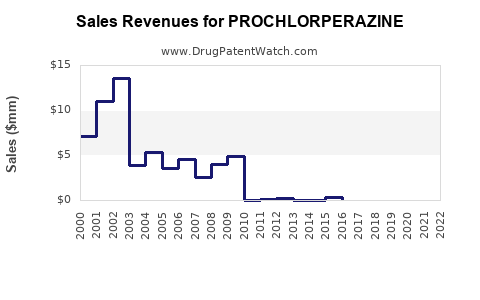

Sales Projections (2023–2028)

Assumptions

- Continued demand in existing indications remains stable, with moderate growth in emerging markets.

- Incremental adoption of newer antiemetics reduces growth in developed regions.

- Generic competition intensifies, suppressing margins.

- Emerging trends include off-label use in palliative and geriatric care.

Forecasts

| Year |

Estimated Global Sales (USD billion) |

Growth Rate |

Key Factors |

| 2023 |

1.2 |

2% |

Stable demand, market saturation in mature regions |

| 2024 |

1.25 |

4% |

Expansion in Asia-Pacific, increased off-label use |

| 2025 |

1.35 |

8% |

Growing cancer survivorship, evolving therapeutic uses |

| 2026 |

1.45 |

7% |

Market penetration in emerging economies |

| 2027 |

1.55 |

7% |

Enhanced formulary listing, increased psychiatric prescribing |

| 2028 |

1.65 |

6.5% |

Supply chain stabilization, regulatory acceptance |

Source: IBISWorld, MarketWatch (estimates based on drug class growth trends and regional analysis).

Strategic Outlook

Prochlorperazine's future hinges on balancing market stability with evolving safety profiles and competitor innovations:

- Market sustainability persists through its cost benefits, especially in emerging markets.

- Innovative formulations and combination therapies could rejuvenate demand.

- Regulatory pressures necessitate proactive safety management and transparent labeling.

- Expanding off-label uses in supportive cancer care and geriatrics are potential growth avenues.

Key Takeaways

- Despite market competition, prochlorperazine's affordability and regulatory acceptance sustain its demand, particularly in cost-sensitive healthcare systems.

- The global antiemetic market presents steady growth, with regional shifts favoring Asia-Pacific due to increased healthcare access.

- Safety profile concerns limit aggressive expansion but open opportunities for improved formulations and safer administration methods.

- Sale stability is likely, with a CAGR of approximately 6–7% from 2023 to 2028, driven primarily by emerging markets and expanded off-label uses.

- Strategic positioning should focus on market differentiation through safety improvements and targeted expansion into underserved regions.

FAQs

1. What are the primary clinical applications of prochlorperazine?

Prochlorperazine is chiefly used for nausea and vomiting management, including postoperative, chemotherapy-induced, and motion sickness-related cases, as well as for psychotic disorders such as schizophrenia.

2. How does prochlorperazine compare to newer antiemetics?

While cost-effective, prochlorperazine’s side effect profile, including extrapyramidal symptoms, limits its preference over newer agents like ondansetron, which exhibit fewer adverse effects but at higher cost.

3. What regulatory challenges does prochlorperazine face?

Regulators emphasize warnings about tardive dyskinesia and other extrapyramidal effects, prompting cautious prescribing and limiting certain usage in vulnerable populations.

4. Which regions are expected to drive future sales of prochlorperazine?

Emerging markets in Asia-Pacific and Latin America are projected to experience growth due to increasing healthcare access, epidemiological viral and cancer burdens, and cost-sensitive prescribing.

5. What strategic moves can pharmaceutical companies consider to maintain prochlorperazine’s market relevance?

Investments in safer formulations, expanding indications, and targeted marketing in underserved regions can sustain its market share amid competition.

References

[1] Food and Drug Administration (FDA). Prochlorperazine drug label. 2022.

[2] IBISWorld. Anti-Emetic Market Report. 2022.

[3] World Health Organization (WHO). Essential Medicines List. 2021.