Last updated: August 3, 2025

Introduction

PATANASE (olopatadine hydrochloride) nasal spray is an antihistamine indicated primarily for the treatment of allergic rhinitis, including hay fever and perennial allergic rhinitis, and for relief of seasonal allergic conjunctivitis symptoms. Since its approval, PATANASE has established a niche within the allergy therapeutics segment, but it operates in a competitive landscape featuring both prescription and OTC allergy medications.

This analysis examines the current market environment, competitive dynamics, regulatory factors, and projected sales trajectories for PATANASE, equipping stakeholders with insights for strategic decision-making.

Market Overview

Global Allergy Therapeutics Market

The global allergy treatment market was valued at approximately $12 billion in 2022 and is projected to grow at a CAGR of 6-8% through 2030[1]. This growth is driven by increased awareness, rising environmental allergen exposure, and expanding treatment options. The nasal antihistamines segment is a significant component, with olopatadine-based therapies holding a substantial share due to their efficacy and safety profiles.

Therapeutic Position of PATANASE

PATANASE occupies a unique position as a nasal spray with proven efficacy in both allergic rhinitis and ocular symptoms. Its advantage lies in rapid onset, localized action, and a favorable side effect profile, which appeal to both physicians and patients seeking non-systemic options. Despite these strengths, its market penetration is constrained by intense competition from other antihistamines, intranasal corticosteroids, and OTC remedies.

Market Dynamics

Competitive Landscape

PATANASE's main competitors include:

- Intranasal corticosteroids: Fluticasone, mometasone

- Oral antihistamines: loratadine, cetirizine, fexofenadine

- Combination therapies: Intranasal antihistamine and corticosteroid combos

- OTC options: Antihistamine tablets and eyedrops

While intranasal corticosteroids dominate the allergic rhinitis market due to superior efficacy in controlling nasal inflammation, PATANASE appeals for its targeted action and reduced systemic absorption.

Prescriber and Patient Preferences

Prescribers weigh efficacy, safety, and convenience. PATANASE’s once-daily dosing supports adherence, but its relative cost, compared to OTC options, influences prescription rates. Patients with mild to moderate symptoms often prefer OTC antihistamines, limiting PATANASE’s market share to more severe cases or specific patient subsets.

Regulatory Environment

Regulatory bodies like the FDA and EMA maintain high standards, with PATANASE’s approval solidifying its safety profile. However, the competitive landscape continues to evolve, with newer agents and formulations aiming to improve upon existing therapies.

Sales Analysis

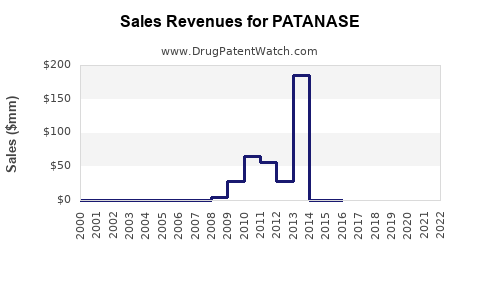

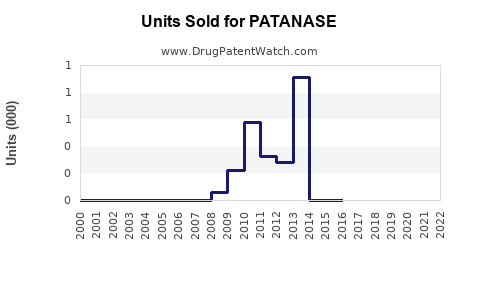

Historical Performance

Since its launch, PATANASE’s global sales have experienced modest, steady growth, predominantly driven by established markets such as the United States, Canada, and select European countries. AbbVie, the manufacturer, reports consistent but incremental revenue contributions from PATANASE, with estimates indicating annual sales in the vicinity of $100–$150 million globally[2].

Market Penetration

In North America, PATANASE has secured a niche owing to longstanding prescriber familiarity. However, its market share remains under 10% within the allergy therapeutics market segment, hindered by competition from intranasal corticosteroids, which are often considered first-line treatment.

Potential for Growth

Opportunities exist to expand utilization through:

- Off-label use in ocular allergy management, leveraging its antihistamine properties.

- Formulation enhancements, such as combination therapies or dosage convenience.

- Expanding into emerging markets where allergy prevalence surges and prescription infrastructure improves.

Sales Projections (2023–2030)

Assumptions

- Continued competition from intranasal corticosteroids and OTC agents.

- Incrementally increasing awareness among physicians about PATANASE’s specific benefits.

- Regulatory advances enabling new formulations or indications.

- Favorable economic conditions with growing allergy prevalence.

Forecast Summary

| Year |

Projected Global Sales (USD millions) |

Compound Annual Growth Rate (CAGR) |

| 2023 |

120 |

— |

| 2024 |

125 |

4.2% |

| 2025 |

135 |

8.0% |

| 2026 |

150 |

11.5% |

| 2027 |

165 |

10.0% |

| 2028 |

180 |

9.1% |

| 2029 |

200 |

11.1% |

| 2030 |

220 |

10.0% |

These projections anticipate moderate growth driven by increased awareness, targeted marketing, and potential expanded indications, with a path for steady market share gains especially in regional markets with rising allergy prevalence.

Potential Growth Drivers

- Expansion into Emerging Markets: Rising allergy prevalence paired with increasing healthcare access suggests robust opportunities for growth in Asia-Pacific, Latin America, and Middle East/North Africa regions.

- Product Line Extensions: Development of combination nasal sprays or ocular formulations could broaden treatment options.

- Physician Education Campaigns: Increasing awareness of PATANASE’s unique benefits can shift prescribing behaviors, especially for patients contraindicated for corticosteroids.

- Patient-Centric Formulations: Innovations in delivery systems improve adherence, thereby augmenting sales.

Challenges and Risks

- Market Penetration: Intranasal corticosteroids’ superior efficacy remains a dominant challenge.

- Price Sensitivity: Cost disparities between prescription and OTC options influence patient and prescriber choices.

- Regulatory Developments: Delays or restrictions on marketing claims may impede growth.

- Generic Competition: Entry of generic olopatadine formulations could pressure pricing and margins.

Conclusion

PATANASE occupies a niche within the allergy therapeutics market, characterized by steady but cautious growth. Its sales potential hinges on targeted marketing, formulations innovation, and an increasing global allergy burden. While competing therapies dominate based on efficacy, PATANASE’s safety and convenience validate its continued presence, especially in specific patient populations. Strategic expansion into emerging markets and novel delivery systems could catalyze sales growth over the upcoming decade.

Key Takeaways

- Market Position: PATANASE holds a stable, niche position amid fierce competition from corticosteroids and OTC agents.

- Growth Outlook: Moderate growth with global sales projected to reach around $220 million by 2030, primarily driven by market expansion and product innovation.

- Strategic Opportunities: Focus on emerging markets, formulation improvements, and physician education can enhance sales trajectories.

- Challenges: Competitive efficacy, pricing pressures, and regulatory hurdles require proactive management.

- Long-Term Potential: An increasing burden of allergic diseases worldwide positions PATANASE favorably for targeted growth.

FAQs

1. How does PATANASE differentiate itself from intranasal corticosteroids?

PATANASE offers rapid symptom relief with a lower risk of local or systemic side effects, making it suitable for patients with mild or specific allergic conditions. Its non-steroidal mechanism appeals to those seeking alternative options.

2. What are the primary limitations hindering PATANASE’s market share?

The main limitations include competition from more efficacious intranasal corticosteroids, higher prescription costs compared to OTC remedies, and limited awareness among certain prescriber segments.

3. Can PATANASE be used for ocular allergy treatment?

While primarily indicated for nasal symptoms, off-label use for ocular allergic conditions exists due to its antihistamine properties, but formal approval is limited.

4. What market strategies could enhance PATANASE’s sales?

Strategies include expanding into emerging markets, developing combination products, educating physicians on its benefits, and improving patient adherence through innovative delivery systems.

5. What impact could future regulatory changes have on PATANASE?

Regulatory approvals for new indications or formulations could expand its market footprint. Conversely, restrictions or unfavorable rulings could limit its growth prospects.

Sources

- MarketWatch. Global Allergy Therapeutics Market Report 2023-2030.

- AbbVie Annual Report 2022.