Last updated: July 27, 2025

Introduction

Lactulose, a synthetic disaccharide used predominantly for treating hepatic encephalopathy and chronic constipation, occupies a significant niche within the gastrointestinal and hepatic disease treatment markets. Its unique pharmacological profile, including osmotic laxative effects and ammonia reduction capabilities, positions it as a crucial therapeutic agent in managing complex liver conditions. This report provides a comprehensive market analysis and sales projection outlook for lactulose, highlighting key drivers, competitive dynamics, and growth opportunities in the current pharmaceutical landscape.

Market Overview

Lactulose's primary applications in hepatic encephalopathy (HE) management—a neuropsychiatric complication of liver cirrhosis—drive a consistent demand pattern. Its effectiveness in reducing serum ammonia levels sustains its use via oral and rectal formulations, ensuring its integration into treatment protocols globally. Additionally, lactulose’s role as a first-line laxative for chronic constipation, especially in elderly populations, widens its market reach.

The global gastrointestinal drugs market is anticipated to expand at a CAGR (Compound Annual Growth Rate) of approximately 6% from 2023 to 2030, with therapeutic agents for gastrointestinal and hepatic disorders proliferating due to increasing prevalence rates, aging populations, and rising awareness about liver health [1]. Lactulose figures prominently within this expanding landscape.

Key Market Drivers

1. Rising Prevalence of Liver Diseases

The global incidence of liver cirrhosis, chronic hepatitis, and hepatic encephalopathy has escalated, driven by lifestyle factors such as alcohol consumption, obesity, and viral infections. According to the WHO, approximately 1.32 million deaths annually are attributable to cirrhosis and other chronic liver diseases [2]. This increasing burden incentivizes healthcare providers to adopt established therapies like lactulose for disease management.

2. Aging Population and Chronic Constipation

Globally, aging demographics contribute to higher constipation prevalence, particularly among geriatric populations. As per the CDC, about 16% of U.S. adults suffer from chronic constipation, often requiring osmotic laxatives such as lactulose [3].

3. Off-Label and Adjunct Uses

Emerging research explores lactulose’s utility in gut microbiome modulation, potentially expanding its therapeutic scope. Although not yet mainstream, such novel applications could sustain or boost future sales.

4. Increasing Healthcare Infrastructure and Awareness

Expanding healthcare access, especially in emerging economies, and educational initiatives regarding liver health amplify the adoption of lactulose therapy.

Market Constraints and Challenges

1. Competition from Alternative Therapies

Rifaximin, a non-absorbable antibiotic, and other drugs like L-ornithine L-aspartate are gaining traction as adjunct options for HE, potentially limiting lactulose's market share [4]. Additionally, osmotically active agents like polyethylene glycol (PEG) offer similar laxative effects that compete with lactulose in constipation management.

2. Side Effect Profile and Patient Compliance

Common adverse effects such as bloating, gas, and diarrhea impact patient adherence. Formulation palatability issues also hamper long-term compliance, influencing sales negatively.

3. Regulatory and Reimbursement Barriers

Variations in regulatory approvals and reimbursement policies across regions can delay market penetration, especially in low- and middle-income countries.

Market Segmentation

By Indication

- Hepatic Encephalopathy: The dominant market segment, accounting for about 60–65% of sales.

- Chronic Constipation: A significant segment, particularly in geriatrics and pediatrics.

- Potential Future Uses: Gut microbiota modulation, experimental therapies.

By Formulation

- Oral solutions: Most common, used for HE and constipation.

- Rectal enema: Primarily for acute HE management.

By Geography

- North America: Largest market due to high disease prevalence and advanced healthcare infrastructure.

- Europe: Significant market with increasing adoption.

- Asia-Pacific: Fastest-growing segment driven by rising liver disease prevalence and improving healthcare access.

- Rest of World: Emerging markets with growth potential but regulatory challenges.

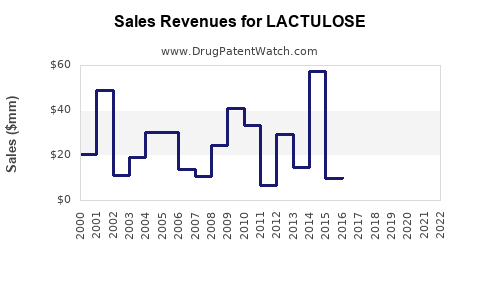

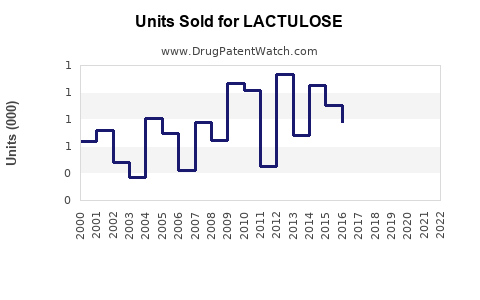

Sales Projections (2023–2030)

Based on current trends, market size estimations, and growth drivers, lactulose’s global sales can be projected as follows:

- 2023: ~$300 million

- 2024-2025: Growth driven by increasing liver disease treatment, reaching approximately $330–$350 million annually.

- 2026-2028: Accelerated growth as awareness rises and new formulations enter emerging markets, with sales reaching approximately $400–$450 million.

- 2029-2030: Stabilization with a plateau at around $500 million, factoring in market saturation in mature regions and expanding markets in Asia-Pacific.

These projections assume an average annual growth rate of approximately 7%, considering innovations, regional expansion, and increased disease prevalence.

Competitive Landscape

The lactulose market is characterized by a mix of generic producers and a few branded formulations. Major pharmaceutical companies, including AbbVie, Sanofi, and generic manufacturers such as Hikma Pharmaceuticals, dominate supply chains. Key differentiators include formulation improvements (taste masking), dosage convenience, and regional pricing strategies.

Additionally, emerging bioequivalence developments and formulary shifts favoring once-daily dosing or palatable formulations could influence market dynamics.

Opportunities for Growth

- Product Diversification: Developing user-friendly formulations and combining lactulose with probiotics or other agents for synergistic effects.

- Expanding into New Markets: Targeting underpenetrated regions like Latin America, Southeast Asia, and Africa.

- Clinical Research: Investing in new indications, including microbiome-related therapies.

- Regulatory Navigation: Accelerating approval pathways and reimbursement strategies in emerging markets to boost accessibility.

Conclusion

Lactulose’s essential role in managing hepatic encephalopathy and constipation promises sustained demand amidst a competitive landscape. Market growth hinges on demographic trends, increasing disease burden, and strategic marketing in emerging regions. Although competitive pressures and side effect considerations temper growth expectations, ongoing product innovations and expanding healthcare infrastructure offer robust avenues for revenue expansion.

Key Takeaways

- The global lactulose market is expected to grow at a CAGR of approximately 7%, reaching around $500 million by 2030.

- Increasing prevalence of liver diseases and aging populations are primary drivers.

- Competition from alternative therapies and side effect profiles pose challenges.

- Emerging markets and formulation innovations represent significant growth opportunities.

- Strategic focus on regional expansion, product differentiation, and clinical research will underpin future success.

FAQs

1. What are the primary therapeutic uses of lactulose?

Lactulose is mainly used to treat hepatic encephalopathy by reducing serum ammonia levels and as an osmotic laxative for chronic constipation management.

2. How does lactulose compare to alternative therapies for hepatic encephalopathy?

While lactulose remains the first-line treatment, alternatives like rifaximin have shown efficacy, especially as adjunct therapy. Rifaximin tends to have fewer gastrointestinal side effects but is more costly.

3. What are the key factors influencing lactulose sales?

Disease prevalence, healthcare infrastructure, formulation improvements, competition, and regional reimbursement policies significantly affect sales.

4. Is there potential for new indications for lactulose?

Emerging research into gut microbiome modulation suggests potential future applications, although further clinical validation is required.

5. How might regulatory changes impact the lactulose market?

Streamlined approval processes and favorable reimbursement policies can enhance accessibility and market penetration, especially in emerging economies.

References

[1] Market Research Future, "Global Gastrointestinal Drugs Market," 2022.

[2] WHO, "Global Liver Disease Burden," 2021.

[3] CDC, "Chronic Constipation Statistics," 2020.

[4] Garcia-Tsao G., et al., "Management of Hepatic Encephalopathy," Gastroenterology, 2020.