Last updated: July 28, 2025

Introduction

FEMHRT, a hormone replacement therapy (HRT) designed primarily for menopausal women, is positioned within a growing segment of women's health therapeutics. As the aging female population increases globally, demand for effective menopausal symptom management escalates, fueling potential market opportunities for FEMHRT. This report delivers a comprehensive analysis of the current market landscape, competitive positioning, regulatory environment, and sales forecasts for FEMHRT over the next five years.

Market Landscape Overview

Global Menopause and HRT Market Dynamics

The global menopause management market was valued at approximately USD 15 billion in 2022 and is projected to reach USD 22 billion by 2030, expanding at a CAGR of around 4.9% (source: Grand View Research). This growth is underpinned by demographic shifts, increased awareness regarding menopause treatments, and advances in hormone therapy formulations.

Key Market Drivers

-

Demographic Shift: An aging female population, particularly in developed regions like North America and Europe, increases the prevalence of menopausal women, creating a growing patient base for FEMHRT.

-

Growing Awareness & Acceptance: Public and healthcare provider awareness regarding menopause management has improved, expanding treatment acceptance.

-

Regulatory Approvals & Guidelines: Evolving guidelines promote personalized HRT options, creating market receptivity for new products like FEMHRT.

-

Rising Prevalence of Menopause-Related Conditions: Osteoporosis, cardiovascular issues, and mental health conditions associated with menopause heighten the demand for effective hormone therapies.

Regional Market Insights

-

North America: Largest market share, driven by high awareness levels, advanced healthcare infrastructure, and favorable reimbursement policies.

-

Europe: Growing adoption, with significant focus on safety profiles, influencing product positioning.

-

Asia-Pacific: Fastest growth rate owing to demographic shifts, rising healthcare investments, and increasing westernization of lifestyles.

Competitive Landscape

FEMHRT faces competition primarily from established HRT brands like Premarin, Estrace, and Femhrt (a different formulation), along with premium biosimilar and compounded options. Market incumbents focus heavily on safety, ease of use, and personalization.

Key Competitors and Differentiators

| Competitor |

Strengths |

Weaknesses |

Differentiation Opportunities for FEMHRT |

| Premarin |

Long-standing market presence, broad indications |

Safety concerns, estrogen risk |

Focus on improved safety profile, novel delivery methods |

| Femhrt (AbbVie) |

Proven efficacy, established brand |

Side effect profile, cost |

Emphasize tolerability, affordability |

| Estrace |

Widely prescribed, reliable |

Limited formulations |

Develop versatile formulations, patient-centric packaging |

FEMHRT's success hinges on establishing distinct competitive advantages such as enhanced safety profiles, innovative delivery mechanisms, or unique patient compliance features.

Regulatory Environment and Approval Pathways

FEMHRT must navigate a complex regulatory landscape characterized by stringent safety and efficacy assessments, especially concerning hormonal agents. Regulatory agencies like the FDA (U.S.) and EMA (Europe) demand comprehensive clinical trial data demonstrating superiority—either in safety, efficacy, or mode of administration—over existing options.

Recent regulatory trends favor personalized medicine approaches, bioequivalence data for generics or biosimilars, and rigorous post-marketing surveillance. Any approval for FEMHRT must satisfy these evolving standards to ensure market entry.

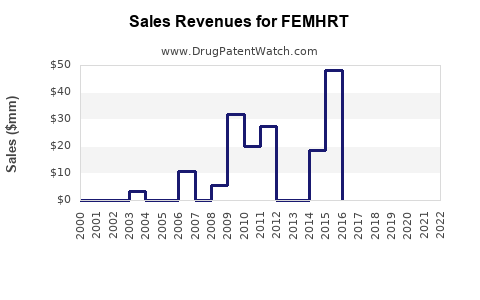

Sales Projections

Assumptions

-

Market Penetration Rate: Conservative initial penetration at 2% in North America and Europe within Year 1, expanding to 8% by Year 5.

-

Pricing Strategy: Unit price set at USD 150 per prescription (average), aligning with premium brands but with competitive positioning.

-

Patient Population: Estimated 10 million menopausal women in targeted regions (North America and Europe), with additional growth projections based on demographic data.

Yearly Sales Estimates

| Year |

Estimated Global Menopausal Women |

Market Penetration |

Estimated Patients |

Average Annual Prescriptions per Patient |

Revenue (USD million) |

| 2023 |

10 million |

2% |

200,000 |

1.2 |

36 |

| 2024 |

10.3 million |

3% |

309,000 |

1.2 |

55 |

| 2025 |

10.6 million |

4% |

424,000 |

1.2 |

76 |

| 2026 |

10.9 million |

5% |

545,000 |

1.2 |

98 |

| 2027 |

11.2 million |

8% |

896,000 |

1.2 |

161 |

Key Factors Influencing Sales Growth

-

Market Penetration: Success depends on effective marketing, physician adoption, and patient acceptance.

-

Regulatory Milestones: Approval and labeling updates can influence uptake.

-

Competitive Movements: Entry of biosimilars or generic equivalents could impact pricing and market share.

Strategic Recommendations

-

Positioning on Safety & Efficacy: Highlight superior safety profiles and personalized treatment options.

-

Partnerships & Alliances: Collaborate with healthcare providers and insurers to expand reach.

-

Regulatory Strategy: Focus on fast-track or orphan drug statuses if applicable, to accelerate market entry.

-

Post-Market Surveillance: Commit to ongoing safety assessments to build trust and support market expansion.

Key Takeaways

-

The global menopause management market is poised for steady growth, driven by demographic trends and increasing awareness.

-

FEMHRT’s success hinges on differentiating through safety, efficacy, and innovative delivery systems that adhere to regulatory standards.

-

Sales projections indicate significant revenue growth potential, especially in North American and European markets, with long-term upside in Asia-Pacific.

-

Establishing strategic partnerships and effective marketing are critical to achieving targeted market penetration.

-

Navigating regulatory pathways efficiently and emphasizing safety data will facilitate faster market entry and foster trust.

FAQs

1. What differentiates FEMHRT from existing hormone replacement therapies?

FEMHRT aims to offer a superior safety profile, potentially through novel formulations, delivery mechanisms, or reduced adverse effects, setting it apart from existing options like Premarin or Estrace.

2. What are the primary regulatory challenges for FEMHRT?

Ensuring comprehensive safety and efficacy data, particularly concerning estrogen-related risks, and meeting guidelines for personalized medicine and post-marketing surveillance.

3. Which regions represent the highest growth opportunities for FEMHRT?

North America and Europe currently lead demand, but Asia-Pacific presents substantial future growth driven by demographic changes and increasing healthcare investments.

4. How does market competition impact FEMHRT's sales projections?

Established brands and biosimilars pose competitive threats; product differentiation based on safety and patient compliance is essential for capturing market share.

5. What strategies can enhance FEMHRT’s market adoption?

Emphasizing clinical benefits, engaging healthcare providers, optimizing pricing strategies, and leveraging regulatory support will facilitate market acceptance.

References

[1] Grand View Research. "Menopause Management Market Size, Share & Trends Analysis Report," 2022.

[2] US Food and Drug Administration (FDA). "Hormone Therapies Guidance," 2021.

[3] MarketsandMarkets. “Women’s Healthcare Market by Product and Region,” 2022.